Roman Tax on Estate Auctions was the Outrageous Level of 1%

QUESTION: Mr. Armstrong; You recently showed a coin of the emperor Hadrian burning tax records. Was there a tendency to always raise taxes as we have today to extreme levels? It seems that our government here in BC just assumes everything you have belongs to them. We should be grateful for what they allow us to retain. That is really the attitude here in Canada. Has this been the norm for governments in general?

QUESTION: Mr. Armstrong; You recently showed a coin of the emperor Hadrian burning tax records. Was there a tendency to always raise taxes as we have today to extreme levels? It seems that our government here in BC just assumes everything you have belongs to them. We should be grateful for what they allow us to retain. That is really the attitude here in Canada. Has this been the norm for governments in general?

KV

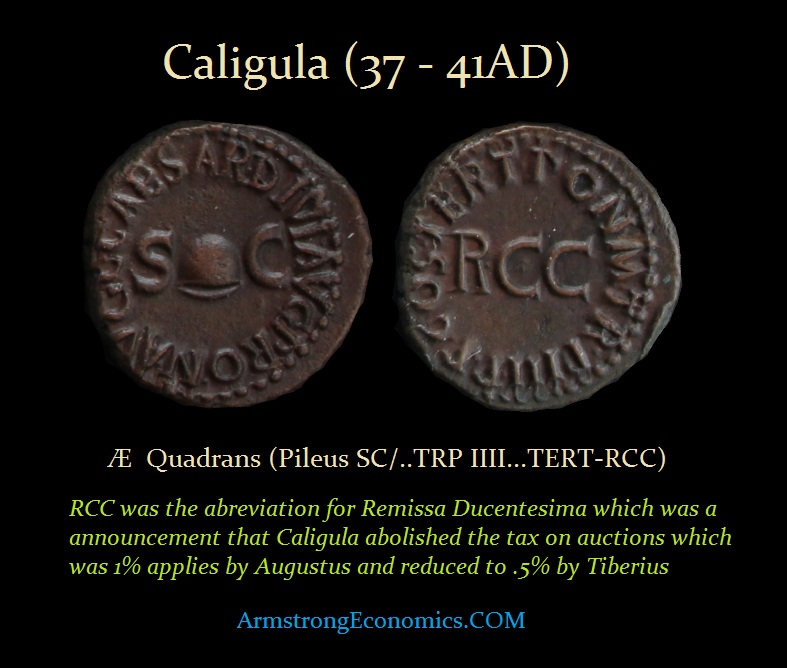

ANSWER: Actually no. This attitude toward tax levels over 10% is the product of Socialism and Karl Marx. Even the notorious Emperor Caligula abolished taxes placed on auctions. This was the norm when estates were liquidated and the proceeds went to the family. Augustus put in this auction tax which was effectively on top of a 5% Inheritance Tax. It caused a lot of tax protests. The tax level was the outrageous level of 1%. The next emperor Tiberius bowed to the pressure and cut the tax in half to just 0.5%. Then Caligula followed Tiberius and he issued this coin announcing that he abolished the auction tax altogether. Note that the coin has SC meaning it was sanctioned by the Senate.

Overall, Rome did not have any direct taxation on income and this was the model for the Founding Fathers of the United States where the Constitution forbids direct taxation. The Roman Empire only imposed indirect taxes. It was Augustus who added to the taxes on harbors and manumission the centesima rerum venalium. Augustus imposed the 1% tax on the price of articles sold at auctions. There was the quinta et vicesima mancipiorum, or 4% tax on the price of every slave purchased but a 5% tax if you freed a slave. Then there was the vicesima hereditatum et legatorum, of 5% on all inheritances above 100,000 sesterces, which did not fall to the nearest blood-relations, and on all legacies. The freedom of the citizens from direct taxation following the victory of the Punic Wars continued unimpaired. Emperor Caracalla in 212 AD granted to all free subjects of the Empire the right of citizenship, but it did not abolish taxation as was the case for those in Italy. There was a customs tax was 2.5% and there was a religious tax on Jews of an extra two denarii a year for not supporting the temples. Diocletian (284-305AD) removed the last distinctions between the inhabitants of Italy and of other parts of the Empire by introducing into Italy the same taxation as obtained in the provinces.

I think we all would prefer an Emperor with low taxation than career politicians who never leave office either and want everything we earn.