Understanding Share Prices will Rise When a Currency Falls

QUESTION: Hi Marty,

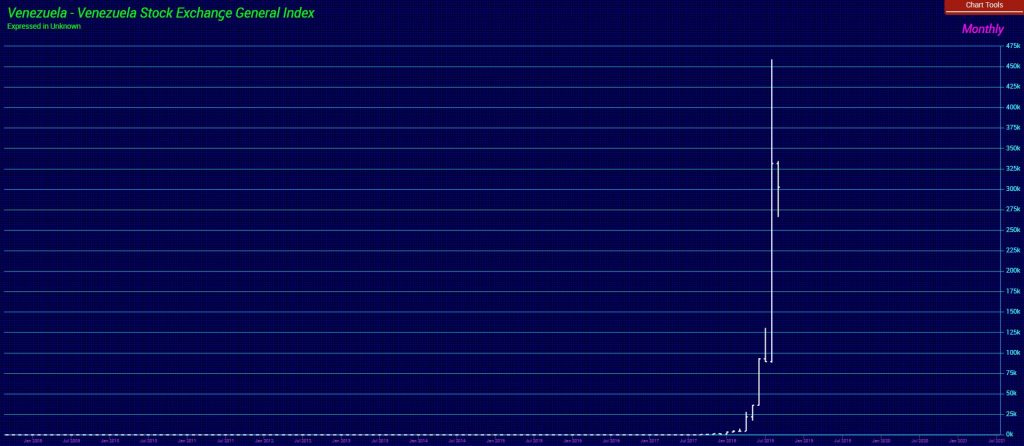

The Venezuela vertical market chart you showed in your 9/7 post is quite interesting. To see historic examples is one thing, to see it happen in real-time, quite another.

The question I have is this – How can one profit from such a move if the local currency is simultaneously plunging?

Venezuela aside, if this type of event comes to pass in the US or Europe how can we (small investors) protect ourselves?

It seems to me that the best you can hope for is to trade the vertical market brilliantly which, in reality, simply be treading water because the currency you must ultimately exit into has been equally devalued!

Your insights and thoughts would be greatly appreciated by us all!

S.M.

ANSWER: In this case, there is no opportunity for foreign investors. It is purely a hedge against the currency for domestic citizens. You cannot get involved for the rise in the market is due to the fall in the currency. A foreign investor must subtract the loss in the currency against the rise in the equity. Then there is the risk of nationalization. Nonetheless, this is what will happen to all markets when the confidence in government suddenly collapses. There are no contingency plans at this moment. They are simply hunkering down and assume they can raise taxes and pass laws to prevent the inevitable. They are sewing the seeds of their own demise by avoiding the reality of what has been done economically for decades.