Bonds & The Record High Short Position Can Majority Be Wrong?

QUESTION: Hi Marty,

Can you help us better understand the dynamics of the sovereign debt crisis as it relates to US Treasuries? I know we are in a global debt crisis, which will also impact US Treasuries but it seems like short treasuries is the current consensus (I believe they are currently at the biggest net short position in recent history). Since most people need to be wrong, does this suggest that as global debt unwinds that perhaps US Treasuries may still have another rally in them before the final crash?

Thank you for any insight into what we know to be the greatest bubble.

Looking forward to the WEC!

SB

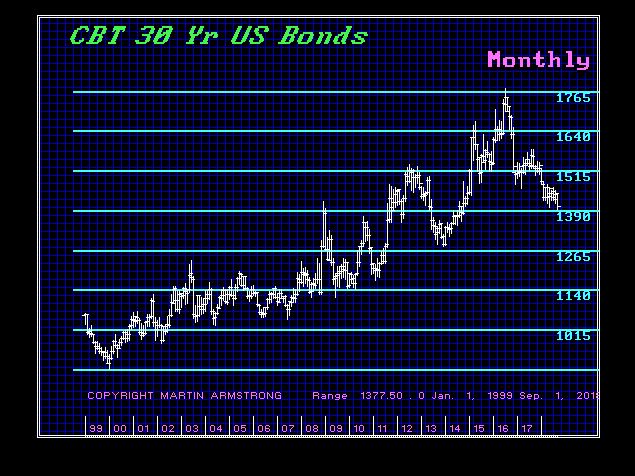

ANSWER: We have to always look at markets collectively from a global perspective, and also separating the long-term from the short-term trend. It is sort of the saying you can win the battle, but lose the war. This is the same thing. In the case of interest rates, the long-term is clearly staring at higher rates square in the eyes. However, then we have shifts in trend within the short-term. For example, domestically, you have this pervasive hatred of the stock market and as an evergreen tree, they have been perpetually bearish since 2009. They have not wavered in that forecast because they have blinders on and make forecasts solely upon a flat model limited to patterns and domestic analysis at best. Therefore, there will be these bouts of flight to quality sell stocks and buy bonds. We have NOT yet crossed the Rubicon in interest rates. We still have not yet elected the 4th Monthly Bearish Reversal. When we do, the 30-year will signal the debt crisis is in full gear.

Now we have to look at this market from a Hedge Fund Manager’s world. My decision has to be made on a global scale – not domestic. This boils down to you are a prince and your father compels you to ask one of the three ugliest girls in town for a date for political reasons for the realm. So, you choose the prettiest of the three ugly sisters as they say. This is what happens internationally. You have to have money in debt because you are trying to also be diversified (I do not always agree with that strategy). Hence, the euro looks like death warmed over, political chaos is brewing, so you have to push money out the door to other currencies. Hence, the dollar keeps rising and the political rhetoric against Trump is desperate to hide the trend that his strategies have been working on bringing capital home and renegotiating NAFTA. So with the dollar strong, euro in crisis, you have no choice but to buy Treasuries even if for short-term plays.

Consequently, you can be correct that the long-term trend is UP UP AND AWAY for interest rates. However, the devil is lurking behind every rock along the path. You may be correct on the war, but lose a fortune of the short-term corrections. Hence, we have not yet crossed the Rubicon. When we do, it will be time to shout very loud so our readers will hear. We can see that the chart patterns between dollars and euro in the 30-year Treasuries is as different as night and day.