US Share Market Meltdown?

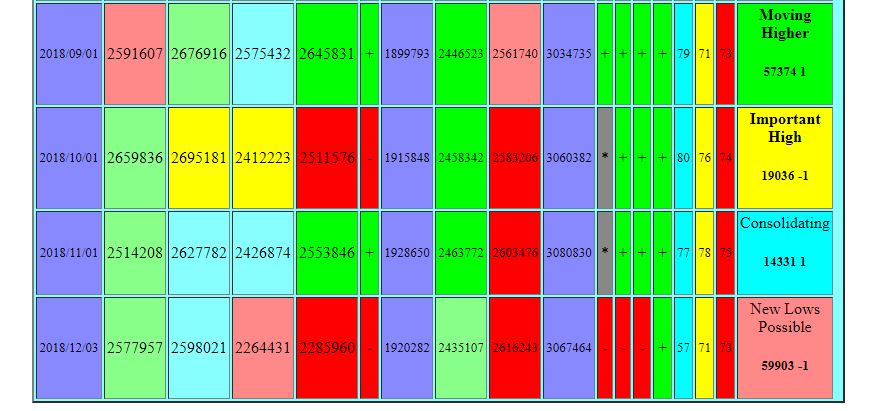

Everything is still on track for a pullback. The Dow Jones Industrial Average closed at a 14-month low on Thursday, the second consecutive day of sell-offs after the Federal Reserve announced its fourth widely-anticipated rate hike of the year. Interestingly, despite the fact that the rate hike was expected, the Fed’s revised outlook for a cooler economy stoked overall fears about a slowdown coming 2019-2020. There are also concerns over the government shutdown threatened by President Trump and the continuing trade tensions with China worried investors. Of course, none of these issues are really long-term bearish factors. Our model has been pointing to a correction given the NASDAQ peaked in August, S&P500 in September, and the Dow in October showing a great disparity between domestic retail v professional investors against international. The market has still not breached important support levels.

We will provide a PRIVATE BLOG update for the morning