The Business Cycle & Why They Pretend it Cannot be Forecast

QUESTION: Mr. Armstrong; I have studied you Economic Confidence Model and found it to be extremely accurate in forecasting the business cycle. When I showed it to my professor here at ——— he responded that itis impossible to forecast the business cycle. He would not even engage in a conversation about it. Why are they so intimidated by your work?

Thank you

GM

ANSWER: What you have to understand is that IF it is possible to forecast the business cycle, then that means politics have to change. The entire system is based upon the proposition of vote for me and I will reduce unemployment and bring world peace unless I do not like the people. If you listen to Larry Summers, he states that if you could forecast the business cycle, that would be bad because it would become a self-fulfilling prophecy. He also states that the economy is far too complex, like weather, with way too many moving components that make it impossible to forecast. That means the door is open to manipulate the economy, as he suggested with negative interest rates. When that failed, he then discovered there was the zero interest boundary where people would withdraw their cash from banks and defeat his negative interest tool. He has thus advocated eliminating physical paper money to allow his negative interest rate idea to then work — so he maintains. He ignores, of course, the entire pension fund system.

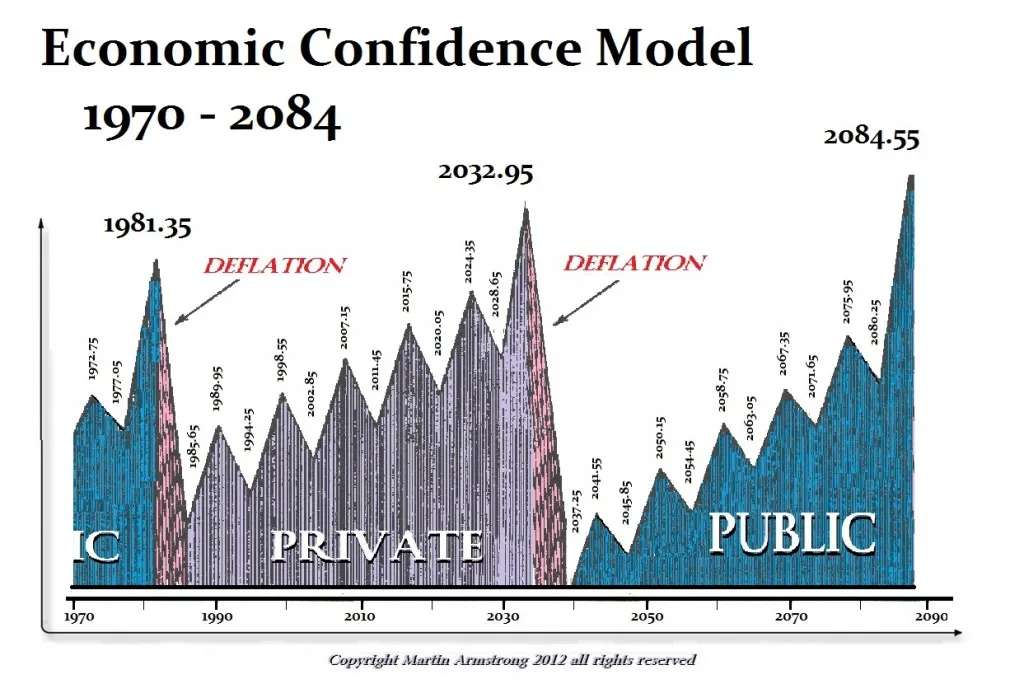

Many governments want our forecasts so they can understand what is happening. However, they would not publicly state that a recession is coming. Yet, the central banks have been warning that another economic crisis is on the horizon. Therefore, we are dealing with a question of political power. Even in the middle of an economic crash, the president will always come out and make some statement declaring the economy is sound. Can you image if he publicly stated we were going to collapse to 10 cents on the dollar? No matter what they may believe, they MUST speak to try to maintain confidence. Hence, I have called this the Economic Confidence Model because it all depends upon confidence at the end of the day.