Bitcoin v Gold

QUESTION: Do you think that Bitcoin will replace gold as some people claim it is some new reserve asset?

Thank you for being the voice of reason in the middle of all these people preaching their own position.

GD

ANSWER: That is really a bizarre question. I do not see how that is possible. As far as it becoming a reserve asset that surpasses everything else, I would have to say that is not plausible. These are proposals propagated clearly by retail people involved in the conspiracy world. Even if we look at the German hyperinflation, the PRIMARY assets to survive was real estate. That became the backing of the replacement currency.

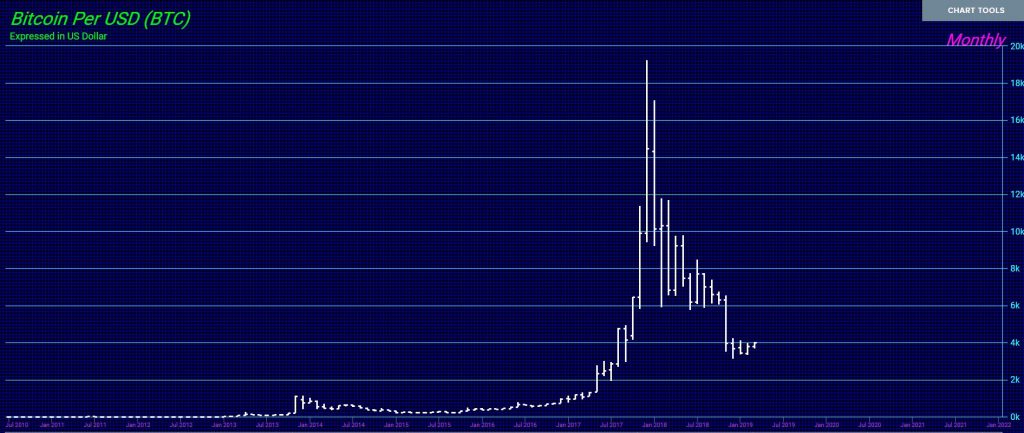

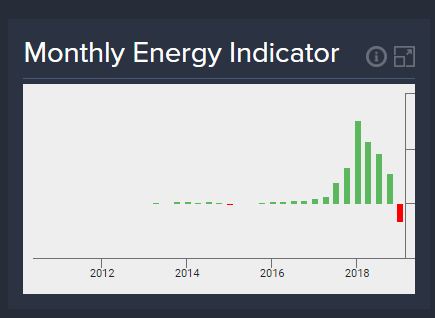

Money itself is NEVER a store of wealth. It rises and falls against tangible assets. I have stated plenty of times that Bitcoin is a trading vehicle — nothing more. Just look at the chart. This fluctuates like everything else. That alone proves it will never be some mythical store of value or reserve asset. Our Energy Models have turned negative so it has squeezed out most of the excess which would allow it to make a rally if it exceeds the Weekly Bullish Reversals (see Socrates report for further details — available to subscribers only).

Money itself is NEVER a store of wealth. It rises and falls against tangible assets. I have stated plenty of times that Bitcoin is a trading vehicle — nothing more. Just look at the chart. This fluctuates like everything else. That alone proves it will never be some mythical store of value or reserve asset. Our Energy Models have turned negative so it has squeezed out most of the excess which would allow it to make a rally if it exceeds the Weekly Bullish Reversals (see Socrates report for further details — available to subscribers only).

It does not matter what you are talking about. ABSOLUTELY NO instrument will ever be the main “reserve asset” for people will always disagree. There will be people who cling to gold, others to stocks or real estate, and then we have the sublime fools who will hold government debt. You will never convince everyone to create a single reserve asset.

These are usually the rantings of people unfamiliar with how the world economy really functions. Even central banks hold dollars but in bonds to earn interest. They do not hold physical paper dollars. When they were leasing out gold to earn some income, these same people accused them of suppressing the market in a conspiracy.

Institutions need to earn some income. This is why they do not hold gold. Gold shares they can hold but bullion must be lent out to earn income. How are they going to hold Bitcoin that pays no interest and fluctuates like any other commodity?

What these people preach sounds great to the retail market who is just looking to make capital gains. But institutions cannot function that way. Pension funds need income to make payments. They can no more hold Bitcoin than gold bullion in a vault without income.

So as far as Bitcoin replacing gold among the retail investor, I think we have more readers of our gold reports than Bitcoin.