Did Life Insurance Companies Survive the Great Depression?

QUESTION: Did insurance companies just declare bankruptcy during the 1930s to escape liabilities?

PD

ANSWER: Personally, I have NEVER had an insurance policy that EVER paid what they promised. To me, it is one giant scam. You lie to an insurance company and it is a crime. They lie to you, and they walk on water. They have greased the palms of Congress so completely that they are untouchable in so many ways. That is my PERSONAL opinion and bias. Now for the facts.

The insurance industry was deeply involved in the Great Depression. When the stock market crashed, the formerly abstract risks endemic to the 1920s mortgage market surfaced as borrowers could no longer afford even moderate monthly payments. It was insurance companies that had lent into the mortgage market extensively more so than banks. It was primarily insurance companies who were foreclosing on liens they held on properties. Between 1928 and 1933, home prices declined by nearly 30% following the break of the Florida Land Bubble in 1927. During 1932, property values collapsed on average nearly 11% that year alone.

The insurance industry was deeply involved in the Great Depression. When the stock market crashed, the formerly abstract risks endemic to the 1920s mortgage market surfaced as borrowers could no longer afford even moderate monthly payments. It was insurance companies that had lent into the mortgage market extensively more so than banks. It was primarily insurance companies who were foreclosing on liens they held on properties. Between 1928 and 1933, home prices declined by nearly 30% following the break of the Florida Land Bubble in 1927. During 1932, property values collapsed on average nearly 11% that year alone.

Consequently, while 9,000 banks failed, there was also a massive default of intermediaries such as S&Ls (Savings & Loans). The popular products they were selling were both the balloon and amortizing mortgages. The amortizing mortgages involved a share accumulation loan plan whereby borrowers were required to buy shares in the S&L each period until their holdings were at par with the amortizing loan principal at which point the debt was canceled. Therefore, as the property values declined, the value of their forces share purchases also collapsed. Defaults were thereby increasing the net loan balances for remaining borrowers by reducing the value of the sinking fund. This only led many others to default for their debt increased as the market declined. Many S&Ls were forced to liquidate their holdings completely resulting in over 5,000 collapsing during the 1930s. The more properties that went into default, the greater the market for property declined as more and more supply was up for sale.

Life insurance had its beginning in the USA around the middle of the 19th century and experienced steady growth after 1880. They realized it was ok to sell fire insurance, but people would not buy death insurance. They switch the label to life insurance and then the boom unfolded.

Life insurance had its beginning in the USA around the middle of the 19th century and experienced steady growth after 1880. They realized it was ok to sell fire insurance, but people would not buy death insurance. They switch the label to life insurance and then the boom unfolded.

By the end of 1918, the total policies outstanding reached nearly $30 billion which was huge back then. The life insurance business then entered a Phase Transition during the Roaring ’20s, for in 1919 alone they wrote $8 billion in new policies. By 1929, the annual market was expanding by almost $20 billion. This large flow of new business created a Ponzi scheme that far more than offset cancellations of old policies by deaths, maturities, or surrenders so that the total of insurance in force increased each year by $4 billion to $8 billion. While it took 79 years to achieve, in 1922 the first $50 billion of life insurance was accumulated whereby the second $50 billion was attained in less than 7 years. The total amount outstanding in life insurance exceeded $100 billion by August 1929. The annual total of new business declined moderately at first during 1930, falling to $17.2 billion in 1931, and fell further in 1932 to an estimated $14.7 billion. With 121,759,000 policies outstanding at the end of 1931, the Association of Life Insurance Presidents estimated that 68 million persons, or over 55% of the population, were insured. It was estimated that this declined slightly to 65 million or 53% by 1932 at the bottom.

In 1934, with Roosevelt’s New Deal, Congress passed the National Housing Act of 1934, which created two new agencies: (1) the Federal Housing Administration (FHA), which insured mortgages met specific criteria, and (2) the Federal Savings and Loan Insurance Corporation (FSLIC), which insured deposits at S&Ls. Both of these steps were intended on shoring up the housing market by making credit available. The FHA moved to impose restrictions on the terms and interest rates of qualifying mortgages. They typically required fully amortizing mortgages to carry terms to maturity in excess of 15 years, with interest rates exceeding 5% annually in only isolated cases. The structure of these new mortgages mitigates much of the risk inherent to pre-crash instruments.

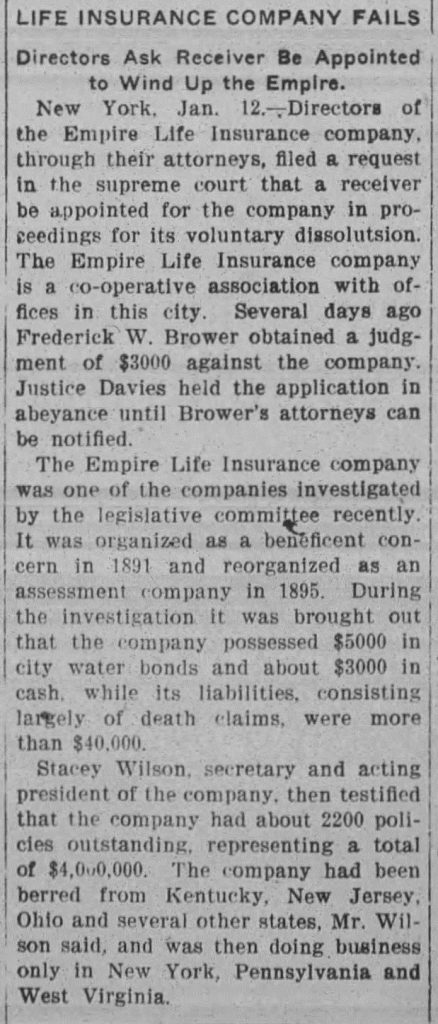

The average default rate on property among first-time buyers during the 1930s was nearly 40%. You can see why real estate prices collapsed. The life insurance companies certainly failed as it was often just really a Ponzi Scheme. Here is a notice of Empire Life Insurance. However, the major ones today will suffer losses and will be caught up in a liquidity crisis, but they may avoid all-out default.