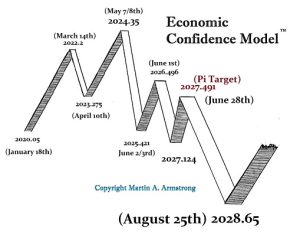

The Next Cycle in the ECM Beginning January 2020

QUESTION:

Martin,

I am a huge fan of yours and have followed your blog for probably 8 years now, I watched your many predictions using the AI models and have been amazed by their accuracy. I am a very concerned small investor and with this big shift coming in the ECM in January 2020 am wondering where you think I should be invested… Gold, the DOW, real estate, cash? I have bought far out of the money Jan 2021 GLD options which are extremely cheap right now. How do you best recommend your fans to position themselves for the coming storm?

Hopefully I will be able to make your next conference.

All the best.

Sincerely

RW

ANSWER: It is still too early to make a reliable forecast just yet. But generally, the next wave of the ECM business cycle should be an inflationary one. It certainly appears that all of this Quantitative Easing has caused tremendous damage and has now trapped the central banks to the point that the biggest debtor is the government. They have tried to use interest rates under Keynesian economics to manipulate “demand,” which is used to force us to borrow or stop borrowing. But all of these manipulations have no impact on preventing government borrowing. The danger now is that after 10 years of QE, governments are addicted to low interest rates and raising them this time will blow up the government budgets. They will respond by raising taxes to try to keep the ball rolling, but that will result in civil unrest and deflation.