ECB Will Lend to Banks Long-Term in Hopes They Will in Turn Lend Again

Come September, Draghi at the ECB will make loans to Eurozone banks on a long-term basis at rates less than the short-term lending window. The objective is to encourage banks to lend money to businesses. Nobody thinks about letting businesses bypass the banks mainly because the banks are in such a vulnerable state because Europe never took the toxic assets out of the banks as did the USA. To do that would have meant that some countries would have been bailed out more than others so they cut rates and hoped for the best which never happened.

The world economy is crashing BECAUSE of negative interest rates. These insane people have REFUSED to consider that this entire idea of lowering interest rates to stimulate the economy will NEVER work. You are wiping out pension funds and the elderly who are a vital part of the economic base. They keep using the same theories that are decades old and have ALWAYS failed each and every time.

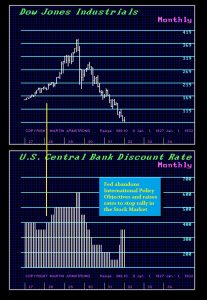

Just look at the Great Depression. Lowering interest rates FAILED to reverse the decline. The market rallied when the rumors proved correct that Roosevelt would devalue the dollar creating currency inflation. Lowering interest rates has NEVER worked even once, yet they keep trying the same theory over and over again because they cannot think of anything else to try.