China v US Trade War

China understands the difference between the German mercantilist model of manufacturing and sells to everyone else and the United States which became the largest economy in the world because it allowed its domestic consumer economy to develop. China will become the largest economy in the world and take the crown from the United States because America lacks the political stability to foster long-term economic growth like China.

That statement will be a political bombshell no doubt. The demise of the United States is easily seen by the polarization of American politics. The Democrats come in and want to raise taxes and hunt the rich sending jobs and capital overseas. The Republicans come in and want to lower taxes and bring jobs and capital back home. The problem is very clear. Tax rates should NOT be a political yoyo. Corporations must have a budget. They cannot plan long-term because it all depends upon the next election every time. Unless the Supreme Court outlaws Marxism, there is no hope for the United States to survive long-term. Our political system will self-destruct the economy. There is just no consistency which is vital to economic growth.

China, in contrast, has a long-term plan. Its politicians are a career employee, but they need not stand for election. That actually allows for actual long-term planning where the United States cannot compete because of the polarization in American politics dominated by free-market Adam Smith v Marxist Socialism. This political war keeps getting worse and it is tearing the economy apart.

Those who have been expecting a quiet solution to the China v USA Trade War were shocked by the statements on Friday. China’s trade war escalation increased tariffs on imports imposing $75 billion worth of duties on U.S. goods, beginning Sept. 1 and December 15. China’s foreign ministry said that it would resume tariffs on U.S. imports of automobiles and auto parts and place an additional 5% or 10% tariff on agricultural and food products like soybeans, coffee, whiskey, and seafood.

China has a major car manufacturing operation. China had no problem allowing investment in its financial sector because there is a serious problem which can use capital at this point in time. China’s banks are not intricately connected to US banks as was the case with European and American banks. Therefore, a debt problem in China is more likely to have an isolated Asian influence rather than create a contagion infecting the US economy directly.

Donald J. Trump

@realDonaldTrump

@realDonaldTrump

Trump responded in a series of 4 tweets where he said:

Our Country has lost, stupidly, Trillions of Dollars with China over many years. They have stolen our Intellectual Property at a rate of Hundreds of Billions of Dollars a year, & they want to continue. I won’t let that happen! We don’t need China and, frankly, would be far better off without them. The vast amounts of money made and stolen by China from the United States, year after year, for decades, will and must STOP. Our great American companies are hereby ordered to immediately start looking for an alternative to China, including bringing your companies HOME and making your products in the USA. I will be responding to China’s Tariffs this afternoon. This is a GREAT opportunity for the United States. Also, I am ordering all carriers, including Fed Ex, Amazon, UPS and the Post Office, to SEARCH FOR & REFUSE, all deliveries of Fentanyl from China (or anywhere else!). Fentanyl kills 100,000 Americans a year. President Xi said this would stop – it didn’t. Our Economy, because of our gains in the last 2 1/2 years, is MUCH larger than that of China. We will keep it that way!

To put this all in perspective, $75 billion in tariffs to an American economy in excess of $20 trillion, amounts to .003%. You would not think all the wild swings and talk of trade would be a major factor in the US economy. However, China would very much like to see Trump lose the election so they can get back to negotiating trade deals by offering special treatments to the career politicians who look to get something out of everything for themselves.

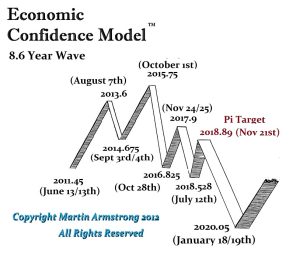

The way the markets respond to every issue with trade is really over-kill. But the market is in a bearish mode as the Economic Confidence Model heads into its business cycle low come January 2020.