Life & How it Evolves

QUESTION: Martin;

What was the tipping point in your investing infancy that flung you to believe you could invest for others?

If so can you tell us the trade? And did you mortgage your house for it?

For it appears that the best in the business made it on their own first.

Apprehensive at this point in time;

RH

ANSWER: No. There was no trade. I was very young and was really trading bullion as a dealer in the cash markets prior to 1975. One of my clients was a senior executive at a major New York bank. The floating exchange rate system began in August 1971. There were no courses to take. He knew I understood how to trade and called me in to look at a foreign exchange loss involving the Italian lira. After that, institutions with FX problems would call me more or less saying get that guy that helped the other bank.

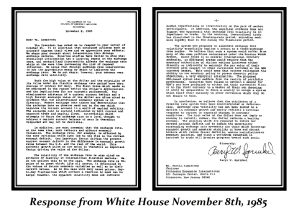

That is why by 1985 I was called by Congress for the G5. I was regarded as one of the top forecasters in foreign exchange. I realized that I was called into a dog and pony show where they had already made up their minds to create the G5 and just wanted experts to testify to pretend they relied on someone other than themselves. I protested and wrote to the president warning that lowering the dollar by 40% would cause a panic in 2 years because the Japanese would sell US assets since they would lose a fortune after buying 1/3rd of the US national debt.

The White House had to respond. I suppose that opened the door to governments. Ever since I have been called into just about every single major international event from China to Europe and the Middle East.

The White House had to respond. I suppose that opened the door to governments. Ever since I have been called into just about every single major international event from China to Europe and the Middle East.

As far as trading was concerned, people were soliciting me all the time. I declined to manage money for individuals. Post-1985, I managed money only on an institutional level. I also tended to specialize in crisis management whereas I would be called in to manage a particular market crisis and get them out of some crazy trade.

I was asked by Deutsche Bank to manage a public fund that would be a hedge fund but onshore in Australia, which would be the first regulated hedge fund. I also manage funds for Magnum.

The London Financial Times had reported on our forecast in 1998. The computer projected the collapse and I took major short positions and more more than 60% in a single month. I was then named Hedge Fund Manager of the Year.

The banks lost big on that and from then on it was outright war. They do their best to try to slander me all the time in desperate hopes somebody will listen. As Nigel Farage said at our WEC in Rome, we have become the alternative to Davos.