Understand What is the Repo Market

QUESTION: Mr. Armstrong and thank you for what you are doing for us regular people. For my first ever question for you, would you please explain as simply as possible exactly what the REPO market is and how it works and how it affects our multi-faceted financial world.

I am truly grateful for your work and communication.

GLH

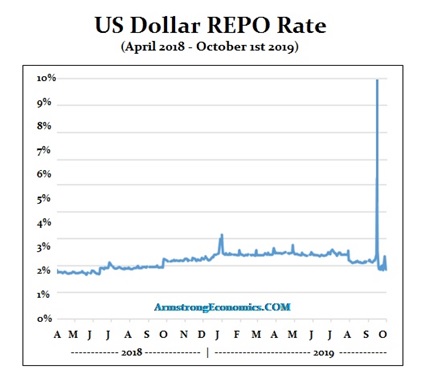

ANSWER: The REPo Market is where banks will post AAA securities and borrow against them for the night. Normally, the big banks like J.P. Morgan provide over $300 billion in liquidity daily which allows banks, hedge funds, and institutions to raise cash for the night. When the banks withdrew from lending into the Repo Market, the Fed was compelled to inject cash and thereby lending into the Repo market to prevent the short-term interest rate from rising as it did to 10% on September 17th, 2019.

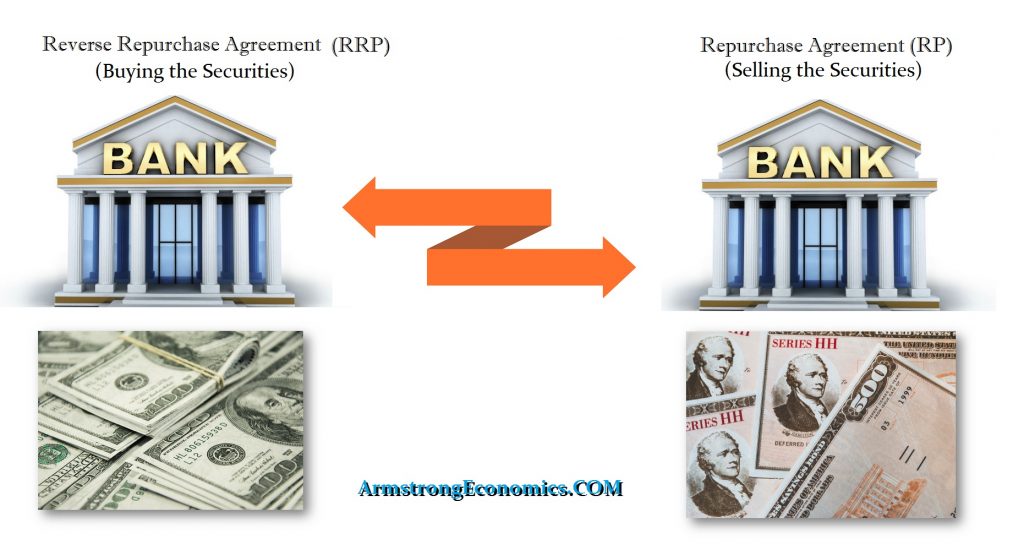

A Reverse Repo (RRP) injects the purchase of securities with the agreement to sell them at a higher price at a specific future date. The party selling the security to raise cash in the market agrees to repurchase the securities (repo) from the lender at a future point in time which is known as a Repurchase Agreement (RP). Repos are classified as a money-market instrument, and they are usually used to raise short-term capital.

This is not a market that is open to the public. However, it is the basic market where everything else is factored on top of this rate. If the Fed did not intervene, then short-term rates would rise and instead of the consumer paying even 20% on a credit card, it would have jumped as must as 10%.

QE was where the Fed was trying to lower long-term rates after the mortgage-backed crisis hit in 2007 so they were buying 30-year bonds. This is the short-term which has nothing to do with QE. Here the Fed is trying to prevent short-term rates from rising rather than lowering long-term rates which they can only “influence” since the Fed posts only short-term rates like the discount rate (wholesale rate) which banks can borrow at.

Here the economy is not declining and unemployment is back to the 1960s. All the talk about QE makes zero sense for these people do not understand what is taking place and it takes professionals in the field to grasp this issue and they cannot speak since they are under confidentiality agreements.