Failure of the Quantity of Money Theory

QUESTION: Marty; Are you saying that Bill Gross is wrong and they will not try “helicopter money” again or that “helicopter money” will not stimulate the economy?

ANSWER: Whether or not the Fed tries to apply “helicopter money” is highly debatable. Bill Gross DID NOT make a forecast that any QE (Quantitative Easing) would be successful or create inflation. All he said was that the Feds will print money trying to “stimulate” again as they did in the past buying bonds which he will eagerly sell to them. So I do not see where this is a right or wrong confrontation. He did not say “helicopter money” would succeed. He just said they would try it again. So where is the disagreement with respect to inflation? As far as the Fed even attempting another QE program is debatable. They realize that it did not work and it foolishly created the Excess Reserve Facility which allowed banks to park (hoard) money at the Fed which defeated the “stimulus” purpose because the money never made it into the economy to increase consumer spending. So the only quasi-disagreement at best is simply I am saying that the Fed realizes now that QE failed. They can see Japan and Europe. If those central banks raise rates, they will create panics because the idiot pundits convinced themselves that lower rates (even negative) are good for stock markets and economy while higher rates are evil. The central banks are trapped and this cannot end nicely.

ANSWER: Whether or not the Fed tries to apply “helicopter money” is highly debatable. Bill Gross DID NOT make a forecast that any QE (Quantitative Easing) would be successful or create inflation. All he said was that the Feds will print money trying to “stimulate” again as they did in the past buying bonds which he will eagerly sell to them. So I do not see where this is a right or wrong confrontation. He did not say “helicopter money” would succeed. He just said they would try it again. So where is the disagreement with respect to inflation? As far as the Fed even attempting another QE program is debatable. They realize that it did not work and it foolishly created the Excess Reserve Facility which allowed banks to park (hoard) money at the Fed which defeated the “stimulus” purpose because the money never made it into the economy to increase consumer spending. So the only quasi-disagreement at best is simply I am saying that the Fed realizes now that QE failed. They can see Japan and Europe. If those central banks raise rates, they will create panics because the idiot pundits convinced themselves that lower rates (even negative) are good for stock markets and economy while higher rates are evil. The central banks are trapped and this cannot end nicely.

Additionally, a number of questions seem to be amazed that a raw theory of the Quantity of Money does not work. They are stunned that I have shown velocity which has been in crash-mode since 1998. They were shocked that the Fed’s Excess Reserve Facility is proof of banks hoarding cash. People hoard money in times of uncertainty, and the data now shows that Americans are saving more and spending less. Their savings (hoarding) reached a 3-year record high in December 2015. This continued to cause the declining Velocity. Then we have banks parking (hoarding) cash at the Fed, corporates cash rich (hoarding) are buying back their own shares, and we have European banks shipping money to the States also parking (hoarding) cash at the Fed collecting 0.25% against negative rates at the ECB.

Additionally, a number of questions seem to be amazed that a raw theory of the Quantity of Money does not work. They are stunned that I have shown velocity which has been in crash-mode since 1998. They were shocked that the Fed’s Excess Reserve Facility is proof of banks hoarding cash. People hoard money in times of uncertainty, and the data now shows that Americans are saving more and spending less. Their savings (hoarding) reached a 3-year record high in December 2015. This continued to cause the declining Velocity. Then we have banks parking (hoarding) cash at the Fed, corporates cash rich (hoarding) are buying back their own shares, and we have European banks shipping money to the States also parking (hoarding) cash at the Fed collecting 0.25% against negative rates at the ECB.

The question is merely whether the Fed would do another QE because people “think” that is necessary despite the fact there is no empirical evidence this has ever worked. The Euro peaked in 2008 and crashed. The capital flows turned into the USA despite the introduction of increasing the money supply by QE. So while the central bankers expected inflation and the Gold Promoters misrepresent this issue claiming that increasing the supply of money is automatically inflationary so gold must rise and the dollar fall, exactly the opposite has unfolded. So the Gold Promoters are preaching the same story as the central bankers. As the economic crisis became worse around the world, the dollar was (and remains) the only currency standing. The Fed has become the de facto central bank of the world yet the money supply increased. You cannot dismiss this and keep touting that the Quantity of Money still is relevant or that it works. Something is seriously missing. If such a theory is valid, then it MUST hold up 100% of the time. It is not the pure Quantity of Money that matters, there is another factor here being ignored – DEMAND; as in supply demand. Naturally, the Gold Promoters will say I am wrong because this is their #1 sales pitch. What they do not understand is you can fool people sometimes, but only a fool believes a fallacy eternally. The rest get burnt and they never come back because they lost confidence in the sales pitch. Gold is a HEDGE AGAINST GOVERNMENT, and to create a bull market requires the decline in DEMAND for dollars because they lost CONFIDENCE in government. Only when government is unable to then sell its debt or raise taxes, then it prints money like Germany to cover its expenses and it debases the currency stretching what resources it has to increase the supply of money to pay its bills when coins were a precious metal. There is simply more to this simplistic view that increasing the supply of money automatically produces inflation. The central banks have followed the very same theory as the Gold Promoters and also failed miserably.

The question is merely whether the Fed would do another QE because people “think” that is necessary despite the fact there is no empirical evidence this has ever worked. The Euro peaked in 2008 and crashed. The capital flows turned into the USA despite the introduction of increasing the money supply by QE. So while the central bankers expected inflation and the Gold Promoters misrepresent this issue claiming that increasing the supply of money is automatically inflationary so gold must rise and the dollar fall, exactly the opposite has unfolded. So the Gold Promoters are preaching the same story as the central bankers. As the economic crisis became worse around the world, the dollar was (and remains) the only currency standing. The Fed has become the de facto central bank of the world yet the money supply increased. You cannot dismiss this and keep touting that the Quantity of Money still is relevant or that it works. Something is seriously missing. If such a theory is valid, then it MUST hold up 100% of the time. It is not the pure Quantity of Money that matters, there is another factor here being ignored – DEMAND; as in supply demand. Naturally, the Gold Promoters will say I am wrong because this is their #1 sales pitch. What they do not understand is you can fool people sometimes, but only a fool believes a fallacy eternally. The rest get burnt and they never come back because they lost confidence in the sales pitch. Gold is a HEDGE AGAINST GOVERNMENT, and to create a bull market requires the decline in DEMAND for dollars because they lost CONFIDENCE in government. Only when government is unable to then sell its debt or raise taxes, then it prints money like Germany to cover its expenses and it debases the currency stretching what resources it has to increase the supply of money to pay its bills when coins were a precious metal. There is simply more to this simplistic view that increasing the supply of money automatically produces inflation. The central banks have followed the very same theory as the Gold Promoters and also failed miserably.

Let me make this very clear; our study of the Quantity of Money extends back into ancient times and it is NOT based upon my “opinion” so if you want to argue, please show the data correlation that explains the failure of QE with the survival of the theory of the Quantity of Money. You cannot just say you “think” or express your “opinion” to have any serious consideration in the real world. This is why we reconstructed the world economy using the coinage from all countries. Before the 1663, dies used to impress images on coins were created by hand and are unique and the coinage was hammered rather than machine pressed and milled. This has allowed us to catalogue the number of known dies and then apply the average number of coins that can be struck from a die before it breaks – 15,000. We even collected ancient dies for study. This method allowed us to recreate the money supply on an annual basis. All of this research has enabled us to see the Quantity of Money produced on an annual basis and to test economic theories not guess about them or accept the ones that support a predetermined political view. To understand how things TRULY function, you MUST just let the data speak for itself. Then you can learn the truth rather than political or self-interest propaganda.

You cannot simply come up with theories and support them on “belief” and “opinion” for that just does not cut it in real science. Physics you must prove a theory. They hand out Nobel prizes in economics if they sound nice or to people who lack the back-testing as was the case with Black–Scholes theory which they won the Nobel Prize and then completely failed. So if I am going to make a statement, it is based upon real back-testing. This is NOT my personal opinion. So no worries. They would NEVER give me the Nobel Prize in economics because it proves Marx was wrong and that means government cannot function as it does or have politicians running for office promising to change something they cannot control nor do they understand. They only hand out Nobel Prize in economics to people who support the status-quo. The “establishment” has always been about manipulating the Invisible Hand of Adam Smith because they do not like being the subject of free market movements.

You cannot simply come up with theories and support them on “belief” and “opinion” for that just does not cut it in real science. Physics you must prove a theory. They hand out Nobel prizes in economics if they sound nice or to people who lack the back-testing as was the case with Black–Scholes theory which they won the Nobel Prize and then completely failed. So if I am going to make a statement, it is based upon real back-testing. This is NOT my personal opinion. So no worries. They would NEVER give me the Nobel Prize in economics because it proves Marx was wrong and that means government cannot function as it does or have politicians running for office promising to change something they cannot control nor do they understand. They only hand out Nobel Prize in economics to people who support the status-quo. The “establishment” has always been about manipulating the Invisible Hand of Adam Smith because they do not like being the subject of free market movements.

Perhaps the day will come when someone will plagiarize this work, call it their own, and pretend this is their theory without ever having to collect coins to actually do the work. That too is the way it always goes. Francis Hutcheson, the teacher of Adam Smith, I believe plagiarized Xenophon copying his book Oikonomikos from the 4th century BC which was a how to manage your estate for dummies. Hutchenson called his Book III “The Principles of Oeconomics and Politics” giving birth to the word “economics” which was Greek in origin “Oikonomikos” stemming from the compounded form of oikos meaning “household” and the complex root nem– meaning in this context to “regulate,” “administer” or “control.” So this will no doubt show up one day in the same manner. Outside of physics, there is no ethics in economics.

As far as the Quantity of Money and inflation is concerned, there is ABSOLUTELY no empirical evidence whatsoever which supports that the two are linked in some perfect union always producing the same result. Throughout the Roman Empire, the annual budge was funded by 80% taxes and 20% expansion of the money supply. As the empire expanded bringing in new regions, the bottom-line impact was identical to an increase in population. If the money supply does not increase keeping pace with population growth, then you produce deflation since there is less money per person causing money to rise in purchasing power resulting in the price of goods, services and labor to decline in terms of money (whatever that might be). To reconstruct the money supply required recording the number of known dies of the coinage for every year given they were all hand crafted with subtle differences. Experiments prove that about 15,000 coins were able to be produced from a die on average before it cracked. Hence, reconstructing the new money supply produced each year is a definable FACT (see above chart 157-50BC).

I am not asserting opinion here. We can easily determine the money supply and the expansion of the money supply as well as inflation throughout the course of the Roman Empire. This clearly demonstrates that the modern theory of the Quantity of Money alone is immature and lacks depth no less historical back-testing. This is why everyone from the Gold Promoters to Central Banks who all rely on this theory have been wrong. Make no mistake about it. The QE program which has failed is based on this theory which is also used to promote gold sales. They are both in the same camp.

I am not asserting opinion here. We can easily determine the money supply and the expansion of the money supply as well as inflation throughout the course of the Roman Empire. This clearly demonstrates that the modern theory of the Quantity of Money alone is immature and lacks depth no less historical back-testing. This is why everyone from the Gold Promoters to Central Banks who all rely on this theory have been wrong. Make no mistake about it. The QE program which has failed is based on this theory which is also used to promote gold sales. They are both in the same camp.

Much of the records have survived as have the accounts of many contemporary historians. We even have the records as to the pay of a soldier and pensions over time. The term “stipend” comes from the Latin Stipendium, meaning a pension or pay, from stipem (meaning contribution, dues, income, tax, tribute) and pendo (meaning hang, weigh or pay). Prior to the introduction of silver coins in Rome during 280BC, the money in use was bronze paid by weight and is known as Aes Rude because it traded in lumps, as shown here. This is why we have the merger of income and weight to create the word Stipendium.

There was no pay for a Roman solider prior to 405BC. The Senate appears to have approved pay for the military at that time. According to the historian Livy, the Roman Senate began the practice of giving pay to the Roman soldiers (stipendium) on the occasion of the taking of Tarracina which was a town 35 miles south of Rome. Livy tells us the change was spontaneous and unsolicited act of the senate, but from another passage we are told that in the year 421 BC, the Tribunes had proposed that the occupiers of the public land should pay their property tax regularly, and that it should be devoted to the payment of the troops (Titi Livi Ab Vrbe Condita Liber IV. 36).

There was no pay for a Roman solider prior to 405BC. The Senate appears to have approved pay for the military at that time. According to the historian Livy, the Roman Senate began the practice of giving pay to the Roman soldiers (stipendium) on the occasion of the taking of Tarracina which was a town 35 miles south of Rome. Livy tells us the change was spontaneous and unsolicited act of the senate, but from another passage we are told that in the year 421 BC, the Tribunes had proposed that the occupiers of the public land should pay their property tax regularly, and that it should be devoted to the payment of the troops (Titi Livi Ab Vrbe Condita Liber IV. 36).

No doubt, like the USA which failed to respect the veterans from World War I and attacked the Bonus Army asking for money, we see this similar action in the Roman context. The USA threatened with World War II was compelled to pass the GI Bill because of their harsh treatment of the vets from World War I. Here in Roman times, there appears to have been a proposal in 421BC to pay the troops, but it too waits until there is the treat of another war in 405BC, 16 years later. This became urgent for Tarracina revolted, which had been under Roman rule for some time. Rome needed a paid army to retain its power. The prospect of losing Tarracina was rather serious enough to prompt paying the troops for if their revolt had been successful, like the BREXIT referrendum in June 2016, the fear is the empire would fail. Indeed, Rome would later face the prospect of another war with Veii which came in 396BC. This was about securing all of Italy.

No doubt, like the USA which failed to respect the veterans from World War I and attacked the Bonus Army asking for money, we see this similar action in the Roman context. The USA threatened with World War II was compelled to pass the GI Bill because of their harsh treatment of the vets from World War I. Here in Roman times, there appears to have been a proposal in 421BC to pay the troops, but it too waits until there is the treat of another war in 405BC, 16 years later. This became urgent for Tarracina revolted, which had been under Roman rule for some time. Rome needed a paid army to retain its power. The prospect of losing Tarracina was rather serious enough to prompt paying the troops for if their revolt had been successful, like the BREXIT referrendum in June 2016, the fear is the empire would fail. Indeed, Rome would later face the prospect of another war with Veii which came in 396BC. This was about securing all of Italy.

Late in 218 B.C., the Carthaginians again defeated the Romans on the left bank of the Trebia River, a victory that earned Hannibal the support of allies including the Gauls and Ligurians. By the spring of 217 B.C., he had advanced to the Arno River in Italy. It was the invasion of Italy by Hannibal which prompts the first issue of Roman gold coins. The obverse is the Roman god Janus (for whom January is named), and the reverse depicts an oath scene of allegiance. Rome issued gold coins to demonstrate to the other Roman cities that Rome was rich and that they should not abandon them for Hannibal. This gold issue was clearly a political display of wealth. A stater in the Greek world equaled 20 drachms. The weight was idealized at 8 grams of gold with a silver drachm being 4 grams making the silver to gold ratio about 10:1. However, in practical terms, the ratio was closer to 8.6 since the silver drachms were really about 3.2 grams.

Late in 218 B.C., the Carthaginians again defeated the Romans on the left bank of the Trebia River, a victory that earned Hannibal the support of allies including the Gauls and Ligurians. By the spring of 217 B.C., he had advanced to the Arno River in Italy. It was the invasion of Italy by Hannibal which prompts the first issue of Roman gold coins. The obverse is the Roman god Janus (for whom January is named), and the reverse depicts an oath scene of allegiance. Rome issued gold coins to demonstrate to the other Roman cities that Rome was rich and that they should not abandon them for Hannibal. This gold issue was clearly a political display of wealth. A stater in the Greek world equaled 20 drachms. The weight was idealized at 8 grams of gold with a silver drachm being 4 grams making the silver to gold ratio about 10:1. However, in practical terms, the ratio was closer to 8.6 since the silver drachms were really about 3.2 grams.

Knowing the weight of coinage is one thing. We then must also have some reference point with respect to its purchasing power within society.

Knowing the weight of coinage is one thing. We then must also have some reference point with respect to its purchasing power within society.  According to the Greek historian Polybius (c. 200 – c. 118 BC), the daily pay of a legionary amounted to two oboli. However, he makes a Greek drachma equivalent to a Roman denarius, and a denarius in paying the soldiers was then estimated at ten bronze asses. The Greek tetradrachm (4 drachms) was 16.85 grams making a drachm/denarius about 4.25 grams. However, this was a gross salary and Roman soldiers, since what was deducted from their gross pay was the money value of whatever they received in kind such as food (corn), armor and clothes.

According to the Greek historian Polybius (c. 200 – c. 118 BC), the daily pay of a legionary amounted to two oboli. However, he makes a Greek drachma equivalent to a Roman denarius, and a denarius in paying the soldiers was then estimated at ten bronze asses. The Greek tetradrachm (4 drachms) was 16.85 grams making a drachm/denarius about 4.25 grams. However, this was a gross salary and Roman soldiers, since what was deducted from their gross pay was the money value of whatever they received in kind such as food (corn), armor and clothes.

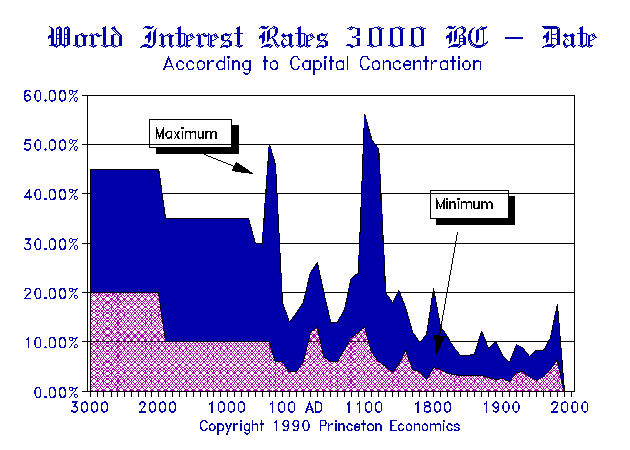

There was a sharp increase in money supply as illustrated above between 97 and 87BC. We then find a very sharp decline in new money coming into the economy. This prompted a serious debt crisis prior to the First Civil War. In fact, corruption was so outrageous it was similar as we see Goldman Sachs donating tons of money to politicians to buy favor that even Obama says he can now make serious money doing speaking engagements for Goldman at the 2016 White House Correspondent’s Dinner. The corruption buying votes sent interest rates soaring for the elections. During the Roman Republic, the corruption was so widespread, that interest rates doubled from 4% to 8% for the elections of 54 BC because there was so much bribery going on to gain votes. There was a very serious shortage of money resulting in a deflationary wave. People could not pay their debts because money was scarce. This was the state of the economy going into the breach of the First Civil War prompting Caesar to cross the Rubicon. We have the coinage record as well as historical accounts.

There was a sharp increase in money supply as illustrated above between 97 and 87BC. We then find a very sharp decline in new money coming into the economy. This prompted a serious debt crisis prior to the First Civil War. In fact, corruption was so outrageous it was similar as we see Goldman Sachs donating tons of money to politicians to buy favor that even Obama says he can now make serious money doing speaking engagements for Goldman at the 2016 White House Correspondent’s Dinner. The corruption buying votes sent interest rates soaring for the elections. During the Roman Republic, the corruption was so widespread, that interest rates doubled from 4% to 8% for the elections of 54 BC because there was so much bribery going on to gain votes. There was a very serious shortage of money resulting in a deflationary wave. People could not pay their debts because money was scarce. This was the state of the economy going into the breach of the First Civil War prompting Caesar to cross the Rubicon. We have the coinage record as well as historical accounts.

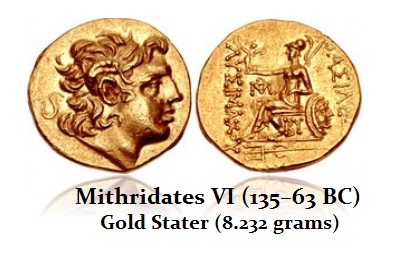

The bronze coinage of the Roman Republic collapsed in weight and was used in terms of accounting only, but virtually no bronze coinage was even being minted. C. Coota complained in 75BC that there was no money (Sallust, Hist. ii, 47M, 6-7; cf. 46M), which is confirmed by a letter from Pompey the Great from Spain (Hist. ii, 98M, 2 and 9). Clearly, people were hoarding money despite the sharp increase in coinage which had taken place going into 87BC, because of the fear of the future. The population had expanded but the money supply did not keep pace producing deflation. There was the First Mithridatic War (88–84 BC) when the legions were commanded by Lucius Cornelius Sulla. We see the issue of Roman gold aureus at this time issued 84-83BC with a weight of 10.78 grams making the silver/gold ratio its lowest point at 6.9:1 demonstrating the rising abundance of gold as Rome moved East. The war ended with a Roman victory, and the Treaty of Dardanos in 85 BC, but the Second Mithridatic War (83–81 BC) broke out which ended inconclusively after a Roman defeat, and withdrawal on Sulla’s orders. This uncertainty would Rome survive contributed to the hoarding.

The bronze coinage of the Roman Republic collapsed in weight and was used in terms of accounting only, but virtually no bronze coinage was even being minted. C. Coota complained in 75BC that there was no money (Sallust, Hist. ii, 47M, 6-7; cf. 46M), which is confirmed by a letter from Pompey the Great from Spain (Hist. ii, 98M, 2 and 9). Clearly, people were hoarding money despite the sharp increase in coinage which had taken place going into 87BC, because of the fear of the future. The population had expanded but the money supply did not keep pace producing deflation. There was the First Mithridatic War (88–84 BC) when the legions were commanded by Lucius Cornelius Sulla. We see the issue of Roman gold aureus at this time issued 84-83BC with a weight of 10.78 grams making the silver/gold ratio its lowest point at 6.9:1 demonstrating the rising abundance of gold as Rome moved East. The war ended with a Roman victory, and the Treaty of Dardanos in 85 BC, but the Second Mithridatic War (83–81 BC) broke out which ended inconclusively after a Roman defeat, and withdrawal on Sulla’s orders. This uncertainty would Rome survive contributed to the hoarding.

The Senate seems to have known about the rising threat from Mithridates VI (135–63 BC) who was perhaps the Republic’s greatest foe at this time since in 78BC they appropriated 18 million denarii to pay for the military. They sent a Quaestor to Cyrene to raise cash since that was a Roman property from 96BC. All accounts show there was a wave of deflation despite the rise in coinage production into 87BC (money supply like QE today). This was followed by the Third Mithridatic War (75–63 BC) commanded by Lucius Licinius Lucullus (75–66 BC) and then by Gnaeus Pompeius Magnus (“Pompey the Great”, 66–63 BC), where Rome was finally victorious and Mithridates VI died in 63 BC.

The Senate seems to have known about the rising threat from Mithridates VI (135–63 BC) who was perhaps the Republic’s greatest foe at this time since in 78BC they appropriated 18 million denarii to pay for the military. They sent a Quaestor to Cyrene to raise cash since that was a Roman property from 96BC. All accounts show there was a wave of deflation despite the rise in coinage production into 87BC (money supply like QE today). This was followed by the Third Mithridatic War (75–63 BC) commanded by Lucius Licinius Lucullus (75–66 BC) and then by Gnaeus Pompeius Magnus (“Pompey the Great”, 66–63 BC), where Rome was finally victorious and Mithridates VI died in 63 BC.

During the 70s BC, the prospect of war led the people to hoard money despite the fact that the money supply increased sharply to pay the troops. There was no government bonds. They issued coinage to cover expenses. There was not enough money to pay the troops as recorded in a speech of Pompey in 59BC (Cassius Dio XXXVIII, 5, 1). Money was being produced in large quantities, but it was being hoarded thanks to uncertainty. Rome was expanding, but it was not yet in possession of Europe or Asia. To fight the pirates dominating the Mediterranean Sea, the Senate appropriated 36 million denarii (Appian, Mith. 430; cf. Plutarch, 25).

There was a tremendous wave of inflation that is not reflected in the silver coinage, but in the gold coinage. The first gold aureus to be minted in Rome itself was that produced by Julius Caesar. The previous issues of gold were struck in the provinces by Sulla to pay troops. The gold inflation wave, much akin to the California gold rush of the 19th century and the Spanish flooding Europe with gold from the New World, has its parallel also at this point in history. The gold inflation wave was created by Julius Caesar’s four victories over Gaul, Egypt, Pharnaces, and Africa, resulting in Rome being flooded with gold. The Roman economy was overwhelmed by gold driving its value of down sharply for it became commonplace. The historian Appianus tells us that Caesar brought back 65,000 talents of gold (talent = 32.3 kilograms (71 lb)) which would have been about 262,437 gold aureii. Additionally 2,822 golden wreaths weighing 20,414 pounds, were carried along the triumphal procession. Caesar gave out an enormous amount of money in gold to both his army and the population of Rome. He paid out the equivalent of 400 sestertii to each and ever citizen or 200 silver denarii equivalent to 4 gold aureii (there was no issue of bronze sestertii to account for the payments). To his troops, he gave them 20,000 sesterii or 5,000 silver denarii which equalled 200 gold aureii. Since these payments were made in gold, they were measured in sestertii (unit of account) but again no such bronze coinage was produced in that denomination. Instead, we have this enormous gold issue. There are 111 known obverse dies from the issue of 46BC and 122 dies of the reverse. This would account for 1,830,000 gold aureii being struck that from that issue alone. This enormous issue of gold aureii caused a collapse in the value of gold.

There was a tremendous wave of inflation that is not reflected in the silver coinage, but in the gold coinage. The first gold aureus to be minted in Rome itself was that produced by Julius Caesar. The previous issues of gold were struck in the provinces by Sulla to pay troops. The gold inflation wave, much akin to the California gold rush of the 19th century and the Spanish flooding Europe with gold from the New World, has its parallel also at this point in history. The gold inflation wave was created by Julius Caesar’s four victories over Gaul, Egypt, Pharnaces, and Africa, resulting in Rome being flooded with gold. The Roman economy was overwhelmed by gold driving its value of down sharply for it became commonplace. The historian Appianus tells us that Caesar brought back 65,000 talents of gold (talent = 32.3 kilograms (71 lb)) which would have been about 262,437 gold aureii. Additionally 2,822 golden wreaths weighing 20,414 pounds, were carried along the triumphal procession. Caesar gave out an enormous amount of money in gold to both his army and the population of Rome. He paid out the equivalent of 400 sestertii to each and ever citizen or 200 silver denarii equivalent to 4 gold aureii (there was no issue of bronze sestertii to account for the payments). To his troops, he gave them 20,000 sesterii or 5,000 silver denarii which equalled 200 gold aureii. Since these payments were made in gold, they were measured in sestertii (unit of account) but again no such bronze coinage was produced in that denomination. Instead, we have this enormous gold issue. There are 111 known obverse dies from the issue of 46BC and 122 dies of the reverse. This would account for 1,830,000 gold aureii being struck that from that issue alone. This enormous issue of gold aureii caused a collapse in the value of gold.

The enormous gold coinage of Julius Caesar in 46-45BC flooded the money supply with the yellow metal and produced a violent disturbance in the monetary system as the silver/gold ratio had risen from its low under Sulla (6.9:1) rising to 12.5:1 and then collapsing again back to 9:1 in about 31 years (Pi Cycle). This contributed to the debt crisis insofar as loans had been in terms of denarii, not gold aureii. This clearly sent the financial market into chaos down the Via Sacra, the Wall Street of its day. Creditors had been demanding repayment in denarii, which was obviously at a premium to gold.

The enormous gold coinage of Julius Caesar in 46-45BC flooded the money supply with the yellow metal and produced a violent disturbance in the monetary system as the silver/gold ratio had risen from its low under Sulla (6.9:1) rising to 12.5:1 and then collapsing again back to 9:1 in about 31 years (Pi Cycle). This contributed to the debt crisis insofar as loans had been in terms of denarii, not gold aureii. This clearly sent the financial market into chaos down the Via Sacra, the Wall Street of its day. Creditors had been demanding repayment in denarii, which was obviously at a premium to gold.

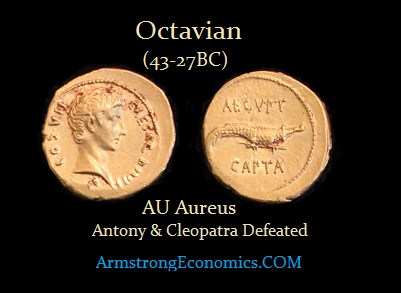

After the Second Civil War where Octavian (Augustus) defeats Marc Antony and Cleopatra, some of the aurei of Augustus (27BC-14AD) were struck at the reduced rate of 42 to the pound whereas Caesar struck the aureus at 40 to the pound (8 grams). The weight was further reduced by Nero (54-68AD) who struck the aureus at 45 to the pound (7.3 grams). Marcus Aurelius (161–180AD) struck aurei at 50 to the pound (6.5 grams), and by the time of Caracalla (211–217AD) he introduced double denominations that were only about 50% greater in weight.

During the 3rd century, the gold aureus was reduced sharply during the financial meltdown of 260-268AD and after that crisis the coin stabilized at 4.5 grams. However, double aureii were struck regularly weighing only 6.62 grams on average or about 50% greater in weight yet were twice the value showing it was not the metal content that determined the purchasing power. The monetary reform of Diocletian (284–305AD) around 301 AD, struck the solidus at 60 to the Roman pound (and thus weighing about 5.5 grams each) and with an initial value equal to 1,000 denarii, which had been reduced to bronze. The gold solidus was reintroduced by Constantine I (306–337AD) in 312 AD after he confiscated the wealth of the pagan temples. This denomination now permanently replaced the aureus as the gold coin of the Roman Empire. The solidus was struck at a rate of 72 to a Roman pound of pure gold, each coin weighing about 4.5 grams of gold. By this time, the solidus was worth 275,000 of the increasingly debased bronze denarii (once silver).

During the 3rd century, the gold aureus was reduced sharply during the financial meltdown of 260-268AD and after that crisis the coin stabilized at 4.5 grams. However, double aureii were struck regularly weighing only 6.62 grams on average or about 50% greater in weight yet were twice the value showing it was not the metal content that determined the purchasing power. The monetary reform of Diocletian (284–305AD) around 301 AD, struck the solidus at 60 to the Roman pound (and thus weighing about 5.5 grams each) and with an initial value equal to 1,000 denarii, which had been reduced to bronze. The gold solidus was reintroduced by Constantine I (306–337AD) in 312 AD after he confiscated the wealth of the pagan temples. This denomination now permanently replaced the aureus as the gold coin of the Roman Empire. The solidus was struck at a rate of 72 to a Roman pound of pure gold, each coin weighing about 4.5 grams of gold. By this time, the solidus was worth 275,000 of the increasingly debased bronze denarii (once silver).

Where the silver was debased, the gold was reduced in weight. Julius Caesar doubled the salary for the legionary soldier according to Suetonius prior to the civil war (Sueton. Jul. Caes. 26). After the Civil War and Augustus defeats Marc Antony, Suetonius tells us that Augustus appears to have raised the military pay to 10 asses a day (three times the original sum), or 300 a month, or 1200 in four months.

We even know how many legions Marc Antony and Cleopatra had in the battle against Octavian. Antony issued a denarius for each legion. At the time of Julius Caesar, a denarius was ideally 4 grams. The legionary denarii of Marc Antony weight about 3.8 grams. So we do not see any massive debasement given there were two civil wars back to back despite the fact that the money supply rose significantly to pay the troops.

We even know how many legions Marc Antony and Cleopatra had in the battle against Octavian. Antony issued a denarius for each legion. At the time of Julius Caesar, a denarius was ideally 4 grams. The legionary denarii of Marc Antony weight about 3.8 grams. So we do not see any massive debasement given there were two civil wars back to back despite the fact that the money supply rose significantly to pay the troops.

Here is the chart of the debasement of the Roman silver denarius. Note that the debasement begins with Nero (54-68AD). The reason for this was largely to cover the cost of government, which included the military.

Here is the chart of the debasement of the Roman silver denarius. Note that the debasement begins with Nero (54-68AD). The reason for this was largely to cover the cost of government, which included the military.

Now as the original amount of a solider’s pay had been tripled, the soldiers could not complain if the denarius were reckoned at 16 asses (bronze) in payments made to themselves, as well as other persons; and taking this value, the 1200 asses amount to exactly 3 aurei, or 3 × 400 asses. This sum then was considered as an unit, and called stipendium, being paid three times a year. Hence Suetonius says of Domitian raised the soldier’s pay (Dom. 7): “Addidit et quartum stipendium, ternos aureos”: a fact which Zonaras confirms (Ann. II. p196) otherwise expresses by stating, that instead of 75 drachmae (i.e. denarii) Domitian gave the soldiers 100, i.e. he made a pay raise of 25 denarii or 1 aureus to their pay.

Putting together the history of the world monetary system reveals that there is ABSOLUTELY no support for the idea that “helicopter money” creates inflation nor is it the cause of the decline and fall of a nation. That becomes the net result of a collapse in confidence FIRST whereas people then hoard money and do not spend it. The economy turns down and tax revenue also declines. Rome’s budget was effectively 80% taxes and 20% creating new money. As confidence collapsed, there was less and less to tax. People saved (hoarded) rather than spent and in the process the economy shrinks. This comes SECOND comes the “helicopter money” which emerges as tax revenues collapse. We will see this in the years ahead as social programs are cut and we see state and local government go bust. The ONLY source of funding becomes the creation of money. When government becomes strapped and can no longer sell their debt today, then the implosion unfolds. This is being furthered by central banks buying government debt which they can never resell. Then the entire system implodes.

Putting together the history of the world monetary system reveals that there is ABSOLUTELY no support for the idea that “helicopter money” creates inflation nor is it the cause of the decline and fall of a nation. That becomes the net result of a collapse in confidence FIRST whereas people then hoard money and do not spend it. The economy turns down and tax revenue also declines. Rome’s budget was effectively 80% taxes and 20% creating new money. As confidence collapsed, there was less and less to tax. People saved (hoarded) rather than spent and in the process the economy shrinks. This comes SECOND comes the “helicopter money” which emerges as tax revenues collapse. We will see this in the years ahead as social programs are cut and we see state and local government go bust. The ONLY source of funding becomes the creation of money. When government becomes strapped and can no longer sell their debt today, then the implosion unfolds. This is being furthered by central banks buying government debt which they can never resell. Then the entire system implodes.

There is a growing concern that the central bank is out of ammunition both in lowering interest rates as well as QE printing money. While many people will say I am wrong or whatever, they do not speak directly to people in central banks or to staff on the House Banking Committee – I do! Central Banks have even attended our World Economic Conferences. In fact, the Commission designing the Euro attended our 1997 Conference in London and took the entire back row. So I do not speak out of total speculation.

Right now, even in Germany, the Bundesbank is departing from the policies of the ECB and Draghi. The negative interest rates are becoming widely seen as undermining pensions. Here is the front cover of a German magazine warning that pension funds are broke thanks to negative interest rates.

I would NOT put it as 100% guaranteed that the Fed will engage in “helicopter money” buying government bonds. They are trapped. They know that. They may have no choice in the end, but that would be if government finds it cannot sell its debt. Do not expect the Fed to be the first to fall. They will be the LAST. We have the data. We have run the correlations. If someone wants to disagree, then ask for their data – not opinion or “I think” scenarios based upon assumptions and bias.