The Dow & Volatility

With the CBOE Volatility Index (STOXX: .VIX) at its lowest level in over 10 years, many people call this the fear gauge and are concerned that people have become complacent. The VIX, is by no means a perfect measure of overall fear in the market. How we measure volatility depends upon the formula. Here are just three indicators of volatility each measured differently (1) internal, being the different between the high and low of that session, (2) the close to close degree of volatility, and then (3) overnight volatility, which is measured from the day’s close to the next day’s open.

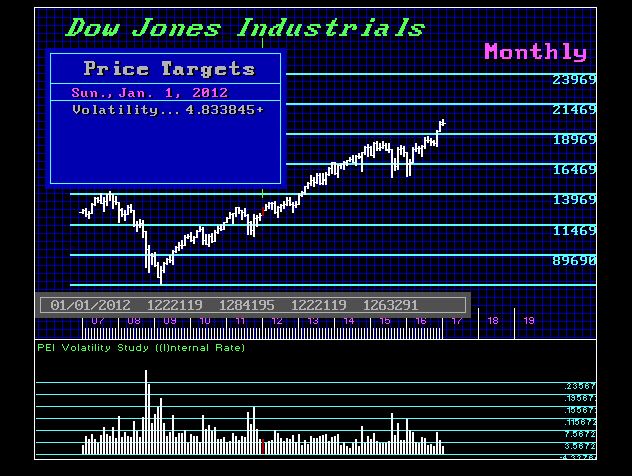

The VIX is not a perfect indicator and it is different from how we look at volatility. You can see here that we ran our Internal Volatility measurement on the VIX and the low was January 2012. Here is the comparison on the Dow so you can see where the VIX low took place, whereas our Internal Volatility has declined since that period of time.

The biggest risk to volatility going forward was Trump’s dismissal of Comey. This could now act as a battle cry to stop his tax reform – very stupid decision.