How High Can the Euro Go on this Reaction – 116 or 125-128?

This upcoming seminar in Frankfurt Germany will deal with both the short-term and long-term. This has been the Year from Political Hell, and it will not end until after the German elections. With the ECB finally throwing in the towel admitting (but certainly not publicly) that nearly 10 years of low to negative interest rates has utterly failed to reverse the deflation. Now with the expectation of higher interest rates, the optimism is returning on schedule in Europe as virtually 99% are touting that deflation is over and let the good times roll.

Of course, the greatest error with currency is the general public view it as a share price. They assume that the higher the Euro the stronger the economy becomes. Yet historically, the exact opposite is always true because currency is the medium of exchange which sits on the opposite side of the scale with tangible assets. Deflation is when assets decline because the currency rises in purchasing power.

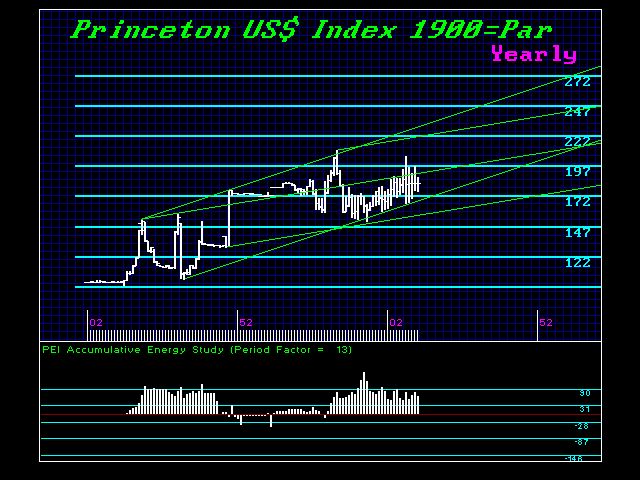

When we look at the historical highs in the U.S. dollar, we can see the peaks are not marked by economic booms, but the economic depressions/recessions. The first peak in the dollar was World War I, then 1931 and the Depression, then 1949 post World War II, then 1985 and the steep recession that prompted the birth of the G5.

The rise in the euro and the decline in the dollar is part of the set-up before the Monetary Crisis begins in 2018. You must always swing to the opposite direction of the eventual trend. The lowered dollar is EXACTLY what Trump wants to increase US exports in theory to create more jobs. A higher dollar will reverse all the aspirations of Trump.

The real question become which target can the Euro reach before reversing the trend in 2018? Are we looking at the 116 level again or 125-128? This will be the topic for the upcoming Frankfurt Seminar on July 22nd. We reached our minimum target of 114.