The Euro & the Dollar

Nothing has yet changed. We are still 500 points away from the start of important resistance. Keep in mind that the ONLY way to break the bank of the monetary system will be a STRONG DOLLAR – not a weaker on. People far too often make a serious mistake and believe that a strong currency reflects a strong economy. Trump wants a lower dollar to reduce the trade deficit, increase sales of US products, and hence create more jobs.

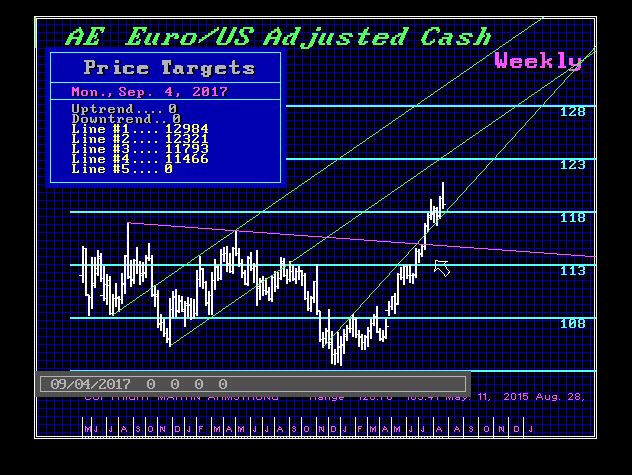

Nothing has yet changed. We are still 500 points away from the start of important resistance. Keep in mind that the ONLY way to break the bank of the monetary system will be a STRONG DOLLAR – not a weaker on. People far too often make a serious mistake and believe that a strong currency reflects a strong economy. Trump wants a lower dollar to reduce the trade deficit, increase sales of US products, and hence create more jobs.

Europe remains caught up in the postwar thinking when the higher the currency the more they were recovering from World War II. A rising Euro is deflationary – not inflationary. It reduces the price of imports from energy to manufactured goods and food.

The counter-trend rally should have been in play going into the German elections due September 24th, 2017. Keep in mind that the Monetary Crisis Cycle begins NEXT YEAR not now. We have the correction in the dollar and the potential pull back in the Dow in dollar terms.

When we look at the Dow in terms of Euros, the peak was the week of 02/27 and we have not yet reached out target to retest the key technical support. This just takes some patience, but we MUST suck everyone in on these counter-trend moves in order to set everything up for the slingshot in the opposite direction next year.