German Property Market – A Real Estate Bubble?

QUESTION: Possible Correlation with ECM-peak in Nov. 2017? Mr. Armstrong, just today I became aware of your story and your life’s work. Your theory is captivating, especially in the light of a series of unsettling changes in my work environment. All of this near Nov. 24-25, a predicted turning point within your ECM forecast. I am a self-employed agent, working mainly on behalf of a … German finance [company] which specializes in selling mortgages for public housing projects ….

Since it´s foundation … [we] operated with a strict lending limit of 80%. Upon so-called “customer-demand”, those limits have now been raised to enable 100% lending at almost the same interest rates (Nov. 9. 2017) while additionally allowing fixed interest rates for 25 years and amortization terms up to ca. 40 years. I have seen even more outrageous offers from competitors. These factors, combined with the unnaturally low-interest rates caused by the ECB, enable almost every household to acquire a house of one’s own.

However, these amortization terms fail to include future investments and a possible future increase in interest rates. In my opinion, households with an average income have a high risk of debt overload or at least a risk of constantly living in debt. It seems to me as if the public model of never repaying one’s debt is slowly being transferred to the private sector.

My observation might just be a small part of the picture, probably a peak in one minor cycle you observe. Yet it does make me feel uneasy, for this peak correlates with your next predicted ECM turning point. Although the public opinion states the opposite, I fear a massive housing bubble on the German market. Even minor changes in interest rates or household income could cause substantial problems for the average homeowner.

I would very much like to hear your thoughts on this subject. Please excuse my rusty English, I did not have practice for a very long time. Thank you in advance for your response. Also, I want you to know that I have the highest respect for your resolve in those times of imprisonment.

From Germany, FW

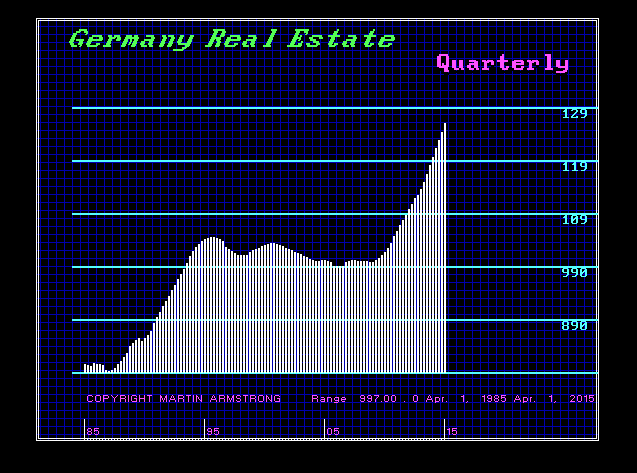

ANSWER: Unfortunately, Germany has allowed its own housing bubble not much different from the USA that burst in 2007. Normally, like fashion, things tend to start in Europe and then migrate to the USA. In the case of real estate, the value of property in areas such as Bavaria was very cheap compared to international levels. The market has been rising since 1996. Even back in 2015, Sparda Bank (www.sparda-bw.de) was offering just over 1% fixed rate mortgages for 10 years.

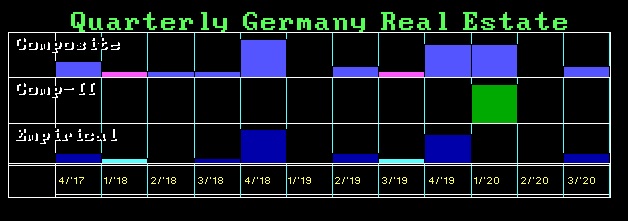

Our timing models do suggest that there is a pause in the trend due here in November (4th quarter). There should be a decline or softening in the market going into the first quarter of 2018. Thereafter, the trend will shift and the next big turning point will be the 4th quarter 2018.

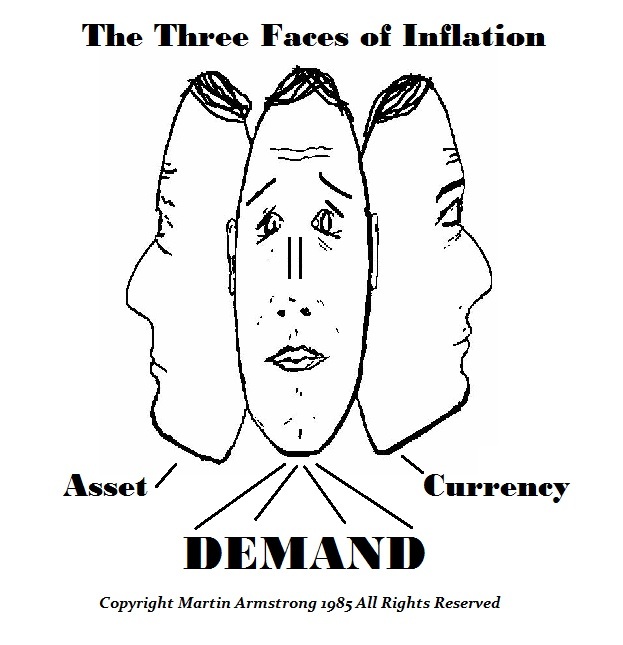

The risk of fixed rates even out now for 25 years will not be on the back of the home-buyer. That risk will belong to the lenders. Yes, the ECB with its negative rates has caused tremendous distortions in the debt markets. They were unsuccessful in creating inflation or expanding the economy. What they have created is asset inflation, which does not show up in the economic statistics as they are focused upon by the media.

The central banks are focused on DEMAND inflation. That has been defeated by any expansion in the money supply which is sterilized by a net rise in taxation. Consequently, the consumer is buying assets and hoarding cash. They are not spending it frivolously on dinner, wine, cloths, and song.

The risk to the borrower will be the rise in taxation that then eats into their disposable income. Lending 100%+ to buy houses is insane. Those who have no equity are highly prone to default. As this group defaults, they increase the supply of property coming to the market and thus all prices are suppressed. This is the process that creates the major high in REAL TERMS.

The homeowner who has equity will lose short-term. However, the euro will crack and in this regard, a low FIXED rate mortgage that they can maintain will be a HEDGE against the currency. The market will shift from asset inflation and cross-over to currency inflation.

The homeowner who has equity will lose short-term. However, the euro will crack and in this regard, a low FIXED rate mortgage that they can maintain will be a HEDGE against the currency. The market will shift from asset inflation and cross-over to currency inflation.

Nonetheless, in terms of INTERNATIONAL VALUE, the market is peaking now in November. Housing prices have risen to world standards so the foreign capital will back-off and not see this as cheap anymore. As the euro declines, then the property in real value terms globally will also decline.