Conflict between Fiscal & Monetary Policy

We are moving into a crisis of monumental proportions. There has been a serious fundamental problem infecting economic policy on a global scale. This conflict has been between monetary and fiscal policy. While central banks engaged in Quantitative Easing, governments have done nothing but reap the benefits of low-interest rates. This is the problem we have with career politicians who people vote for because they are a woman, black, or smile nicely. There is never any emphasis upon qualification. Every other job in life you must be qualified to get it. Would you put someone in charge of a hospital with life and death decisions because they smile nicely?

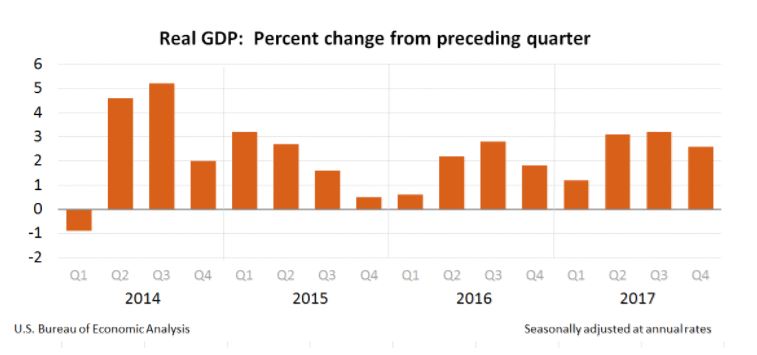

Economic growth has been declining year-over-year and we are in the middle of a situation involving low-productivity expansion with high and rapidly rising budget deficits that benefit nobody but government employees. Once upon a time, 8% growth was average, then 6%, and 4% before 2015.75. Now 3% is considered to be fantastic. Private debt at least must be backed by something whereas escalating public debt is completely unsecured. The ECB wanted to increase the criteria for bad loans, yet if those same criteria were applied to government, nobody would lend them a dime.

Monetary policy, after too long a phase of low-interest rates and quantitative easing, has created governments addicted to low-interest rates. They have expanded their spending and deficits for the central banks were simply keeping the government on life-support – not actually stimulating the private sector. Governments have pursued higher taxes and more efficient tax collection. They have attacked the global economy assuming anyone doing business offshore was just an excuse to hide taxes.

The combination of fiscal policy and monetary policy around the world has produced historically the most irresponsible economic mismanagement in history. This assumption that government can manipulate the economy is extremely dangerous for we remain clueless about how the global economy even functions. This entire Marxist/Keynesian proposition that governments are capable of managing the economy has implemented various miserably conceived theories that will lead to a budget crash and a debt crisis for every reasonably rational contemporary society. Historically, there were debt jubilees mentioned in the Bible.

You shall then sound a ram’s horn abroad on the tenth day of the seventh month; on the day of atonement, you shall sound a horn all through your land. You shall thus consecrate the fiftieth year and proclaim a release through the land to all its inhabitants. It shall be a jubilee for you (Leviticus 25:1-4, 8-10, NASB).

Religion aside, was a debt forgiveness a way to prevent monument collapses of society? The Romans never even had a national debt. Today, we have government hawking 100-year bonds. We have pension funds that required 8% returns and then governments ordered that the bulk of such funds if not 100% should be “conservative” and invest in only government bonds. We are reaching a crisis point in longer-dated yields because investors are unwilling to lend money at low rates long-term. Smart money is beginning to wake up to the perpetual mismanagement of the long-term trend by the government. The central banks have been backing off of continually buying government debt and the Fed in the USA has announced it will not reinvest when its holdings of government debt mature.

This is the Sovereign Debt Crisis and Monetary Crises we face in the years ahead.