Making Sense of The Federal Reserve

I was giving a lecture in Toronto to our institutional clients years ago and the central bank of Canada came with ten people. It was an interesting session because the audience began to ask me questions about what the central banks were looking at to make their decisions. I would answer and then the audience would immediately turn to see their response. It was a really fascinating session that turned me into this quasi-spokesperson for the central banks. I would respond and usually swat down these absurd theories one after another. The head of the Bank of Canada I knew well and the whole table was unbelievable poker-players. They never flinched nor did you get any read from any body language. When it was over, I went up to them and apologized saying I hoped I did not insult them in any way. Their reply was astounding: “Marty, I only wish I could tell these fools we do not look at this stuff!”

People attribute to central banks all sorts of theories you would think they were the all-powerful demigods of finance. Decoding what a central bank says is very important. Yet I find all the commentary to be so off the mark it is laughable. The new word the Fed likes to use is its increasing reliance on “transitory” factors to explain the past six-year problem of being unable to reach the Fed’s 2% inflation target. They explain the failure with “transitory price changes” in some components such as healthcare and financial services. That was in their minutes from the May 1-2, 2018 meeting. When you look closely, price changes become “transitory” on the downside as well as “transitory” when they move on the upside. Indeed, they love to explain trends as “transitory” for that avoids any permanent trend forecast.

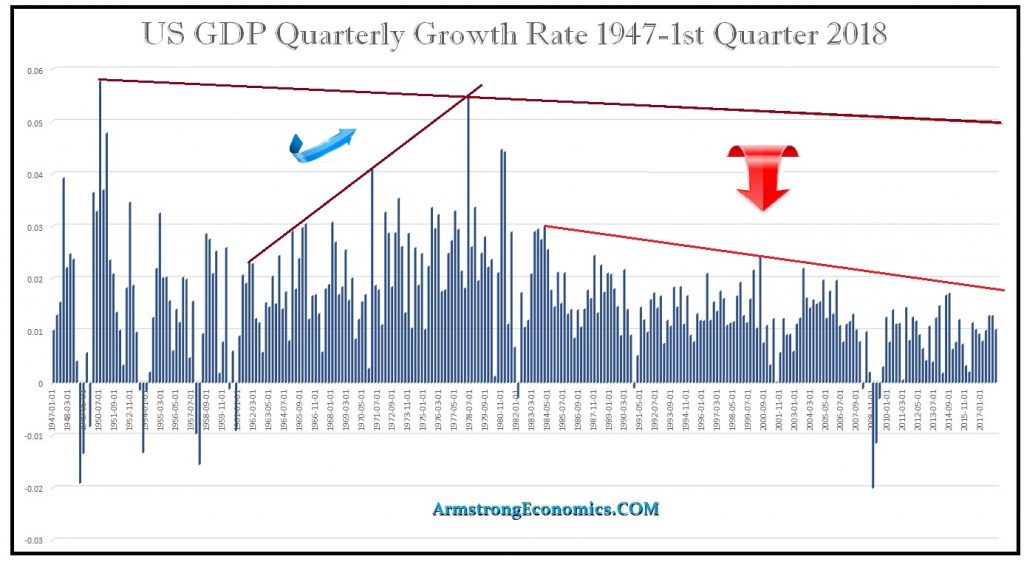

All of this is really just designed to be a distraction. It is the code word they love to explain the “IDK” factor (I don’t Know) because of the weakening business cycle. Step back and plot the growth rate using the Fed’s data since 1947. There was an economic boom between 1960 onward with the “feel good” election of JFK. That peaked in 1978 in nominal dollar terms because we moved to a floating exchange rate system in 1971. Then the dollar soared from 1980 when gold began to decline moving into 1985 creating a massive wave of deflation. As two factors combined, the rise in the dollar and the rise in taxation under the Clintons/Obama, the growth rate has been progressively declining.

Trump sees the trend. His tariff policy is correct insofar as he is trying to address the decline in those areas. However, tariffs are one-sided. He looks at the loss of jobs yet ignores the rise in the standard of living by allowing the consumer to get the best price. If the workers in those areas cannot compete, then lower the taxes for the workers in those industries to enable competition. DO NOT force consumers to pay more for something to subsidize expensive labor. Nobody ever looks at that solution.

The Fed is clearly using code words like “normalize” interest rates BECAUSE they see the crisis brewing in pensions. They are BY NO MEANS raising interest rates because of inflation or expansion in the economy that risks a bubble. The Fed understands the crisis that has resulted from the manipulated low-interest rate policies. They cannot come out and explain the reason rates are rising because we have a pension crisis. So they have used the term “transitory” to explain both ups and downs and “normalize” to warn the marketplace it will continue to raise interest rates and pretend it is about some “transitory” factor you cannot nail down to a hardline explanation. So forget inflation and the usual scenarios attributed to central bank policy. We are facing a pension crisis and the Fed understands that much so they are trying to “normalize” interest rates and that has nothing to do with jobs or inflation.