The Misconception of Central Banks

QUESTION: Mr. Armstrong; I was at the Treasury Management Association of Canada (TMAC) conference in Vancouver when you appeared as a speaker as well as Peter Detallis of the Bank of Canada if I remember his name correctly. I was there at the cocktail party when the Finance Minister of Nova Scotia said you diminished the central bankers. They were right there as well and he did not know it. You introduced him to them. He was upset. I laughed at that. My question is why are you the exception to meet with central banks?

HWF

ANSWER: It should come as no surprise that I routinely argue against “demand-side” economics which justifies central banks manipulating demand by raising and lowering interest rates. It has never worked. That said, the Democrats vilified “supply-side” economics when Reagan lowered taxes. They vilified it calling it “trickle-down Economics.” They never actually explain the difference because they want to do as they desire and then expect the central banks to clean-up their mess from the fiscal mismanagement of the economy. That said, the conspiracy theorists blame the central banks for absolutely everything and assign no blame to the politicians for the fiscal side.

Consequently, it still took me some time to understand why the central banks would talk to me. They clearly knew I understood the real dynamics of the system as a whole with both the fiscal and monetary side in addition to Demand v Supply-side Economics. They also knew I lived in the real world community and was one of the few true international advisers. The difference is I really had some $3 trillion under contract which was about 50% of the US National Debt at the time. They knew I spoke with real-life experience – not theory. That was even part of the Congressional record when I testified before the House Ways & Means Committee.

When our model called the 1987 Crash to the day that was one thing. But the very day of the low it confirmed that was it and the low would hold and off we would go to new highs by 1989.95. I was called in by the White House that day and asked to confirm this low would be it. There are simply times when they just really need to know what is happening and they need to rely on something that is NOT political or just the passing opinion of an analyst. Then the Tokyo Crash took place perfectly with the top of the ECM 1989.95 and again I had two central banks on the phone at the same time. The question was did the computer say they needed to intervene? I said no. It was confined to Japan.

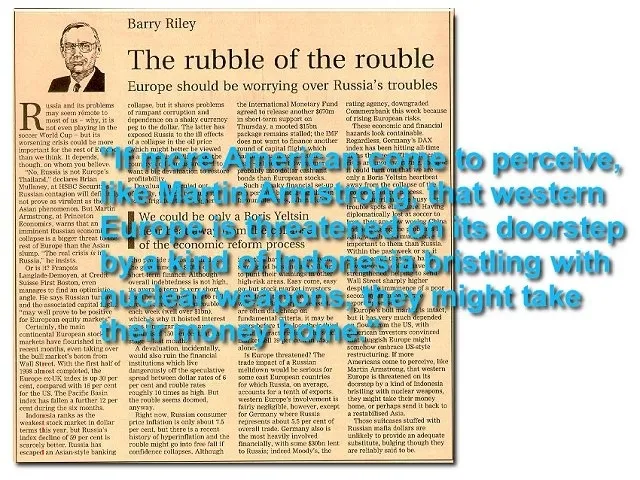

The stock market again peaked on the very day of the ECM July 20th, 1998. That was followed by the collapse of Russia and the Long-Term Capital Management Crisis. That is when the CIA called and wanted the model since it had political implications that became obvious. It has become obvious to those behind the curtain that our model is no joke. There have been WAY TOO may correct forecasts that have picked the turns and highlighted the crisis points.

The stock market again peaked on the very day of the ECM July 20th, 1998. That was followed by the collapse of Russia and the Long-Term Capital Management Crisis. That is when the CIA called and wanted the model since it had political implications that became obvious. It has become obvious to those behind the curtain that our model is no joke. There have been WAY TOO may correct forecasts that have picked the turns and highlighted the crisis points.

Over time, I learned that the central bankers are no different from the rest of us. They do NOT know everything and they are NOT in control of the world as the conspiracy people paint it. In Canada, they filed a lawsuit against the Bank of Canada to demand it focus only on Canadians and ignore international bankers and the Bank of International Settlement (BIS) (see Press release: Ban of Canada Suit _CourtCasePressRelease). They do not grasp that we are ALL CONNECTED and central banks realize that they CANNOT manage the domestic economy by ignoring the international capital flows. The Fed wanted to raise rates in 2014 by the IMF and everyone else lobbied to prevent that. Central banks have lost control of domestic economies because international considerations are causing them to realize we are ALL CONNECTED.

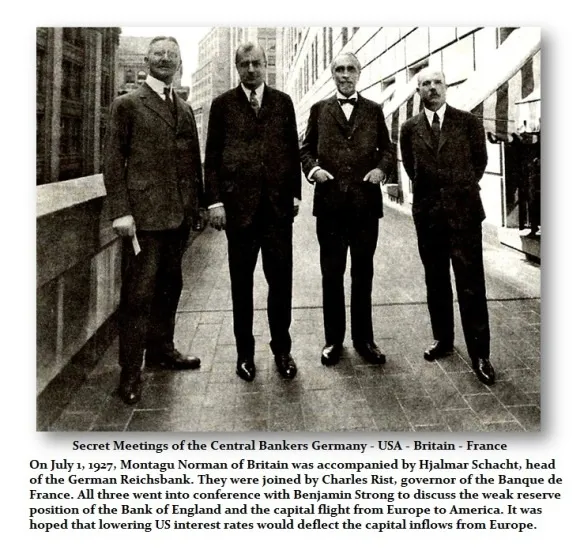

There is such a general misconception of central banks it is unbelievable. The first cooperation took place in July 1927. That was a meeting between USA, UK, France, and Germany. They attempted to manipulate the capital flows by arguing the USA should lower interest rates and in theory, the capital would return to Europe. It failed and they could not prevent the Sovereign Debt Crisis that hit in 1931. It was Roosevelt who usurped all the power of the independent branches of the Federal Reserves and stuffed them all into one size fits all management under a Marxist socialistic theory where Washington kept an eye on the Fed.

Yellen pleaded with Drahi to stop his insane negative interest rate policy. He would NOT listen. She hesitated in raising US interest rates back in 2014 hoping that Draghi would see the huge mistake he was making in creating the next crisis – the destruction of the European bond market and the pending Pension Crisis. When the ECM peaked 2015.75 and started to decline, the pressure on the Pension Funds began to escalate. The Fed broke FAITH with the rest of the central banks and began to raise rates during the last quarter 2015 after the ECM turned October 1st, 2015.

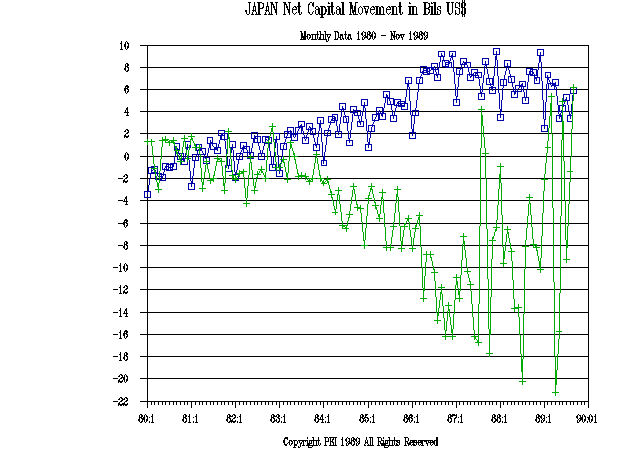

Our computer system is the ONLY mechanism that is tracking the entire world. It picks up everything. This is the chart of the capital flows for the 1987 Crash. How can any central bank ignore the capital flows and the international interconnectivity of the world economy and survive?

Our computer system is the ONLY mechanism that is tracking the entire world. It picks up everything. This is the chart of the capital flows for the 1987 Crash. How can any central bank ignore the capital flows and the international interconnectivity of the world economy and survive?

We have no conflict of interest and that is critical. We also have a track record from the early 1980s that is unbelievable on economic forecasts. In the middle of a crisis, we all need sometimes to call on someone or something. We try to contribute to society in hopes of one day perhaps AFTER the Crash & Burn, just maybe we can avoid a fall into totalitarianism. My time will be over here. We all have an experation date. My concern is for my family I will leave behind.