Silver v Gold Standard

QUESTION: Mr. Armstrong; You do not give much credence to the world returning to a gold standard. Didn’t the entire world use the gold standard before?

Thank you for your input

JK

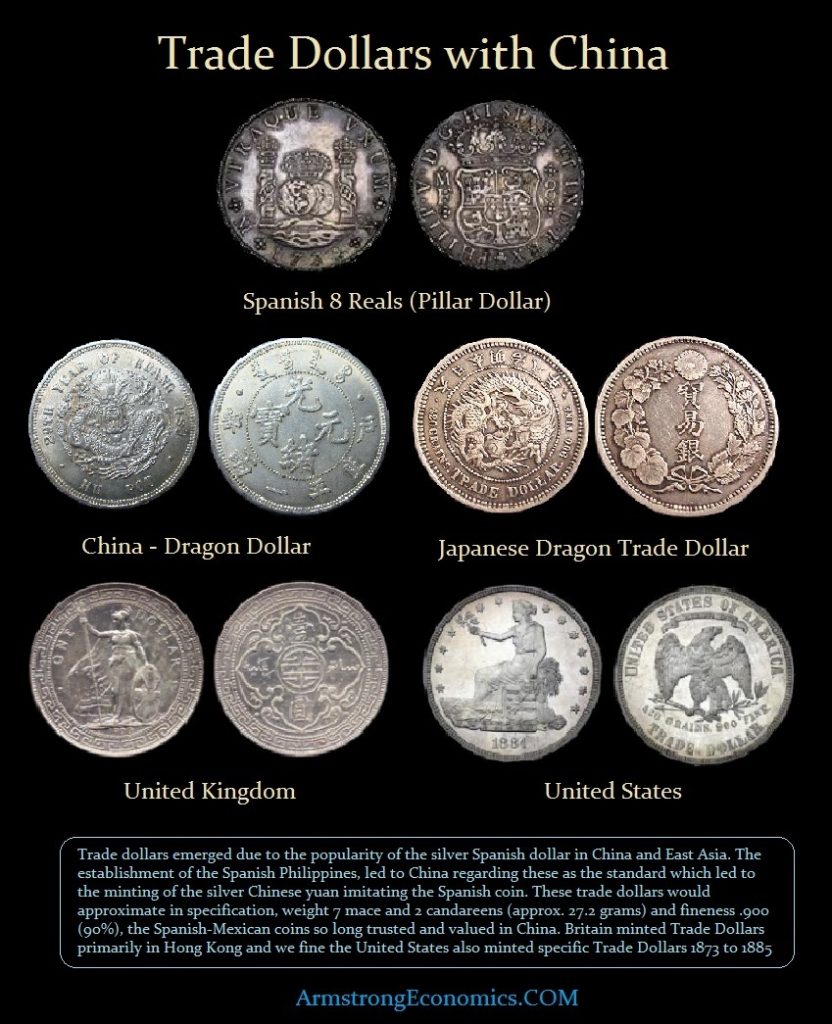

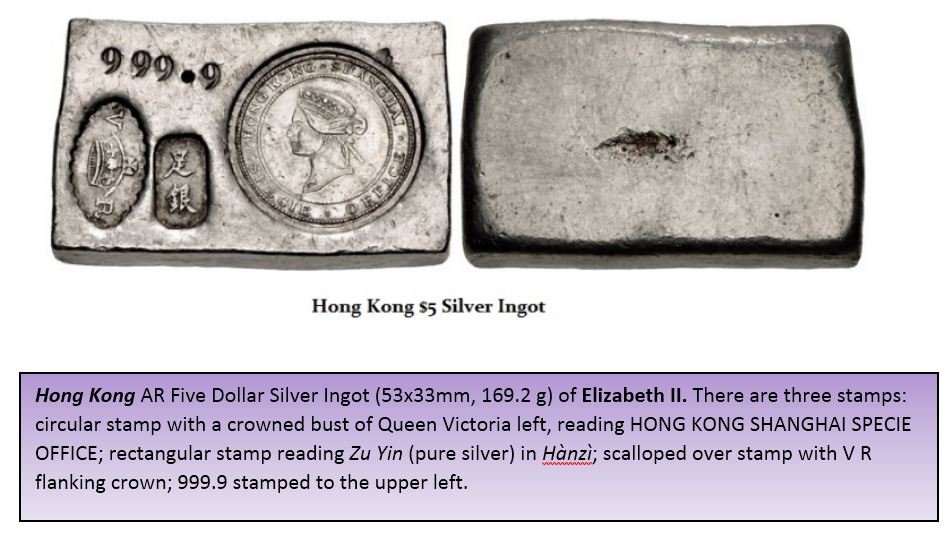

ANSWER: The entire world has NEVER been on the gold standard simultaneously. Asia was on a silver standard while the West was on a gold standard. Above is the first coin struck in Hong Kong in 1866 which was the Hong Kong Dollar. The West struck Trade Dollars during the 19th century to pay for goods from Asia and they were silver – never gold. Here is an example of both the British and American trade dollars used in payments particularly with China. The Spanish 8 reals Americans called Pillar Dollars and slicing this up into pieces like a pie gave rise to the term for a Piece of Eight – 2 bits, 4 bits, 8 bits a dollar.

ANSWER: The entire world has NEVER been on the gold standard simultaneously. Asia was on a silver standard while the West was on a gold standard. Above is the first coin struck in Hong Kong in 1866 which was the Hong Kong Dollar. The West struck Trade Dollars during the 19th century to pay for goods from Asia and they were silver – never gold. Here is an example of both the British and American trade dollars used in payments particularly with China. The Spanish 8 reals Americans called Pillar Dollars and slicing this up into pieces like a pie gave rise to the term for a Piece of Eight – 2 bits, 4 bits, 8 bits a dollar.

The Spanish silver “Pillar Dollar” became a recognized coin worldwide more so than perhaps any other European coin. The Chinese loved this coin and it inspired the development of the yuan. This became the recognized standard in Asia. British, Americans, and even the Japanese, all had to strike silver trade dollars to meet that standard which was even slightly different to meet the standard in Asia for trading purposes.

It is just not practical that we have a monetary system that is based upon a commodity. Historically, inflation would come in waves depending upon new discoveries of the metal. So the quantity theory of money was not developed purely from fiscal mismanagement as often portrayed today. The true value of money is the productive-capability of its people. China, Germany, Japan, all rose from economic depression WITHOUT gold. They did it with the productive capacity of the people. The produce whatever and sell it to someone else and then get gold or whatever in return. This theory that you have nothing without gold is just stupid. It would mean that no nation could ever rise no matter how good their people are because they lack a natural source of gold.

The collapse of the Turkish lira is a reflection of the collapse in confidence in the government. The same has taken place in Venezuela. China and Japan rose from the ashes, not because of their possession of commodities, but because they could bring their people to bear and produce various items efficiently and cost-effective. It was the people first that produced the economic recovery and then they bought even gold.

HYPERINFLATION has nothing to do with the quantity of money – that unfolds when the CONFIDENCE in the government collapses. You cross that line from normal inflation all nations experience into the realm of a collapse in the faith and trust of government. This is HOW revolutions even unfold. They have nothing to do with the quantity of money.