USA v Euro Capital Flows

QUESTION: Mr. Armstrong; Your forecast that the capital flows would shift from the EU to the USA I believe has been confirmed by both the European bond markets and share markets. The German DAX is trading below the low created in 2017 while the USA is trading above it. Is this confirmation that your models are indeed correct on global capital flows?

HJG

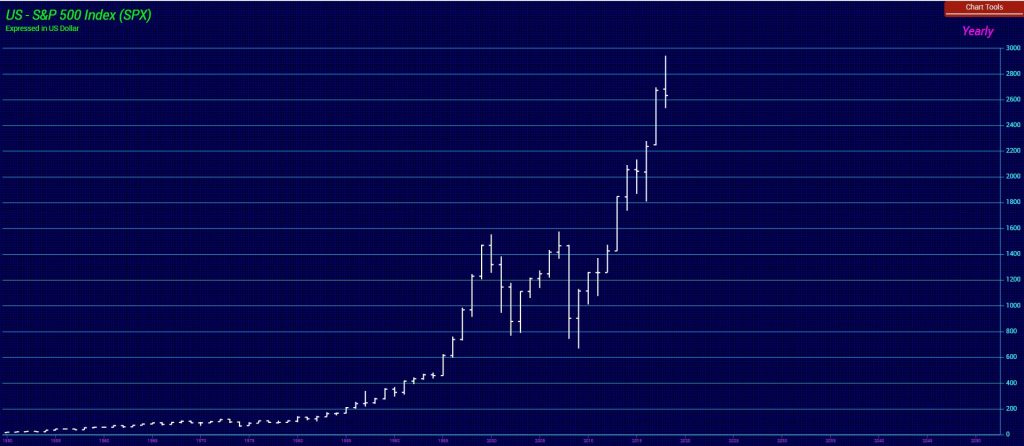

ANSWER: Yes. It is amazing to me that people will argue with me and claim I am wrong yet they never bother to just look at the charts. The Dow and S&P500 index, however, are trading below the 2017 high. The capital flows have been rather intense. Because interest rates have been negative in Europe, the capital has been fleeing around the world. Spanish banks were buying Turkish debt and pension funds were running to buy farmland in Australia and then rented it out to farmers at 5% annually Lowering interest rates to negative by the ECB has created one huge mess in international capital flows. The capital went everywhere BUT Europe and the ECB ended up buying the bulk of government debt because they singlehandedly destroyed the European bond market. Just total insanity!