When is Inflation – Deflation?

QUESTION: Mr. Armstrong; the WEC was the best ever. The materials it took you a month to prepare in advance are amazing. Your insight into the difference between a sovereign debt crisis and how that produces deflation compared to the debasement deserves a Nobel Prize. My question is how did the people cope with the debasement? I see the hoards of even debased coinage. Did they hoard the old silver and gold coins outright or was there a black market where they fetched a premium?

PG

ANSWER: I did not cover that at the WEC and perhaps I did not put that part in detail in the reports handed out. My bad. There was a lot more going on than meets the eye. Nobel Prizes are handed out in economics not for history but for wonderful visions of how government can control society. Nobel Prizes are for the fact only in real sciences – not social sciences. The Nobel Prizes handed out so far like to Black & Scholes for their model soon after blew up and created the Long-Term Capital Management crisis in 1998. So not sure I would want one anyhow. They have a notorious record of endorsing failed theories.

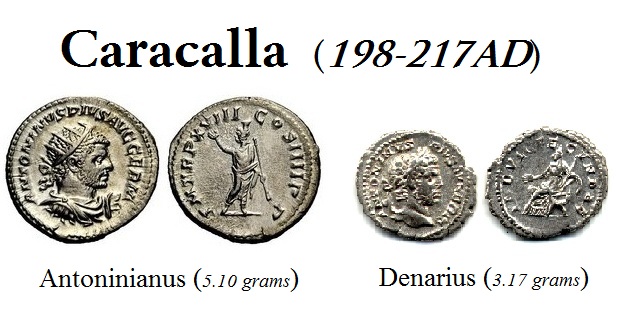

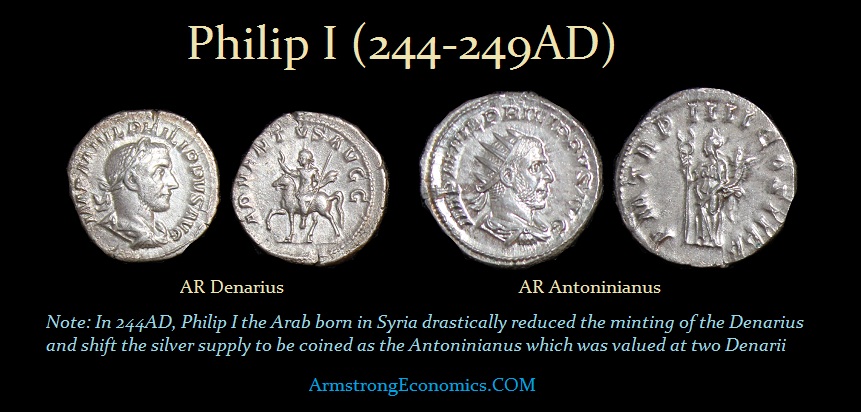

There is no question that the introduction of the double denarius known as the antoninianus under Caracalla (198-217AD) was the beginning of the acceleration of the debasement process. However, the last Emperor to produce the silver denarius in any quantity was Gordian III (238-244AD). He was assassinated by Philip I (244-249AD) and the few denarii he issued are very rare. From this point onward, we see the antoninianus takes center stage as the dominant coin in circulation.

There is no question that the introduction of the double denarius known as the antoninianus under Caracalla (198-217AD) was the beginning of the acceleration of the debasement process. However, the last Emperor to produce the silver denarius in any quantity was Gordian III (238-244AD). He was assassinated by Philip I (244-249AD) and the few denarii he issued are very rare. From this point onward, we see the antoninianus takes center stage as the dominant coin in circulation.

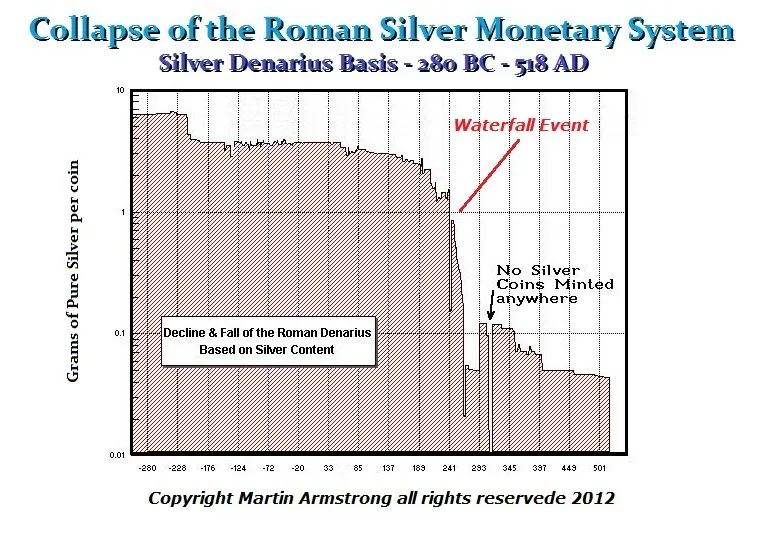

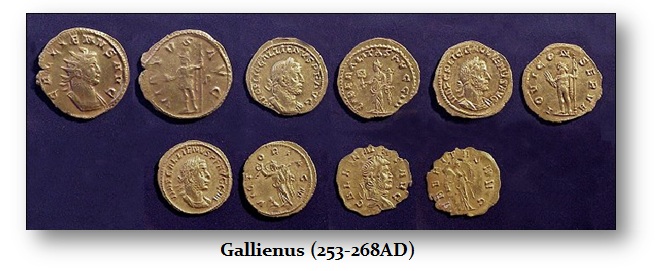

The rise in the price of commodities appears rather stable until the reign of Gallienus (253-268AD) which the silver content of the antoninianus virtually vanishes in just 8 years going into the bottom of that Waterfall event following the capture of his father Valerian I (253-260AD) by the Persians in 260AD. There are some references as early as the Severan period were the silver Antoninianus under Caracalla was used in more major transactions. However, in this case, they were just replacing the gold coins that were gradually being hoarded from the reign of Caracalla onward. Therefore, the silver Antoninianus was replacing gold in the markets as a higher denomination suitable for larger transactions.

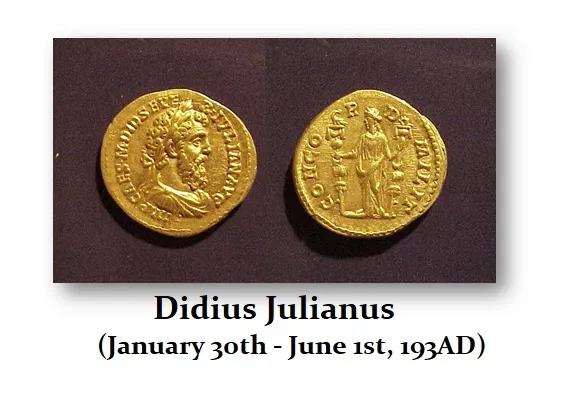

When we analyze the monetary history and the production of Roman coinage, up until the early Severan period, two-thirds of the total face value of the coins in circulation were actually gold aureii. The peak in the Roman Empire was clearly the reign of Marcus Aurelius (161-180AD). Upon his death, his son took power and Commodus (180-192AD) was ruthless and insane. Upon his assassination, the Empire went into yet another civil war. This is when the Praetorian Guard auctioned off the office of the Emperor to the highest bidder who was Didius Julianus (193AD). Didius offered 25,000 sestertii per man. His reign lasted 66 days and enraged the empire as the depths of corruption.

When we analyze the monetary history and the production of Roman coinage, up until the early Severan period, two-thirds of the total face value of the coins in circulation were actually gold aureii. The peak in the Roman Empire was clearly the reign of Marcus Aurelius (161-180AD). Upon his death, his son took power and Commodus (180-192AD) was ruthless and insane. Upon his assassination, the Empire went into yet another civil war. This is when the Praetorian Guard auctioned off the office of the Emperor to the highest bidder who was Didius Julianus (193AD). Didius offered 25,000 sestertii per man. His reign lasted 66 days and enraged the empire as the depths of corruption.

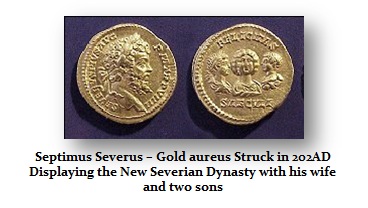

Therefore, with the empire thrust once again into civil war, the financial system came to a halt and hoarding was the name of the game. Even with the end of the civil war and the establishment of the Severan Dynasty under Septimus Severus (193-211AD), something in the confidence of the people had changed. Septimus made great efforts to issue coinage to show the reestablishment of a dynasty in an attempt to reignite confidence in government. The hoarding of gold began to reduce the circulation of the gold aureii at this point in history. This no doubt provides a backdrop to the issuance of the double denarius known as the Antoninianus by Caracalla.

Therefore, with the empire thrust once again into civil war, the financial system came to a halt and hoarding was the name of the game. Even with the end of the civil war and the establishment of the Severan Dynasty under Septimus Severus (193-211AD), something in the confidence of the people had changed. Septimus made great efforts to issue coinage to show the reestablishment of a dynasty in an attempt to reignite confidence in government. The hoarding of gold began to reduce the circulation of the gold aureii at this point in history. This no doubt provides a backdrop to the issuance of the double denarius known as the Antoninianus by Caracalla.

Clearly, the aureii were no longer used in the markets and the value of the gold coins in circulation was triple that of the silver coins in purchasing power. The production of denarii begins to increase at this moment to cover the lack of gold coins circulating. Consequently, following the reign of Gordian III, we find the denarii drop from production and the predominant denomination becomes the Antoninianus.

Clearly, the aureii were no longer used in the markets and the value of the gold coins in circulation was triple that of the silver coins in purchasing power. The production of denarii begins to increase at this moment to cover the lack of gold coins circulating. Consequently, following the reign of Gordian III, we find the denarii drop from production and the predominant denomination becomes the Antoninianus.

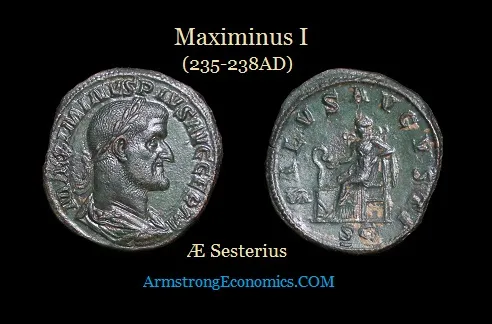

Interestingly, one of the reasons I sought to reconstruct the monetary system was to gain a look at what was really taking place within the Roman Empire because the common denominator is how people respond to events regardless of the century. Despite the increase of antoniniani in circulation, there is no inscription nor literary evidence that seems to indicate a higher degree of monetization. This seems to imply that the economy was contracting significantly thanks to the reign of Maximinus I (235-238AD) who simply declared all private wealth belonged to the state (him). He melted down golden statues of former emperors and paid informants with respect to people hiding wealth. The natural human response was to hoard rather than invest. People stopped even spending normally and saved. Therefore, despite the increase in coinage output, there was  DEFLATION as we have witnessed in Europe under the Quantitative Easing of the European Central Bank (ECB). The increase in money supply resulted only in hoarding rather than inflation. They still had faith in the purchasing power of money.

DEFLATION as we have witnessed in Europe under the Quantitative Easing of the European Central Bank (ECB). The increase in money supply resulted only in hoarding rather than inflation. They still had faith in the purchasing power of money.

Therefore, from 192 to 238AD, in the span of just 46 years, the one thing that the people understood was that government was not something one could count on as being stable. The monetary behavior of the population during this period resulted in the disappearance of the gold aureii from circulation. There are surviving inscriptions and comments showing that it was considered an unparalleled honor and a privilege for someone to be paid in imperial gold coins. In fact, the rare cases of the appearance of gold coins in inscriptions or literary sources only further demonstrate that it was exceptional for gold to be used in a transaction during the 3rd century.

Roman gold medallions, as we call them, have come down to us from antiquity in much smaller number than the silver and bronze medallions. Nevertheless, it is quite probable that a considerable number were coined, but on account of the intrinsic value of the metal relatively few now exist. They are not really a medal that is commemorative in nature. They appear to have been a donative, intended to be deliberately limited in the scope of its appeal. In other words, for all its superficial resemblance to a coin, the primary purpose of these medallions was not circulation as currency but distribution as a gift. They exist in gold, silver, and bronze. Here is a Gordian III gold medallion which was made into an ancient necklace illustrating that they were a donative rather than currency (see Gordian III gold medallion Courtesy of George Ortiz (1927-2013) Collection).

There are a number of funerary inscriptions from Asia Minor that also indicate a turn towards the use of precious-metal bullion instead of coins. There are no real silver or gold bars that have surfaced from the 3rd century that I am aware of. The Roman historian Duncan Jones cites that the nature of standardized fines changed during the 3rd century AD. Tomb raiders were supposed to pay a certain amount of money in the form of precious-metal coins to the family or the city or the imperial treasury, but the fines then changed during the 3rd century to be paid in talents of precious metals and thereby the calculation was by weight rather than by coin.

There are a number of funerary inscriptions from Asia Minor that also indicate a turn towards the use of precious-metal bullion instead of coins. There are no real silver or gold bars that have surfaced from the 3rd century that I am aware of. The Roman historian Duncan Jones cites that the nature of standardized fines changed during the 3rd century AD. Tomb raiders were supposed to pay a certain amount of money in the form of precious-metal coins to the family or the city or the imperial treasury, but the fines then changed during the 3rd century to be paid in talents of precious metals and thereby the calculation was by weight rather than by coin.

This use of bullion is attested for the first time after the middle of the 3rd century but it becomes more regular throughout the fourth and the fifth centuries in Greece as well as in Asia Minor according to Jones. It appears that society reverted back to raw metal and even fines were to be made in metal rather than coin. At the very least, large transactions were clearly taking place in terms of precious metal by weight rather than coin. When we look at the gold coinage of Gallienus, we see that the aureus declined from 3.59 grams to about 1.85 grams. There are even paper thin examples with a weight of 0.77 grams which may be a half-aureus known as a quinarius. Hence, it is very clear that gold was a rare commodity during this Waterfall Event during the 3rd century AD.

This use of bullion is attested for the first time after the middle of the 3rd century but it becomes more regular throughout the fourth and the fifth centuries in Greece as well as in Asia Minor according to Jones. It appears that society reverted back to raw metal and even fines were to be made in metal rather than coin. At the very least, large transactions were clearly taking place in terms of precious metal by weight rather than coin. When we look at the gold coinage of Gallienus, we see that the aureus declined from 3.59 grams to about 1.85 grams. There are even paper thin examples with a weight of 0.77 grams which may be a half-aureus known as a quinarius. Hence, it is very clear that gold was a rare commodity during this Waterfall Event during the 3rd century AD.

There is little question that the function of coins around the time of Gallienus’ reign and this Waterfall Event was drastically altered. Society reverted to raw metals and barter. This is why to a large extent we find very little contemporary comments on rising prices of commodities for that would be reflected in the current coin as produced. It appears that inflation in terms of the official coin was irrelevant when society was in a barter mode rejecting the official coinage of the Empire. Therefore, the inscriptions cited by Ducan Jones indicate a decrease in the use of coinage in large transactions and thus this was, in fact, a partial demonetization of the economy that unfolded during this crisis of the middle 3rd century.

What is fascinating is that the majority of silver and gold bars of the Roman Empire that have survived are predominantly from the 4th and 5th centuries rather than the 3rd century. The Quantity Theory of Money does not fully explain the financial crisis for it fails to take into account the fact that the people simply shift-gears and ignore the official production of money by the state. Still, the debased coinage is found in substantial hoards demonstrating that it was still regarded as useful perhaps in small transactions in the marketplace. Therefore, we still find major hoards of debased coins from the 3rd century.

What is fascinating is that the majority of silver and gold bars of the Roman Empire that have survived are predominantly from the 4th and 5th centuries rather than the 3rd century. The Quantity Theory of Money does not fully explain the financial crisis for it fails to take into account the fact that the people simply shift-gears and ignore the official production of money by the state. Still, the debased coinage is found in substantial hoards demonstrating that it was still regarded as useful perhaps in small transactions in the marketplace. Therefore, we still find major hoards of debased coins from the 3rd century.

Here during the 3rd century, gold coins, which had once comprised 70% of the money supply by value, vanished from circulation and this was then followed by silver coins pre-260AD. We can assume that the amount of gold bullion within the Roman Empire had not diminished, but it simply vanished from circulation. Therefore, while perhaps Rome experienced inflation in terms of the debased antoniniani, there was deflation in terms of silver and gold bullion and pre-260AD.

Here during the 3rd century, gold coins, which had once comprised 70% of the money supply by value, vanished from circulation and this was then followed by silver coins pre-260AD. We can assume that the amount of gold bullion within the Roman Empire had not diminished, but it simply vanished from circulation. Therefore, while perhaps Rome experienced inflation in terms of the debased antoniniani, there was deflation in terms of silver and gold bullion and pre-260AD.

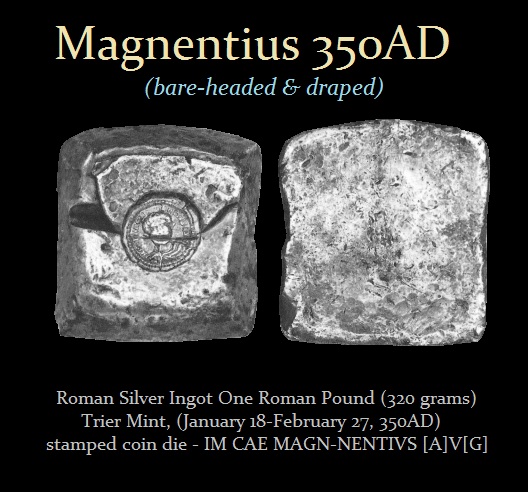

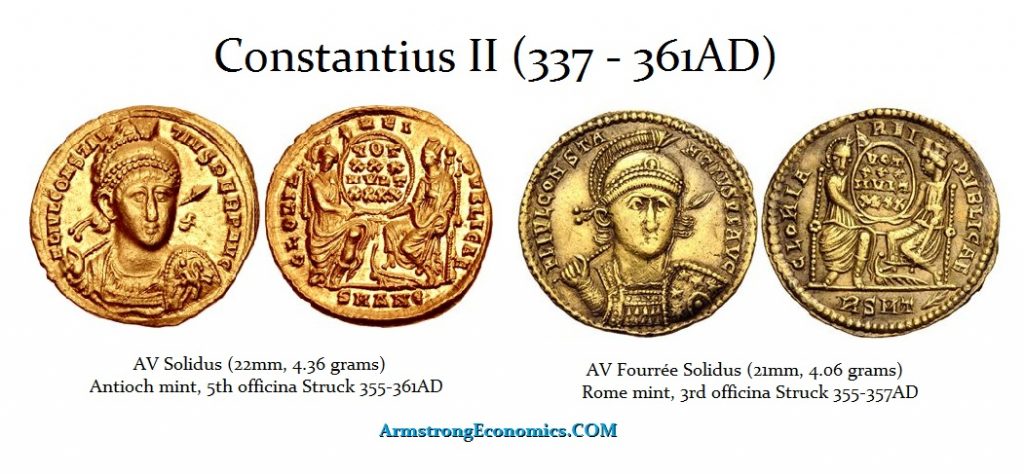

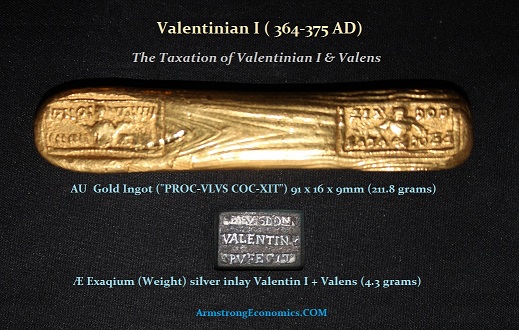

The few gold ingots that have survived from antiquity are found with official counterstamps of the official who melted the coins to produce the bar. During the tax collection of Valentinian I (364-375AD) who imposed high taxes, not in coin but instead by weight of precious metals. Hence, the gold bars of the late Roman Empire was the result of financial reforms initiated in 366-367AD during the reigns of Valentinian I and Valens (364-378AD). The emperors saw the need to eliminate the independence of the central treasuries for fear of corruption in producing bronze coins gold plated known. Illustrated here is a gold plated solidus of Constantius II (337.361AD). Obviously, of greater importance was the concern about the fineness of the gold coin taken in payment for taxes. To endorse such measures to demand taxes by weight rather than coin, it is clear that there was grave concern over the large numbers of mutilated and fake gold solidi in circulation.

The few gold ingots that have survived from antiquity are found with official counterstamps of the official who melted the coins to produce the bar. During the tax collection of Valentinian I (364-375AD) who imposed high taxes, not in coin but instead by weight of precious metals. Hence, the gold bars of the late Roman Empire was the result of financial reforms initiated in 366-367AD during the reigns of Valentinian I and Valens (364-378AD). The emperors saw the need to eliminate the independence of the central treasuries for fear of corruption in producing bronze coins gold plated known. Illustrated here is a gold plated solidus of Constantius II (337.361AD). Obviously, of greater importance was the concern about the fineness of the gold coin taken in payment for taxes. To endorse such measures to demand taxes by weight rather than coin, it is clear that there was grave concern over the large numbers of mutilated and fake gold solidi in circulation.

The Roman government essentially refused to accept coins which were either fake or under the official stated weight of 4.3 grams for a gold solidus as illustrated above in the exaquim (official weight illustrate here) and instead required all tax collections to be melted according to fineness and weight. Everything was melted down and poured into ingots such as the one offered here.

The Roman government essentially refused to accept coins which were either fake or under the official stated weight of 4.3 grams for a gold solidus as illustrated above in the exaquim (official weight illustrate here) and instead required all tax collections to be melted according to fineness and weight. Everything was melted down and poured into ingots such as the one offered here.

The inscription on this ingot reads “melted by Proculus” weighing in at 211.8 grams measuring 91 x 16 x 9 mm. This bar represented 47 gold solidii at an official weight of 4.3 grams each. Above, here is another bar which has survived with a weight of 337.23 grams or 78.4 solidi showing an image of the three emperors – Valentinian I, Valens and Gratian.

The inscription on this ingot reads “melted by Proculus” weighing in at 211.8 grams measuring 91 x 16 x 9 mm. This bar represented 47 gold solidii at an official weight of 4.3 grams each. Above, here is another bar which has survived with a weight of 337.23 grams or 78.4 solidi showing an image of the three emperors – Valentinian I, Valens and Gratian.

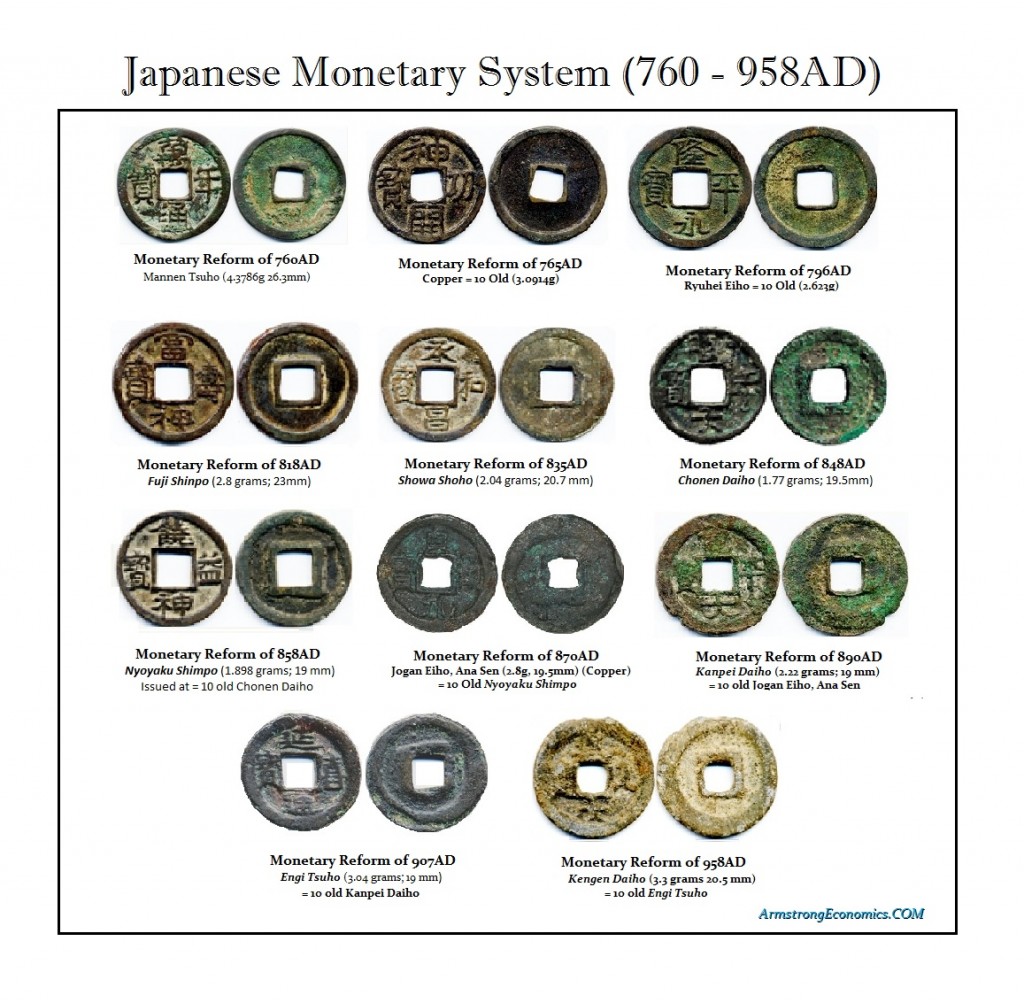

What this illustrates is that the idea that merely increasing the supply of money automatically produces inflation is seriously misguided. That assumes the people are locked into using the coinage. Despite the collapse in the silver content of the Roman coinage, there was clearly a shift to raw metal and barter. The very same thing took place in Japan. Each new emperor devalued the outstanding money supply to be worth 10% of his new coinage. After a few emperors pulling this one off, the people simply refused to accept any Japanese coins for 600 years. They used to barter, bags of rice, and Chinese coins. The Japanese monetary history is thus void of any issue of coinage for 600 years.