Liquidity Crisis

QUESTION: I have attended the last 2 conferences and you have said the “liquidity” in the stock market will become tighter coming into 2020 and that there will be less stocks available to buy. Does that have something to do with this inflow of capital from Europe as people become more aware? I read your article about the Emerging Market crisis with great interest and remembered what you said. Is there more information you can share with us on this topic?

CDH

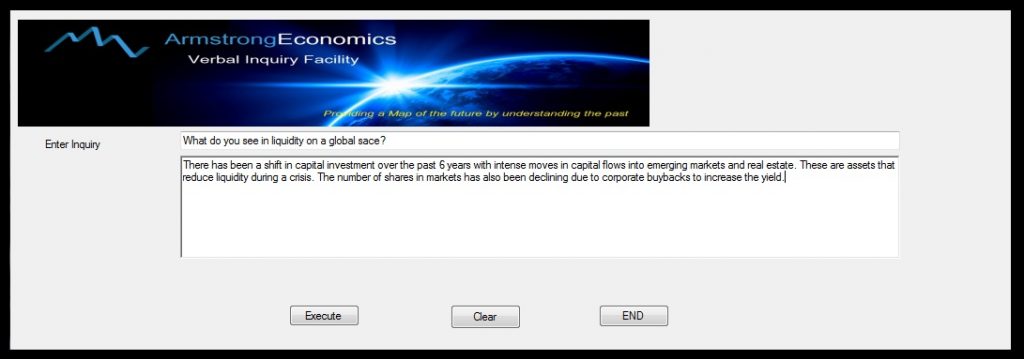

ANSWER: Since Quantitative Easing has failed, capital was driven into non-traditional investments to simply try to earn income. There were institutions buying farmland just to lease it out to get 5% annual income. Others ran off into Emerging Markets. Spanish banks are heavily invested in Turkey. The problem is that this trend has caused a liquidity crisis insofar as capital has been invested in assets that are not liquid. Add to this corporate buybacks that are reducing the supply of stocks available.

All I can say is thank God for Socrates. There are so many global trends emerging that by themselves are confusing and would be impossible for a standard domestic analysts to forecast from a personal interpretation perspective. The combination of investment shifts into real estate, Emerging Markets, and corporate buybacks have created an interesting risk factor for liquidity during a financial panic.