The Endless Hunt for Taxes

QUESTION: Martin – Just read your latest on Lewrockwell.com, regarding taxation. I think the most basic, simplistic explanation you can put forward about income taxation, now in 2019, is that governments are taking directly out of our paychecks, while at the same time, printing money like deranged lunatics. Why tax my labor income if you (the government / CB’s) can just print as much fiat as they need? What do they need to dip into my paycheck for 30% before the money even hits my bank account, when they can just print what they need. Maybe it is because of their greed and lack of morality know no bounds. We are being ruled by tyrannical, Marxist inspired lunatics.

CN

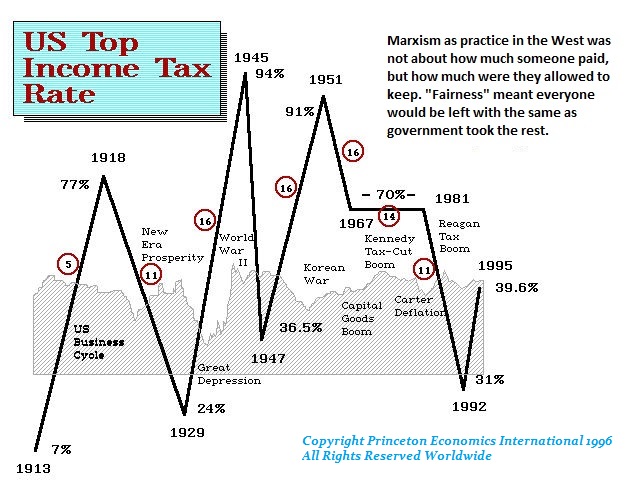

ANSWER: That is my point. When money was precious metals, then taxation made sense. However, most taxes are initially implemented with such modest amounts like 2% for the first income tax in Britain back in 1799. People accept such modest levels. Even the American Revolution was fought over a tax of about 7%. Today, under the influence of Marx, taxes have risen to insane levels. A woman may have fought for the right to work with the Suffrage Movement, but today, it now takes two incomes to support a family because of the levels of taxation. The burden of direct taxation is seriously reducing our standard of living.

Taxes should be fixed because they can raise taxes at will. This is why you also have lobbyists who then fund their campaigns for loopholes.