Why Are Equities so Disconnected from Economics?

Normally, equity valuations reflect the present value of future cash flows that are primarily a function of current cash flows, growth expectations, and then the discount rate. Most fundamentalists will look at the cash flow generation in both the short and long-term. With equity valuations at their record highs, investors, in theory, are showing confidence in short-term cash flows not declining materially. The interpretation normally would be that they are betting on no recession and on stable long-term growth. However, is this analysis just sophistry?

The probability of a recession is much higher than what global equities are currently reflecting. Then there are people pointing to the yield curve and yelling, “See, a crash is coming!” They argue this is a leading indicator, sending the strongest warning signals to investors. Nevertheless, history begs to differ with that analysis for it has often shown a final bullish move in equities despite clear evidence of an oncoming recession. Is this precisely what we are facing? Others point to the Fed, claiming that the first rate cut is often a reliable signal that a recession is coming, which reduces short-term cash flows and raises return expectations as investors become more risk-averse.

There are those who look at all of these factors and then argue that long-term profit growth expectations are way too high. Others argue that corporate debt is too high and we have also reached debt saturation, especially technology companies.

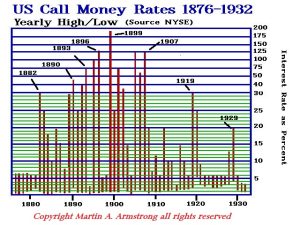

All things considered, we are facing a slightly different future. Doing simple correlations of equities to interest rates reveals that the share markets have NEVER peaked twice with the same level of interest rates because the real issue is the differential between the cost of money and expectation of inflation or future price gains. We are in a similar pattern where interest rates are so low that even a 3% dividend from shares looks fantastic. When we look at the extremes, we also see that the PE ratio hits its extremes, not at speculative booms, but at the bottom. There comes times like in 2009 where capital no longer trusts the banks, governments, and is just looking to get its money back intact. This is when they will buy blue-chip shares without expectation of future profits and cash flow, but the preservation of capital. So while many see the share markets as totally disconnected, perhaps they need to look at the other side of the equation — who do you trust?