Economic Storm Trump Will be Blamed For Because of Bad Advisers

There is a very Dark Cloud hovering over the world economy and at the center of this cloud lies not just Europe, but Germany – the strongest economy holding up all of Europe. The German manufacturing sector is in freefall. Trump will be blamed calling this the result of his Trade War. It is probably too late to get him to even understand that his advisers are old-school and completely wrong with respect to trade. Their obsession with currency movements is what they taught back in school during the 1930s. My advice to China, let the yuan float and Trump will quickly see that China has been supporting its currency, not suppressing it.

Manufacturing indicators have deteriorated globally, yet in a very disproportionate manner. Trump will be blamed for this and his badgering the Fed to lower interest rates is also a fool’s game. Nobody looks at the elderly who were told to save for retirement and you will live off the interest. Their house values were undermined in the 2007-2009 New York Banker’s Mortgage-Backed scam that blew up the world economy from which we have been unable to fully recover. The younger generation cannot afford to buy a house as they are saddled with student loans thanks to the Clintons for degrees that are worthless as 65% cannot find jobs in what they have degrees for these days.

Manufacturing indicators have deteriorated globally, yet in a very disproportionate manner. Trump will be blamed for this and his badgering the Fed to lower interest rates is also a fool’s game. Nobody looks at the elderly who were told to save for retirement and you will live off the interest. Their house values were undermined in the 2007-2009 New York Banker’s Mortgage-Backed scam that blew up the world economy from which we have been unable to fully recover. The younger generation cannot afford to buy a house as they are saddled with student loans thanks to the Clintons for degrees that are worthless as 65% cannot find jobs in what they have degrees for these days.

The insanity of those in power knows no boundary when it comes to stupidity around the world. All they have is interest rates and after more than 10 years of excessively low to negative interest rates failing to stimulate the economy in Europe, what do they do? They argue that all physical money must be eliminated because people are hoarding cash and thus defeat their lower interest rates policy. The IMF recommends confiscating all cash and then driving interest rates deeply negative to force recovery. They remain ignorant that they have destroyed the retirement of the elderly now, as well as the those who have yet retired because they command pension funds must invest in government bonds to various percentages ensuring that pensions will collapse as well.

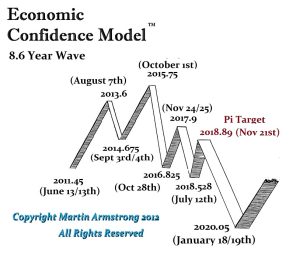

Manufacturing has been contracting compared to the service sector even on a global basis. The financial markets have appeared to be disconnected from the underlying economic trends because capital smells a very big rat. Capital has been shifting toward preservation rather than how much profit can it make today. Even the 10-year 3-month interest rates in the USA have tipped into the inverted yield curve confusing many that this is a sign of impending doom. They fail to read the tea leaves that capital is looking for a place to just park. Traditionally, inverted yield curves take place during recessions and we are in one globally heading into a major low come January 2020.

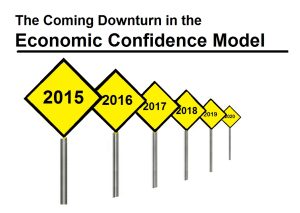

The Economic Confidence Model (ECM) has been on point despite the fact that schools warn you cannot forecast the business cycle yet the ECM has proven them wrong for decades. This particular cycle is exceptional. The central banks outside the USA have single-handedly destroyed their bond markets with Quantitative Easing. They are trapped and cannot allow interest rates to now rise to normal levels as they have kept the various governments on life-support.

The Economic Confidence Model (ECM) has been on point despite the fact that schools warn you cannot forecast the business cycle yet the ECM has proven them wrong for decades. This particular cycle is exceptional. The central banks outside the USA have single-handedly destroyed their bond markets with Quantitative Easing. They are trapped and cannot allow interest rates to now rise to normal levels as they have kept the various governments on life-support.

While central banks have tried to “stimulate” the economy, federal, state, and local governments are in dire need of money and have been raising taxes and increasing enforcement. Government pensions are wiping out budgets in Europe, America, and Japan. The forces of the central banks have been directly opposed by the political fiscal side of government.

We are facing a very Dark Financial Storm from which there is no escape. There is no advice being given to so many governments to avoid this crisis and waking up next year to this error will be too late. There will be nothing that can be done to put it all back together and live happily ever after. Welcome to the reality we face. At least this will make for a very interesting WEC. Make no mistake about it. They will lay all the blame on Trump and attribute this to trade rather than finance.