Claudius (Tiberius Claudius Caesar Augustus Germanicus; b. 10 BC – 54 AD; r. 41-54AD) was the first Roman emperor born outside of Italy. However, he was a member of the Julio-Claudian dynasty as the son of Drusus, who was the brother of Tiberius and Antonia. Antonia was the younger daughter of Marc Antony and Octavia, the sister of Augustus. Claudius was born at Lugdunum (Lyons) in Gaul, which at that time was part of the Roman Empire. Lugdunum was founded in 44 BC, ten years after the conquest of Gaul, in the aftermath of the assassination of Julius Caesar that erupted into civil war. According to the historian Cassius Dio, in 43 BC the Roman Senate ordered Munatius Plancus and Lepidus, governors of central and Transalpine Gaul respectively, to found a city for a group of Roman refugees who had been expelled from Vienne by the Allobroges. Cassius Dio says this was to keep them from joining Mark Antony and bringing their armies into the developing conflict.

Nevertheless, the first scandal to erupt that a member of the royal family was not a Roman citizen came just a few years later concerning the wife of Emperor Vespasian (69-79AD) by the name Domitilla who was born in Sabratha to Italian colonists who had moved there during the reign of Augustus. Her parents were Italian and not strictly Roman Latins, which presented a rather serious scandal as she was alleged to have been a barbarian born in a colony outside of the Roman Empire. Her father had to produce documentation to establish that she was a Roman citizen born prior to the family moving.

The first emperor born from a non-Latin (Rome) family was Trajan (98 – 117 AD) who was born in Italica, Spain, about the year 52 AD. His family was originally from Umbria in Italy, not Rome. He was considered a “provincial” who was born outside of Italy.

The first emperor born from a non-Latin (Rome) family was Trajan (98 – 117 AD) who was born in Italica, Spain, about the year 52 AD. His family was originally from Umbria in Italy, not Rome. He was considered a “provincial” who was born outside of Italy.

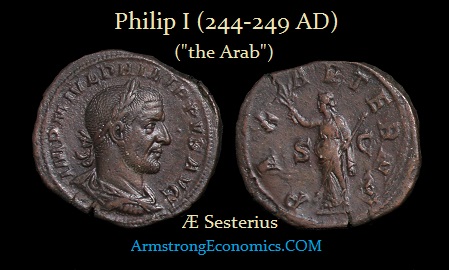

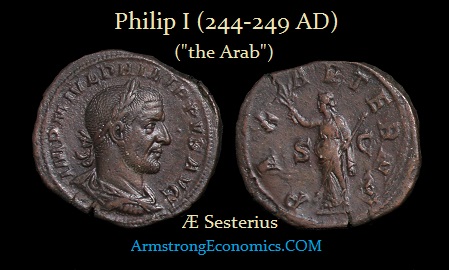

Numerous emperors followed who were born outside of Italy but to parents who were Latin. The first emperor to take the throne whose father was not Latin was ironically a Syrian. He is known to history as Philip I (“the Arab”; 244-249 AD). From this point onward, the conquests of Rome dominated Rome itself. Roman citizenship was granted to everyone so they would be subject to Roman taxation. That was extended by Caracalla in 212 AD when he declared that all free men in the Roman Empire were to be given full Roman citizenship and all free women in the empire were given the same rights as Roman women. Previously, only inhabitants of Italia held full Roman citizenship. Colonies of Romans established in other provinces retained their full citizenship, which was the right to vote along with the obligation to pay taxes. Provincials, on the other hand, were usually non-citizens. Extending Roman citizenship expanded the tax base.

Numerous emperors followed who were born outside of Italy but to parents who were Latin. The first emperor to take the throne whose father was not Latin was ironically a Syrian. He is known to history as Philip I (“the Arab”; 244-249 AD). From this point onward, the conquests of Rome dominated Rome itself. Roman citizenship was granted to everyone so they would be subject to Roman taxation. That was extended by Caracalla in 212 AD when he declared that all free men in the Roman Empire were to be given full Roman citizenship and all free women in the empire were given the same rights as Roman women. Previously, only inhabitants of Italia held full Roman citizenship. Colonies of Romans established in other provinces retained their full citizenship, which was the right to vote along with the obligation to pay taxes. Provincials, on the other hand, were usually non-citizens. Extending Roman citizenship expanded the tax base.

The idea of breeding out a conquered people originated with Alexander the Great who attempted to “mingle” his Greeks with the Persians, Egyptians, Syrians, and everyone else he conquered. This was his assimilation order whereby he believed that assimilation was to turn a defeated and potentially rebellious enemy into a citizen. The idea was this would be far better rather than simply waiting for the unavoidable revolt of a conquered people as was the case with Sparta and the conquered Helots. Rome adopted this philosophy, but eventually those they conquered bred out the Latins instead.

Looking at the Papacy, John Paul II was the first non-Italian pope since the Dutch Pope Adrian VI, who served from 1522 to 1523. Popes were traditionally Italian for about 400 years. However, the first non-Italian pope was considered an anti-pope because he was installed by the French King Philip IV who seized the Catholic Church and moved the seat to France to rob the treasury. He was behind the persecution of the Knights Templar to rob their wealth since France was broke and at war with Edward I of England. Obama’s father was from Kenya, and the controversy was over whether he was born in the USA or not.

There are those in the Middle East who are deliberately looking at the “refugee” issue as the means to conquer Europe. They are preaching this very policy of assimilation to takeover Europe. Even Muslims I know within Europe are disturbed by all of the refugees entering for they are of a different mindset generally and lack skills to be economically beneficial to Europe moving forward. What is disturbing to me is that this may indeed be part of the catalyst which transforms Europe into a third-world country as the financial capital of the world moves to Asia.

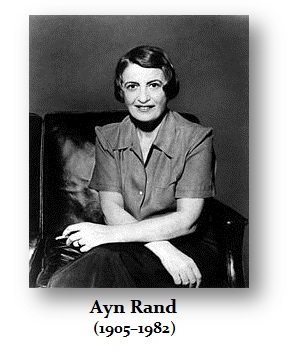

“When you see that in order to produce, you need to obtain permission from men who produce nothing; when you see that money is flowing to those who deal not in goods, but in favors; when you see that men get rich more easily by graft than by work, and your laws no longer protect you against them, but protect them against you. . . you may know that your society is doomed.”

“When you see that in order to produce, you need to obtain permission from men who produce nothing; when you see that money is flowing to those who deal not in goods, but in favors; when you see that men get rich more easily by graft than by work, and your laws no longer protect you against them, but protect them against you. . . you may know that your society is doomed.”

The first emperor born from a non-Latin (Rome) family was

The first emperor born from a non-Latin (Rome) family was