QUESTION: Mr. Armstrong; I have a very basic question. With all the trillions of dollars of stimulus in Europe, USA, and Japan, we are in the age of deflation as you have pointed out. The Federal Reserve itself predicts less than 2% economic growth so that is probably optimistic yet the best in the western world. This all seems to defy logic and you explained it is confidence and not the empirical level of money. The various explanations running around focus the cause on being the 2008 crisis as the main culprit. That appears to be a bit shallow. Could you put your two cents into this nonsense?

I respect the fact that whilst you were one of the billionaire hedge fund managers and even won hedge fund manager of the year, you are clearly not with the bankers. Your public track record showed you had the lowest draw down of anyone in the management field. What they did to you proves you are not one of them. It is becoming terribly obvious that it takes a global perspective to comprehend this mess. There are too few real big international hedge fund managers left these days and they seem to be in league with the bankers donating to Hillary and not very trustworthy.

I appreciate you speak with experience and distinguish opinion from fact. You are truly alone when others remain silent or just buy government.

Thank you; See you in Orlando

PM

ANSWER: Thank you for your observation. The crisis of deflation has very loose ties to the 2007-2009 crisis, but its tentacles do spread far and wide. It is also a direct factor of the decline and fall of western society — our moment with destiny. The entire structure of government social programs is predicated upon a Ponzi scheme that uses Marxism to justify robbing one generation for the previous one. Stir in Keynesianism, and you have a lethal cocktail we cannot survive.

To start, the leveraging of housing was far more significant than just real estate. For example, people would often take home equity loans for various purchases in many categories that were expensive like a piano. To this day, pianos are anywhere from 25% to 50% below 2007 price levels. There was a bubble in this market as well because people could get easy home equity loans with no problem. Those days are gone. Many high-end things of this nature are off considerably since the ability to borrow easy money on your home came to an end.

Consequently, the 2007-2009 crash in real estate impacted other markets beyond just housing. We have seen a contraction in many areas that relied on home equity loans for financing. So the days of easy money came to a terrible end. The collapse in that leverage is not fully appreciated.

The shift to Asia can be also demonstrated with pianos. The top name is Steinway and Weber. Both were German. They are now mostly manufactured in Asia. Japan began to make pianos, and eventually the Japanese improved quality. Now the top names in pianos are Yamaha and Kawai. Pearl River may be the biggest manufacturer in the world. They are in China and they manufacture for other brands. So first product manufacturing migrated for the better price, but that manufacturing improved and actually became a top brand. This is the path all products follow.

Then there is the crisis in pensions mixed with the crisis in demographics. All the pension systems were based upon a Ponzi scheme whereby the assumed population would always increase, so the young would pay for the old. Obamacare was constructed on the same fatal flaw. Note that the trend in lower interest rates did not begin with the 2007-2009 financial crisis. Pension funds WRONGLY assumed that government debt was safe, and as a result, many pension funds simply bought 30-year bonds in an effort to match maturity dates for pensions. That led to a strong bull market and the break-even was 8%. They kept bidding to try to lock in rates for pension payment in the future and their lack of management skills led to this 35-year bull market. Rather than picking stocks, they just believe government is the best thing since sliced bread. Now, they can no longer survive with rates this low, which is why the Fed keeps saying we must “normalize interest rates” for we will see a massive wholesale collapse in pensions. Yes, the 2007-2009 crisis helped create the final Phase Transition into a major long-term high in bonds (5,000 low in rates), but it obviously is not responsible for the 35-year bull market in bonds (decline in rates).

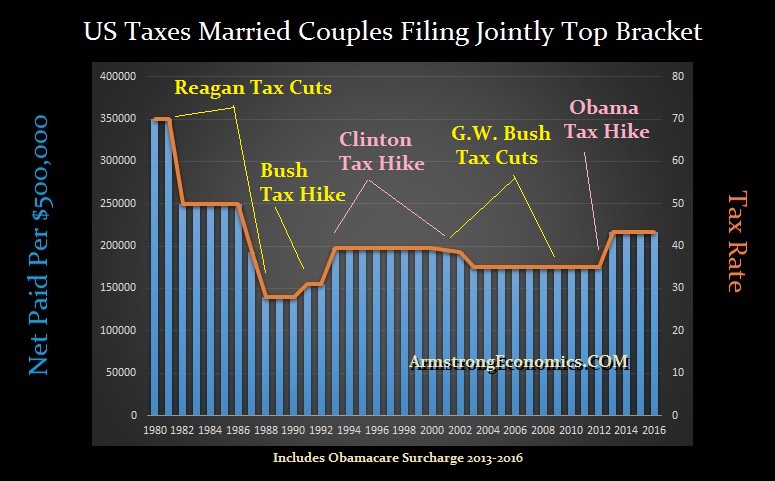

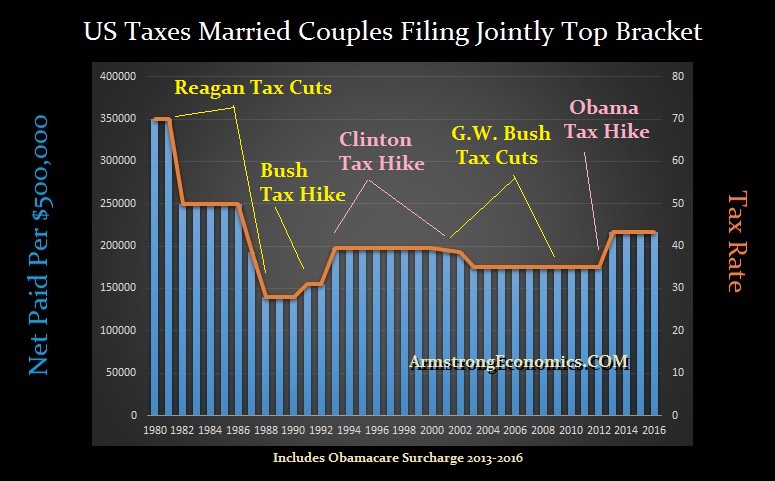

Taxes have risen sharply. Back in 1980, the tax rate was 70.0% on $600,177 for married couples filing jointly. What Clinton calls “trickle-down economics” actually worked. The top tax bracket under Reagan dropped to 50.0% on $203,661 in 1982, and it fell to 38.5% on $181,189 in 1987 for married couples filing jointly. In 1988, in response to the 1987 Crash, the rate was cut again to 28.0% on just $57,738. It then began to rise in 1991, reaching 31.0% on $138,481. Then in 1993 when the Clintons came to power, they raised the tax rate to 39.6% on $397,221. It fell back in 2001 to 39.1% on $385,487, and in 2002, it fell to 38.6% on $391,867 followed by 35.0% in 2003 on $389,249. It was raised again in 2013 to 39.6% on $440,876.

When we look at the annual growth rate in the economy using GDP, nothing even came close to the surge in economic growth during Reagan’s administration. If you look to buy a car and one dealer wants full sticker and another gives you a 5% discount just 5 miles away, I think you would drive the 5 miles. Lowering the tax rate from 70% to 28% by 1987 produced the biggest surge in modern history. Yet all we hear is that trickle-down economics failed.

The growth in the national debt was steadily declining, demonstrating that trickle-down worked. The debt soared during Cheney’s war. This clearly shows that it is a fallacy that war is good for the economy. True, it worked with World War II only because 40% of the workforce had been farmers displaced by the combustion engine and the Dust Bowl.

The other fallacy being totally overlooked is that under Obama, the interest expenditures have soared despite the fact that interest rates have declined. Under Reagan, the national debt was $1.029 trillion, and under Obama, as of September 2016, it stands at $19.528 trillion. If interest rates today were 8% as they were under Reagan, the interest expenditures along for the year would be $1.6 trillion.

Hillary will raise taxes again. Every Democrat has done that except Kennedy, who also cut taxes like Reagan. Government is growing and it is consuming all the productive forces within the economy, and regulation like FATCA is destroying international trade. There is nowhere to go but down. This was not set in motion by 2007-2009. That was simply the catalyst, but not the total cause.