- Home

- Blog

Silver Update on the Private Blog

Market Talk — June 29, 2016

Asia performed well in what appeared to be trading in shadows the majority of the day. Rumors that the PBOC were about to cut rates saw a rally in Shanghai (+1%) only to drift off the highs by the close. Rumors of more BOJ easing (attempting to put even 40yr bonds into single digits). It didn’t help matters when Japan missed on its Retail Sales release either (expected -1.6% but printed -1.9%) but even that could not derail today’s stock market rally that took all Asian markets better. In late US trading, Asian futures has added an additional 1%.

Europe was again the main topic around dealings floors as David Cameron rumors and speculation persists. Rumors of another referendum have finally been quashed by Cameron (again) and also by Angela Merkel. There is also talk of an ongoing battle between the European Commission and the Council as to which body negates Britain’s exit. Meanwhile, GBP is about to finish the worst quarter in eight years. We saw the FTSE outperform core European markets on the downside and today we see it outperform on the upside. FTSE closed +3.58%, DAX +1.75%, CAC +2.6% and IBEX +3.45% – “kinda” makes you wonder who is leaving who!

A nice 4%+ rally in oil, a return of confidence and lots of talk of quarter end pension rebalancing all funnelled well to support the globally led rally. A little news from FED (Jerome Powell) the first we have heard since BREXIT but he did say it could well be a drag on the US economy. However, that was certainly no sign of that today and we saw a broad market rally with DOW +287pts (+1.65%), S+P +1.65%, and NASDAQ +1.93%.

The US curve did see a little give back from the flattening bias with 2’s closing 0.63% and 10’s 1.51% (+4bp). The spread between US and Germany starts to widen again as Bunds remain bid due to the ECB’s playbook. 10yr Bund closed -0.13% closing the spread at +164bp. 10yr Italy closed 1.37% (-3bp), Greece 7.97% (-41bp), Turkey 9.07% (-11bp), Portugal 3.05% (-6bp) and UK Gilt 10yr at 0.945%.

Hillary – Has She Compromised the Country?

A very serious issue is starting to rise behind the curtain. Obama is blasting Trump as part of some global elitist group that does not exist outside of those in Obama’s camp who subordinate the people to government. Indeed, it was Obama who played the role of political elitist by interfering in Britain quite disgracefully. He told the Brits to get to “the back of the queue” when Britain is America’s strongest and oldest ally. If telling Britain to surrender its sovereignty to Brussels was not a global elitist attempt to end democracy in Europe then nothing is. That is the equivalent of the US surrendering its sovereignty to the United Nations,

To the contrary, Vladimir Putin maintained his silence throughout the whole BREXIT campaign. The question this brings up is Hillary’s emails. Putin will not release the emails for it is his secret weapon to control Washington. There are emails involving Obama that were sent to Hillary’s private server, which confirms he knew what she was up to. He also was aware she set up her foundation and that the very countries she approved arms deals for donated to the foundation.

Obama knew she sold a position on the International Security Advisory Board to commodities hedge fund trader Raj Fernando, who also happened to be a donor to the Clinton Foundation, when he had no experience or security clearance. Hillary also refused to appoint anyone to the office of Inspector General to monitor the State Department to prevent anyone from snooping around. Then to hide everything, Obama stood by and did nothing about any of this.

Now the rising concern is that Putin has the evidence. Instead of releasing it all, he has just let them know he has the goods. That means Putin can now control Hillary and Obama. The fact that Putin has Hillary’s emails may be the reason he suddenly pulled out of Syria, for he does not need the confrontation. Putin can topple Hillary at any time.

Vladimir Putin’s announcement that Russia will begin pulling out of Syria appeared to take the White House totally by surprise and revived concerns that the Russian leader was outmaneuvering Barack Obama.

Historians may write that this was how the fall of the United States unfolded at the hands of corrupt Hillary. It is entirely possible that Hillary’s personal greed and corruption has compromised Western culture entirely.

The Three Faces of Inflation – When is Real – Real?

QUESTION:

ANSWER: No. Future inflation will not be demand driven, but asset driven. Retail participation, both in the States and from Europe, in the US share market is at historic lows. This is why the market cannot crash. Where’s the bubble? As long as the Fed continues this crazy policy of accommodating the bankers by paying for excess reserve deposits, banks will continue to hoard. The rate was 0.25% and the Fed raised the rate to 0.5%. This is really stupid. It is why there has been no inflation from Quantitative Easing.

ANSWER: No. Future inflation will not be demand driven, but asset driven. Retail participation, both in the States and from Europe, in the US share market is at historic lows. This is why the market cannot crash. Where’s the bubble? As long as the Fed continues this crazy policy of accommodating the bankers by paying for excess reserve deposits, banks will continue to hoard. The rate was 0.25% and the Fed raised the rate to 0.5%. This is really stupid. It is why there has been no inflation from Quantitative Easing.

All of these gurus assumed that the Fed’s balance sheet would cause huge inflation because they just read headlines and do not comprehend how the system really works. Their assumption was that all this money would spark inflation, which they only see, and the 1970s demand inflation into 1980. The money never made it to the people. The bankers were paid to HOARD that cash, which shows that the Fed is really insane.

If the Fed honestly wants to “stimulate,” it should eliminate paying interest on excess reserves. Then the banks will take that money and have to earn something the good old fashion way – by lending it out. That is the only way you can see “demand” inflation. Otherwise, we are looking at asset inflation to protect money value instead of inflation spiraling out of consumer demand.

Currency inflation is when the currency declines so the assets rise in proportion. This is not actually a gain in real terms; rather it is how tangible assets act as a hedge against government. You will often hear gold will soar to $10,000. The question would be that type of rally would be profitless. Your monthly rent on a condo would probably be $10,000. Everything is relative.

Kondratieff Wave: Interesting But Different From the ECM

QUESTION: Mr. Armstrong, I am just getting started in studying cycles. Someone said you just bumped into the Kondratieff Wave. Your works seems entirely different. Did the K-Wave have any influence on you?

Thanks

ANSWER: Sadly, the Kondratieff wave, commonly known as the K-Wave, is used for things it was not based upon. Moreover, there were cyclical theories that were emerging a generation before Kondratieff. He became the most famous theorist because he was executed for his theory. Here is a chart of the business cycle that was created by a farmer named Samuel Benner. When the Wall Street Journal published this cycle in 1932, nobody knew who had investigated this phenomenon.

Nonetheless, both Benner and Kondratieff made their calculations based upon an economy that was commodity driven. In the 1850s, about 70% of all employment was in the agriculture sector. Therefore, if you created a model at that time based upon commodity prices, you would have been largely correct.

However, taking the K-Wave and Benner’s work forward fails to provide a guide to the modern economy. Why? The economy is not stagnant. It grows and evolves with innovation (technology). This was what Schumpeter noticed and his theory explained the cyclical nature of the business cycle through waves of innovation. The combustion engine caused unemployment in the Great Depression; nobody realized it was because a tractor displaced 100 workers. Today, technology is advancing and the internet has wiped out book publishers and will wipe out the mainstream media. The internet is also wiping out local stores who cannot compete with online prices.

Then add the development of robots. Obama and Hillary want to raise the minimum wage to $15 and mandate equal pay for women. However, this would merely create an incentive to replace workers with robots. Due to pension costs, companies are shifting toward part-time workers to avoid those drastic expenses. This is all part of the innovation cycle in technology. It is the very reason the design of the Economic Confidence Model (ECM) is entirely different.

The mistakes of both Kondratieff and Benner were understandable. If you wanted to monitor the economy today, you would look at the service industry that generally accounts for 70% of all employment (stores, banks, brokers, and even government). We must recognize this flaw in attempting to create any type of business cycle model. This is why the Economic Confidence Model is not based upon Benner or Kondratieff, for that would not provide a modern, accurate indicator since commodities are no longer the primary mover in the economy. It would also fail to recognize that there is a cycle to technology or innovation.

The ECM works ONLY because it was based upon the total economic environment and back-tested into ancient times. So it is very different. The K-Wave still works for the commodity sector, just not the entire economy. The theory of the business cycle, nonetheless, still prevails.

The Rising Trend of Anti-Establishment and Civil Unrest

QUESTION: Mr. Armstrong; Your model on civil unrest and war seem to be rather amazing. The anti-establishment feeling is rising quite strong. Not sure what’s going on with Trump. It looks like the Republicans are still trying to prevent him from being the candidate. All the money is going to Hillary. Government is becoming very aggressive. It seems their police and military will turn against the people. Do you have anything showing this?

ANSWER: Every single government agency is arming itself. Even the IRS has AR-15 military-style rifles, and domestic agencies are armed to the teeth. In America, there are more domestic agents armed with weapons than there are Marines. There are more than 200,000 non-Defense Department federal officers authorized to make arrests and carry firearms. The federal government has tripled the number of agents carrying weapons to defend the government in the past 20 years. They know what is coming. They know the socialistic system they constructed is collapsing. Instead of reform, they are digging in their heels, prepared to plow down any domestic uprising. They have been staging military-like drills in U.S. cities against civil unrest. Obama imposed a “litmus test” on military leaders to ask if they would shoot civilians.

On the evening of Monday, August 18, 2014, the U.S. Army commenced military exercises in Minneapolis and St. Paul, Minnesota. MH-60 variant Black Hawk helicopters buzzed through the downtown and residential areas of the two Midwestern cities, as reported by CBS local news. This shocking event was actually a repeat of the August 2012 exercises we previously reported. The U.S. Special Operations Command conducted exercises until the beginning of September along with police from Minneapolis and St. Paul using helicopters, including Black Hawks.

They know what is coming. The establishment by no means wants to see Trump in the White House. His is not one of them and they fear he will side with the people and reform government, right down to the pervasive nepotism. We are in a battle with very high stakes.

Market Talk — June 28, 2016

The Nikkei had a poor start but finished better as did Shanghai. HSI closed a little lower (-0.3%) but well up from opening levels. Europe was the main talking point yet again today and with a healthy bounce in both currencies and equities; many people spoke of nothing else. After suffering two awful days, we saw 2%+ in all core indices today. Despite the double-notch downgrade inflicted on the UK (from AAA to AA), the FTSE performed best (closing up 2.65%).

This evening PM David Cameron is dining with EU leaders in an attempt to answer questions and to discuss proceedings, but the mainstream press is adamant that no favors will be forthcoming! News from opposition Labour Party this evening is that Jeremy Corbyn suffered a vote of “No Confidence” (not constitutional) by 172-40, at the same time that David Cameron (Conservative Party) has yet to announce his successor. Although GBP bounced 0.8% today, it remains vulnerable to a turn in confidence. The UK has the benefit of a separate currency to act as the pressure value for the economy whilst Europe has only the peripheral bond markets. Many dealers were discussing the amount of LTRO made available on Friday by the ECB. It was announced that the ECB offered Euro 400Bn at 4yrs at 0%. The last 4yr offered (Sept 24th, 2014) was for Euro 82.6bn.

US stocks followed Europe’s sentiment and were trading 0.5% higher even before the cash market opened. DOW closed 270 points higher with S+P and NASDAQ around 2% better also. Crude managed a 3% rally providing the support the markets were looking for.

US Bond Market saw a little profit taking and a 1bp steepening in the 2/10 curve. US 10’s closed at 1.46% (+2bp) while 10yr Bund closed -0.11%; a spread of +157bp. Italy 10yr closed 1.39% (-11bp), Greece 8.38% (-9bp), Turkey 9.18% (-11bp), Portugal 3.11% (-3bp) and UK Gilt 0.96% (+4bp).

Standard & Poor’s Reaction Shows Political Bias

Rating Agencies Testify Before Congress for their AAA-Ratings after 2007

Standard & Poors downgraded United Kingdom (UK), which is comprised of England, Northern Ireland, Scotland, and Wales, from AAA to AA. This shows emotional and political bias rather than any substantial change in economics; they are making good on their political threats of 2015. S&P rates China at AA- and the European Union at AA+. S&P, who is notorious for selling its ratings during the last bubble, claims: “In our opinion, this outcome is a seminal event, and will lead to a less predictable, stable, and effective policy framework in the U.K. We have reassessed our view of the U.K.’s institutional assessment and now no longer consider it a strength in our assessment of the rating.” First of all, such an excuse would be justified with every US presidential election. Additionally, this downgrade before anything is settled is entirely inappropriate, especially when no government has NEVER paid off its debt and continues to borrow year after year.

It would be astonishing, just for once, to listen to how can government debt be rated AAA at any point since they routinely default, impose cuts, and never honor their debt anyway. A historical review of top corporate debt does not reveal any loss in capital whereas government is often restructured. Moreover, with the long-term progression of inflation, you receive less in purchasing power upon maturity of 30-year debt, meaning you actually lose money. Now with negative interest rates, they are clearly defrauding investors who buy government debt. So if the criteria is that you would risk not being paid back when rates are negative, then no government debt should be rated above junk bond status.

S&P is once again playing politics and one must wonder who paid them this time. If we look at economic growth, it has been declining since Britain joined the EU and it has had chronic trade deficits post-1985. So all the hoopla over BREXIT will prove to be a lot about nothing.

Looking at the UK, it shipped US$460.1 billion worth of products around the globe in 2015. This amounts to about 2.5% of total international exports, which is estimated at $18.686 trillion. Now, breaking that down, about 53.6% of UK exports by value are delivered to European trade partners. On the contrary, 22.5% are sold to Asian importers, 16.1% to North America, and just 2.6% to Africa.

United Kingdom’s top 15 trade partners by dollar value during 2015 are below with the percentage of UK exports:

- United States: US$66.5 billion (14.5% of total UK exports)

- Germany: $46.4 billion (10.1%)

- Switzerland: $32.2 billion (7%)

- China: $27.4 billion (5.9%)

- France: $27 billion (5.9%)

- Netherlands: $26.6 billion (5.8%)

- Ireland: $25.5 billion (5.5%)

- Belgium: $17.8 billion (3.9%)

- Spain: $13.1 billion (2.8%)

- Italy: $12.9 billion (2.8%)

- United Arab Emirates: $10.3 billion (2.2%)

- Hong Kong: $9.6 billion (2.1%)

- South Korea: $7 billion (1.5%)

- Saudi Arabia: $6.7 billion (1.5%)

- Sweden: $6.6 billion (1.4%)

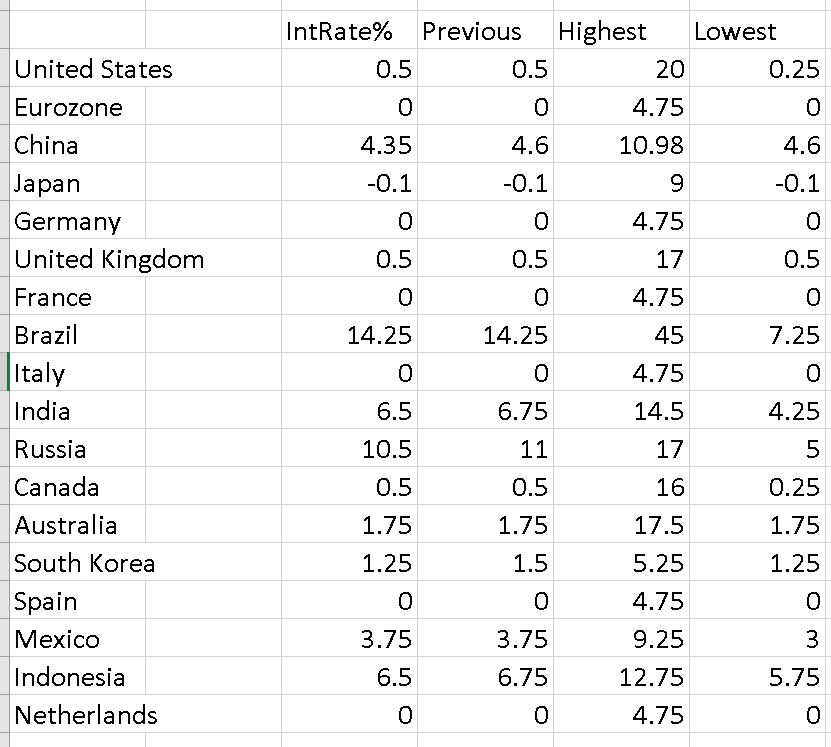

Yet, if we look at interest rates, the UK is at US levels departing from the ECB. They can only do that with a separate currency. The economic risk lies in the European Union, and not in UK. Clearly, S&P is playing politics to lower a credit rating before any action is even taken. One would suppose the same would be justified if Trump were elected. I would guess Hillary’s supporters will pay for that one.

The Dow Held the Reversal 17120

A number of emails are coming in about how, even in a panic, the Reversal system held. The Dow crashed only within a two-day reaction. It elected the first minor Daily Bearish at 17434 on Friday. We saw the Dow fall to 17063 intraday and close at 17140.24 while holding the 17120 level. We warned on June 25, “With the closing on Friday below the first Minor Weekly Bearish at 17434, the Dow should move a bit lower now to test the 17120 level. “

Holding the 17120 level for the close yesterday implied a failure and thus a bounce. We now require a daily closing back above 15752 to imply that the low will hold for now and another retest of resistance should follow.