- Home

- Blog

Panama Paper Names to be Partially Released Today?

The International Consortium of Investigative Journalists (ICIJ) has said that they will release the names of the people involved in the Panama Papers today. They will be withholding the actual documents, which include everything from copies of passports, telephone numbers, Mossack Fonseca’s internal emails, and, in some cases, financial records. Material that will not be included in Monday’s release will remain available only to the ICIJ and its journalist partners.

The glaring question to emerge has been whether they are hiding documents and names that lead to people like the Clintons and their friends. All of the political releases, so far, have been on one side of the political aisle. Will the ICIJ really release the names without political consideration? Lawyers use lawyers. Look at Hillary’s cattle futures deals. Her slush fund, which they pretend is a charity, took in almost $150 million and gave out just $9 million. The dealings of the Clintons have long been considered shady. It will be interesting to see if anyone on the left is contained in this release.

Armstrong Speaking Next Weekend HackMiami 2016

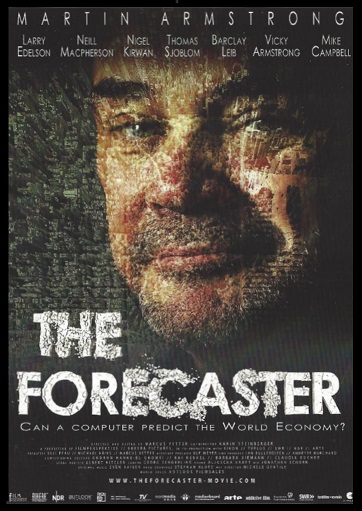

“The Forecaster” will be shown this year at the Hack Miami 2016 Conference, which I will be speaking at. The long arm of government seeks to grab technology and what they are willing to do is becoming highly dangerous to society and threatens our very freedom. The demand that I turn over the source code to our computer program named Socrates was probably the first such endeavor.

“The Forecaster” will be shown this year at the Hack Miami 2016 Conference, which I will be speaking at. The long arm of government seeks to grab technology and what they are willing to do is becoming highly dangerous to society and threatens our very freedom. The demand that I turn over the source code to our computer program named Socrates was probably the first such endeavor.

The demands to control technology have not subsided, as we can see with their high profile demands made against Apple to break their own encryption so that the government can have access to everything. Of course, whatever the government demands is not in the best interest of society for cracking encryption will mean that the security of payment transactions and banking will crumble to the ground.

This will be a special presentation of “The Forecaster” for the programming industry. It is an honor to be invited to speak this year after coding for my entire adult life.

Failure of the Quantity of Money Theory

QUESTION: Marty; Are you saying that Bill Gross is wrong and they will not try “helicopter money” again or that “helicopter money” will not stimulate the economy?

ANSWER: Whether or not the Fed tries to apply “helicopter money” is highly debatable. Bill Gross DID NOT make a forecast that any QE (Quantitative Easing) would be successful or create inflation. All he said was that the Feds will print money trying to “stimulate” again as they did in the past buying bonds which he will eagerly sell to them. So I do not see where this is a right or wrong confrontation. He did not say “helicopter money” would succeed. He just said they would try it again. So where is the disagreement with respect to inflation? As far as the Fed even attempting another QE program is debatable. They realize that it did not work and it foolishly created the Excess Reserve Facility which allowed banks to park (hoard) money at the Fed which defeated the “stimulus” purpose because the money never made it into the economy to increase consumer spending. So the only quasi-disagreement at best is simply I am saying that the Fed realizes now that QE failed. They can see Japan and Europe. If those central banks raise rates, they will create panics because the idiot pundits convinced themselves that lower rates (even negative) are good for stock markets and economy while higher rates are evil. The central banks are trapped and this cannot end nicely.

ANSWER: Whether or not the Fed tries to apply “helicopter money” is highly debatable. Bill Gross DID NOT make a forecast that any QE (Quantitative Easing) would be successful or create inflation. All he said was that the Feds will print money trying to “stimulate” again as they did in the past buying bonds which he will eagerly sell to them. So I do not see where this is a right or wrong confrontation. He did not say “helicopter money” would succeed. He just said they would try it again. So where is the disagreement with respect to inflation? As far as the Fed even attempting another QE program is debatable. They realize that it did not work and it foolishly created the Excess Reserve Facility which allowed banks to park (hoard) money at the Fed which defeated the “stimulus” purpose because the money never made it into the economy to increase consumer spending. So the only quasi-disagreement at best is simply I am saying that the Fed realizes now that QE failed. They can see Japan and Europe. If those central banks raise rates, they will create panics because the idiot pundits convinced themselves that lower rates (even negative) are good for stock markets and economy while higher rates are evil. The central banks are trapped and this cannot end nicely.

Additionally, a number of questions seem to be amazed that a raw theory of the Quantity of Money does not work. They are stunned that I have shown velocity which has been in crash-mode since 1998. They were shocked that the Fed’s Excess Reserve Facility is proof of banks hoarding cash. People hoard money in times of uncertainty, and the data now shows that Americans are saving more and spending less. Their savings (hoarding) reached a 3-year record high in December 2015. This continued to cause the declining Velocity. Then we have banks parking (hoarding) cash at the Fed, corporates cash rich (hoarding) are buying back their own shares, and we have European banks shipping money to the States also parking (hoarding) cash at the Fed collecting 0.25% against negative rates at the ECB.

Additionally, a number of questions seem to be amazed that a raw theory of the Quantity of Money does not work. They are stunned that I have shown velocity which has been in crash-mode since 1998. They were shocked that the Fed’s Excess Reserve Facility is proof of banks hoarding cash. People hoard money in times of uncertainty, and the data now shows that Americans are saving more and spending less. Their savings (hoarding) reached a 3-year record high in December 2015. This continued to cause the declining Velocity. Then we have banks parking (hoarding) cash at the Fed, corporates cash rich (hoarding) are buying back their own shares, and we have European banks shipping money to the States also parking (hoarding) cash at the Fed collecting 0.25% against negative rates at the ECB.

The question is merely whether the Fed would do another QE because people “think” that is necessary despite the fact there is no empirical evidence this has ever worked. The Euro peaked in 2008 and crashed. The capital flows turned into the USA despite the introduction of increasing the money supply by QE. So while the central bankers expected inflation and the Gold Promoters misrepresent this issue claiming that increasing the supply of money is automatically inflationary so gold must rise and the dollar fall, exactly the opposite has unfolded. So the Gold Promoters are preaching the same story as the central bankers. As the economic crisis became worse around the world, the dollar was (and remains) the only currency standing. The Fed has become the de facto central bank of the world yet the money supply increased. You cannot dismiss this and keep touting that the Quantity of Money still is relevant or that it works. Something is seriously missing. If such a theory is valid, then it MUST hold up 100% of the time. It is not the pure Quantity of Money that matters, there is another factor here being ignored – DEMAND; as in supply demand. Naturally, the Gold Promoters will say I am wrong because this is their #1 sales pitch. What they do not understand is you can fool people sometimes, but only a fool believes a fallacy eternally. The rest get burnt and they never come back because they lost confidence in the sales pitch. Gold is a HEDGE AGAINST GOVERNMENT, and to create a bull market requires the decline in DEMAND for dollars because they lost CONFIDENCE in government. Only when government is unable to then sell its debt or raise taxes, then it prints money like Germany to cover its expenses and it debases the currency stretching what resources it has to increase the supply of money to pay its bills when coins were a precious metal. There is simply more to this simplistic view that increasing the supply of money automatically produces inflation. The central banks have followed the very same theory as the Gold Promoters and also failed miserably.

The question is merely whether the Fed would do another QE because people “think” that is necessary despite the fact there is no empirical evidence this has ever worked. The Euro peaked in 2008 and crashed. The capital flows turned into the USA despite the introduction of increasing the money supply by QE. So while the central bankers expected inflation and the Gold Promoters misrepresent this issue claiming that increasing the supply of money is automatically inflationary so gold must rise and the dollar fall, exactly the opposite has unfolded. So the Gold Promoters are preaching the same story as the central bankers. As the economic crisis became worse around the world, the dollar was (and remains) the only currency standing. The Fed has become the de facto central bank of the world yet the money supply increased. You cannot dismiss this and keep touting that the Quantity of Money still is relevant or that it works. Something is seriously missing. If such a theory is valid, then it MUST hold up 100% of the time. It is not the pure Quantity of Money that matters, there is another factor here being ignored – DEMAND; as in supply demand. Naturally, the Gold Promoters will say I am wrong because this is their #1 sales pitch. What they do not understand is you can fool people sometimes, but only a fool believes a fallacy eternally. The rest get burnt and they never come back because they lost confidence in the sales pitch. Gold is a HEDGE AGAINST GOVERNMENT, and to create a bull market requires the decline in DEMAND for dollars because they lost CONFIDENCE in government. Only when government is unable to then sell its debt or raise taxes, then it prints money like Germany to cover its expenses and it debases the currency stretching what resources it has to increase the supply of money to pay its bills when coins were a precious metal. There is simply more to this simplistic view that increasing the supply of money automatically produces inflation. The central banks have followed the very same theory as the Gold Promoters and also failed miserably.

Let me make this very clear; our study of the Quantity of Money extends back into ancient times and it is NOT based upon my “opinion” so if you want to argue, please show the data correlation that explains the failure of QE with the survival of the theory of the Quantity of Money. You cannot just say you “think” or express your “opinion” to have any serious consideration in the real world. This is why we reconstructed the world economy using the coinage from all countries. Before the 1663, dies used to impress images on coins were created by hand and are unique and the coinage was hammered rather than machine pressed and milled. This has allowed us to catalogue the number of known dies and then apply the average number of coins that can be struck from a die before it breaks – 15,000. We even collected ancient dies for study. This method allowed us to recreate the money supply on an annual basis. All of this research has enabled us to see the Quantity of Money produced on an annual basis and to test economic theories not guess about them or accept the ones that support a predetermined political view. To understand how things TRULY function, you MUST just let the data speak for itself. Then you can learn the truth rather than political or self-interest propaganda.

You cannot simply come up with theories and support them on “belief” and “opinion” for that just does not cut it in real science. Physics you must prove a theory. They hand out Nobel prizes in economics if they sound nice or to people who lack the back-testing as was the case with Black–Scholes theory which they won the Nobel Prize and then completely failed. So if I am going to make a statement, it is based upon real back-testing. This is NOT my personal opinion. So no worries. They would NEVER give me the Nobel Prize in economics because it proves Marx was wrong and that means government cannot function as it does or have politicians running for office promising to change something they cannot control nor do they understand. They only hand out Nobel Prize in economics to people who support the status-quo. The “establishment” has always been about manipulating the Invisible Hand of Adam Smith because they do not like being the subject of free market movements.

You cannot simply come up with theories and support them on “belief” and “opinion” for that just does not cut it in real science. Physics you must prove a theory. They hand out Nobel prizes in economics if they sound nice or to people who lack the back-testing as was the case with Black–Scholes theory which they won the Nobel Prize and then completely failed. So if I am going to make a statement, it is based upon real back-testing. This is NOT my personal opinion. So no worries. They would NEVER give me the Nobel Prize in economics because it proves Marx was wrong and that means government cannot function as it does or have politicians running for office promising to change something they cannot control nor do they understand. They only hand out Nobel Prize in economics to people who support the status-quo. The “establishment” has always been about manipulating the Invisible Hand of Adam Smith because they do not like being the subject of free market movements.

Perhaps the day will come when someone will plagiarize this work, call it their own, and pretend this is their theory without ever having to collect coins to actually do the work. That too is the way it always goes. Francis Hutcheson, the teacher of Adam Smith, I believe plagiarized Xenophon copying his book Oikonomikos from the 4th century BC which was a how to manage your estate for dummies. Hutchenson called his Book III “The Principles of Oeconomics and Politics” giving birth to the word “economics” which was Greek in origin “Oikonomikos” stemming from the compounded form of oikos meaning “household” and the complex root nem– meaning in this context to “regulate,” “administer” or “control.” So this will no doubt show up one day in the same manner. Outside of physics, there is no ethics in economics.

As far as the Quantity of Money and inflation is concerned, there is ABSOLUTELY no empirical evidence whatsoever which supports that the two are linked in some perfect union always producing the same result. Throughout the Roman Empire, the annual budge was funded by 80% taxes and 20% expansion of the money supply. As the empire expanded bringing in new regions, the bottom-line impact was identical to an increase in population. If the money supply does not increase keeping pace with population growth, then you produce deflation since there is less money per person causing money to rise in purchasing power resulting in the price of goods, services and labor to decline in terms of money (whatever that might be). To reconstruct the money supply required recording the number of known dies of the coinage for every year given they were all hand crafted with subtle differences. Experiments prove that about 15,000 coins were able to be produced from a die on average before it cracked. Hence, reconstructing the new money supply produced each year is a definable FACT (see above chart 157-50BC).

I am not asserting opinion here. We can easily determine the money supply and the expansion of the money supply as well as inflation throughout the course of the Roman Empire. This clearly demonstrates that the modern theory of the Quantity of Money alone is immature and lacks depth no less historical back-testing. This is why everyone from the Gold Promoters to Central Banks who all rely on this theory have been wrong. Make no mistake about it. The QE program which has failed is based on this theory which is also used to promote gold sales. They are both in the same camp.

I am not asserting opinion here. We can easily determine the money supply and the expansion of the money supply as well as inflation throughout the course of the Roman Empire. This clearly demonstrates that the modern theory of the Quantity of Money alone is immature and lacks depth no less historical back-testing. This is why everyone from the Gold Promoters to Central Banks who all rely on this theory have been wrong. Make no mistake about it. The QE program which has failed is based on this theory which is also used to promote gold sales. They are both in the same camp.

Much of the records have survived as have the accounts of many contemporary historians. We even have the records as to the pay of a soldier and pensions over time. The term “stipend” comes from the Latin Stipendium, meaning a pension or pay, from stipem (meaning contribution, dues, income, tax, tribute) and pendo (meaning hang, weigh or pay). Prior to the introduction of silver coins in Rome during 280BC, the money in use was bronze paid by weight and is known as Aes Rude because it traded in lumps, as shown here. This is why we have the merger of income and weight to create the word Stipendium.

There was no pay for a Roman solider prior to 405BC. The Senate appears to have approved pay for the military at that time. According to the historian Livy, the Roman Senate began the practice of giving pay to the Roman soldiers (stipendium) on the occasion of the taking of Tarracina which was a town 35 miles south of Rome. Livy tells us the change was spontaneous and unsolicited act of the senate, but from another passage we are told that in the year 421 BC, the Tribunes had proposed that the occupiers of the public land should pay their property tax regularly, and that it should be devoted to the payment of the troops (Titi Livi Ab Vrbe Condita Liber IV. 36).

There was no pay for a Roman solider prior to 405BC. The Senate appears to have approved pay for the military at that time. According to the historian Livy, the Roman Senate began the practice of giving pay to the Roman soldiers (stipendium) on the occasion of the taking of Tarracina which was a town 35 miles south of Rome. Livy tells us the change was spontaneous and unsolicited act of the senate, but from another passage we are told that in the year 421 BC, the Tribunes had proposed that the occupiers of the public land should pay their property tax regularly, and that it should be devoted to the payment of the troops (Titi Livi Ab Vrbe Condita Liber IV. 36).

No doubt, like the USA which failed to respect the veterans from World War I and attacked the Bonus Army asking for money, we see this similar action in the Roman context. The USA threatened with World War II was compelled to pass the GI Bill because of their harsh treatment of the vets from World War I. Here in Roman times, there appears to have been a proposal in 421BC to pay the troops, but it too waits until there is the treat of another war in 405BC, 16 years later. This became urgent for Tarracina revolted, which had been under Roman rule for some time. Rome needed a paid army to retain its power. The prospect of losing Tarracina was rather serious enough to prompt paying the troops for if their revolt had been successful, like the BREXIT referrendum in June 2016, the fear is the empire would fail. Indeed, Rome would later face the prospect of another war with Veii which came in 396BC. This was about securing all of Italy.

No doubt, like the USA which failed to respect the veterans from World War I and attacked the Bonus Army asking for money, we see this similar action in the Roman context. The USA threatened with World War II was compelled to pass the GI Bill because of their harsh treatment of the vets from World War I. Here in Roman times, there appears to have been a proposal in 421BC to pay the troops, but it too waits until there is the treat of another war in 405BC, 16 years later. This became urgent for Tarracina revolted, which had been under Roman rule for some time. Rome needed a paid army to retain its power. The prospect of losing Tarracina was rather serious enough to prompt paying the troops for if their revolt had been successful, like the BREXIT referrendum in June 2016, the fear is the empire would fail. Indeed, Rome would later face the prospect of another war with Veii which came in 396BC. This was about securing all of Italy.

Late in 218 B.C., the Carthaginians again defeated the Romans on the left bank of the Trebia River, a victory that earned Hannibal the support of allies including the Gauls and Ligurians. By the spring of 217 B.C., he had advanced to the Arno River in Italy. It was the invasion of Italy by Hannibal which prompts the first issue of Roman gold coins. The obverse is the Roman god Janus (for whom January is named), and the reverse depicts an oath scene of allegiance. Rome issued gold coins to demonstrate to the other Roman cities that Rome was rich and that they should not abandon them for Hannibal. This gold issue was clearly a political display of wealth. A stater in the Greek world equaled 20 drachms. The weight was idealized at 8 grams of gold with a silver drachm being 4 grams making the silver to gold ratio about 10:1. However, in practical terms, the ratio was closer to 8.6 since the silver drachms were really about 3.2 grams.

Late in 218 B.C., the Carthaginians again defeated the Romans on the left bank of the Trebia River, a victory that earned Hannibal the support of allies including the Gauls and Ligurians. By the spring of 217 B.C., he had advanced to the Arno River in Italy. It was the invasion of Italy by Hannibal which prompts the first issue of Roman gold coins. The obverse is the Roman god Janus (for whom January is named), and the reverse depicts an oath scene of allegiance. Rome issued gold coins to demonstrate to the other Roman cities that Rome was rich and that they should not abandon them for Hannibal. This gold issue was clearly a political display of wealth. A stater in the Greek world equaled 20 drachms. The weight was idealized at 8 grams of gold with a silver drachm being 4 grams making the silver to gold ratio about 10:1. However, in practical terms, the ratio was closer to 8.6 since the silver drachms were really about 3.2 grams.

Knowing the weight of coinage is one thing. We then must also have some reference point with respect to its purchasing power within society.

Knowing the weight of coinage is one thing. We then must also have some reference point with respect to its purchasing power within society.  According to the Greek historian Polybius (c. 200 – c. 118 BC), the daily pay of a legionary amounted to two oboli. However, he makes a Greek drachma equivalent to a Roman denarius, and a denarius in paying the soldiers was then estimated at ten bronze asses. The Greek tetradrachm (4 drachms) was 16.85 grams making a drachm/denarius about 4.25 grams. However, this was a gross salary and Roman soldiers, since what was deducted from their gross pay was the money value of whatever they received in kind such as food (corn), armor and clothes.

According to the Greek historian Polybius (c. 200 – c. 118 BC), the daily pay of a legionary amounted to two oboli. However, he makes a Greek drachma equivalent to a Roman denarius, and a denarius in paying the soldiers was then estimated at ten bronze asses. The Greek tetradrachm (4 drachms) was 16.85 grams making a drachm/denarius about 4.25 grams. However, this was a gross salary and Roman soldiers, since what was deducted from their gross pay was the money value of whatever they received in kind such as food (corn), armor and clothes.

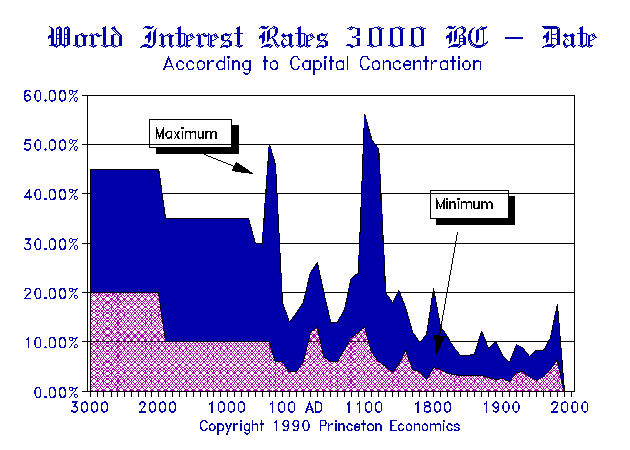

There was a sharp increase in money supply as illustrated above between 97 and 87BC. We then find a very sharp decline in new money coming into the economy. This prompted a serious debt crisis prior to the First Civil War. In fact, corruption was so outrageous it was similar as we see Goldman Sachs donating tons of money to politicians to buy favor that even Obama says he can now make serious money doing speaking engagements for Goldman at the 2016 White House Correspondent’s Dinner. The corruption buying votes sent interest rates soaring for the elections. During the Roman Republic, the corruption was so widespread, that interest rates doubled from 4% to 8% for the elections of 54 BC because there was so much bribery going on to gain votes. There was a very serious shortage of money resulting in a deflationary wave. People could not pay their debts because money was scarce. This was the state of the economy going into the breach of the First Civil War prompting Caesar to cross the Rubicon. We have the coinage record as well as historical accounts.

There was a sharp increase in money supply as illustrated above between 97 and 87BC. We then find a very sharp decline in new money coming into the economy. This prompted a serious debt crisis prior to the First Civil War. In fact, corruption was so outrageous it was similar as we see Goldman Sachs donating tons of money to politicians to buy favor that even Obama says he can now make serious money doing speaking engagements for Goldman at the 2016 White House Correspondent’s Dinner. The corruption buying votes sent interest rates soaring for the elections. During the Roman Republic, the corruption was so widespread, that interest rates doubled from 4% to 8% for the elections of 54 BC because there was so much bribery going on to gain votes. There was a very serious shortage of money resulting in a deflationary wave. People could not pay their debts because money was scarce. This was the state of the economy going into the breach of the First Civil War prompting Caesar to cross the Rubicon. We have the coinage record as well as historical accounts.

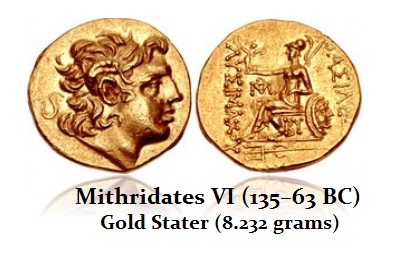

The bronze coinage of the Roman Republic collapsed in weight and was used in terms of accounting only, but virtually no bronze coinage was even being minted. C. Coota complained in 75BC that there was no money (Sallust, Hist. ii, 47M, 6-7; cf. 46M), which is confirmed by a letter from Pompey the Great from Spain (Hist. ii, 98M, 2 and 9). Clearly, people were hoarding money despite the sharp increase in coinage which had taken place going into 87BC, because of the fear of the future. The population had expanded but the money supply did not keep pace producing deflation. There was the First Mithridatic War (88–84 BC) when the legions were commanded by Lucius Cornelius Sulla. We see the issue of Roman gold aureus at this time issued 84-83BC with a weight of 10.78 grams making the silver/gold ratio its lowest point at 6.9:1 demonstrating the rising abundance of gold as Rome moved East. The war ended with a Roman victory, and the Treaty of Dardanos in 85 BC, but the Second Mithridatic War (83–81 BC) broke out which ended inconclusively after a Roman defeat, and withdrawal on Sulla’s orders. This uncertainty would Rome survive contributed to the hoarding.

The bronze coinage of the Roman Republic collapsed in weight and was used in terms of accounting only, but virtually no bronze coinage was even being minted. C. Coota complained in 75BC that there was no money (Sallust, Hist. ii, 47M, 6-7; cf. 46M), which is confirmed by a letter from Pompey the Great from Spain (Hist. ii, 98M, 2 and 9). Clearly, people were hoarding money despite the sharp increase in coinage which had taken place going into 87BC, because of the fear of the future. The population had expanded but the money supply did not keep pace producing deflation. There was the First Mithridatic War (88–84 BC) when the legions were commanded by Lucius Cornelius Sulla. We see the issue of Roman gold aureus at this time issued 84-83BC with a weight of 10.78 grams making the silver/gold ratio its lowest point at 6.9:1 demonstrating the rising abundance of gold as Rome moved East. The war ended with a Roman victory, and the Treaty of Dardanos in 85 BC, but the Second Mithridatic War (83–81 BC) broke out which ended inconclusively after a Roman defeat, and withdrawal on Sulla’s orders. This uncertainty would Rome survive contributed to the hoarding.

The Senate seems to have known about the rising threat from Mithridates VI (135–63 BC) who was perhaps the Republic’s greatest foe at this time since in 78BC they appropriated 18 million denarii to pay for the military. They sent a Quaestor to Cyrene to raise cash since that was a Roman property from 96BC. All accounts show there was a wave of deflation despite the rise in coinage production into 87BC (money supply like QE today). This was followed by the Third Mithridatic War (75–63 BC) commanded by Lucius Licinius Lucullus (75–66 BC) and then by Gnaeus Pompeius Magnus (“Pompey the Great”, 66–63 BC), where Rome was finally victorious and Mithridates VI died in 63 BC.

The Senate seems to have known about the rising threat from Mithridates VI (135–63 BC) who was perhaps the Republic’s greatest foe at this time since in 78BC they appropriated 18 million denarii to pay for the military. They sent a Quaestor to Cyrene to raise cash since that was a Roman property from 96BC. All accounts show there was a wave of deflation despite the rise in coinage production into 87BC (money supply like QE today). This was followed by the Third Mithridatic War (75–63 BC) commanded by Lucius Licinius Lucullus (75–66 BC) and then by Gnaeus Pompeius Magnus (“Pompey the Great”, 66–63 BC), where Rome was finally victorious and Mithridates VI died in 63 BC.

During the 70s BC, the prospect of war led the people to hoard money despite the fact that the money supply increased sharply to pay the troops. There was no government bonds. They issued coinage to cover expenses. There was not enough money to pay the troops as recorded in a speech of Pompey in 59BC (Cassius Dio XXXVIII, 5, 1). Money was being produced in large quantities, but it was being hoarded thanks to uncertainty. Rome was expanding, but it was not yet in possession of Europe or Asia. To fight the pirates dominating the Mediterranean Sea, the Senate appropriated 36 million denarii (Appian, Mith. 430; cf. Plutarch, 25).

There was a tremendous wave of inflation that is not reflected in the silver coinage, but in the gold coinage. The first gold aureus to be minted in Rome itself was that produced by Julius Caesar. The previous issues of gold were struck in the provinces by Sulla to pay troops. The gold inflation wave, much akin to the California gold rush of the 19th century and the Spanish flooding Europe with gold from the New World, has its parallel also at this point in history. The gold inflation wave was created by Julius Caesar’s four victories over Gaul, Egypt, Pharnaces, and Africa, resulting in Rome being flooded with gold. The Roman economy was overwhelmed by gold driving its value of down sharply for it became commonplace. The historian Appianus tells us that Caesar brought back 65,000 talents of gold (talent = 32.3 kilograms (71 lb)) which would have been about 262,437 gold aureii. Additionally 2,822 golden wreaths weighing 20,414 pounds, were carried along the triumphal procession. Caesar gave out an enormous amount of money in gold to both his army and the population of Rome. He paid out the equivalent of 400 sestertii to each and ever citizen or 200 silver denarii equivalent to 4 gold aureii (there was no issue of bronze sestertii to account for the payments). To his troops, he gave them 20,000 sesterii or 5,000 silver denarii which equalled 200 gold aureii. Since these payments were made in gold, they were measured in sestertii (unit of account) but again no such bronze coinage was produced in that denomination. Instead, we have this enormous gold issue. There are 111 known obverse dies from the issue of 46BC and 122 dies of the reverse. This would account for 1,830,000 gold aureii being struck that from that issue alone. This enormous issue of gold aureii caused a collapse in the value of gold.

There was a tremendous wave of inflation that is not reflected in the silver coinage, but in the gold coinage. The first gold aureus to be minted in Rome itself was that produced by Julius Caesar. The previous issues of gold were struck in the provinces by Sulla to pay troops. The gold inflation wave, much akin to the California gold rush of the 19th century and the Spanish flooding Europe with gold from the New World, has its parallel also at this point in history. The gold inflation wave was created by Julius Caesar’s four victories over Gaul, Egypt, Pharnaces, and Africa, resulting in Rome being flooded with gold. The Roman economy was overwhelmed by gold driving its value of down sharply for it became commonplace. The historian Appianus tells us that Caesar brought back 65,000 talents of gold (talent = 32.3 kilograms (71 lb)) which would have been about 262,437 gold aureii. Additionally 2,822 golden wreaths weighing 20,414 pounds, were carried along the triumphal procession. Caesar gave out an enormous amount of money in gold to both his army and the population of Rome. He paid out the equivalent of 400 sestertii to each and ever citizen or 200 silver denarii equivalent to 4 gold aureii (there was no issue of bronze sestertii to account for the payments). To his troops, he gave them 20,000 sesterii or 5,000 silver denarii which equalled 200 gold aureii. Since these payments were made in gold, they were measured in sestertii (unit of account) but again no such bronze coinage was produced in that denomination. Instead, we have this enormous gold issue. There are 111 known obverse dies from the issue of 46BC and 122 dies of the reverse. This would account for 1,830,000 gold aureii being struck that from that issue alone. This enormous issue of gold aureii caused a collapse in the value of gold.

The enormous gold coinage of Julius Caesar in 46-45BC flooded the money supply with the yellow metal and produced a violent disturbance in the monetary system as the silver/gold ratio had risen from its low under Sulla (6.9:1) rising to 12.5:1 and then collapsing again back to 9:1 in about 31 years (Pi Cycle). This contributed to the debt crisis insofar as loans had been in terms of denarii, not gold aureii. This clearly sent the financial market into chaos down the Via Sacra, the Wall Street of its day. Creditors had been demanding repayment in denarii, which was obviously at a premium to gold.

The enormous gold coinage of Julius Caesar in 46-45BC flooded the money supply with the yellow metal and produced a violent disturbance in the monetary system as the silver/gold ratio had risen from its low under Sulla (6.9:1) rising to 12.5:1 and then collapsing again back to 9:1 in about 31 years (Pi Cycle). This contributed to the debt crisis insofar as loans had been in terms of denarii, not gold aureii. This clearly sent the financial market into chaos down the Via Sacra, the Wall Street of its day. Creditors had been demanding repayment in denarii, which was obviously at a premium to gold.

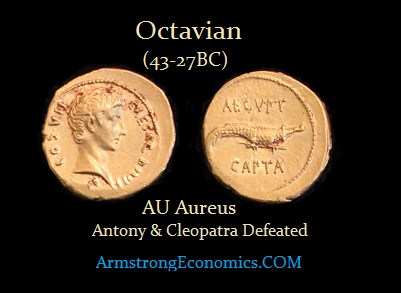

After the Second Civil War where Octavian (Augustus) defeats Marc Antony and Cleopatra, some of the aurei of Augustus (27BC-14AD) were struck at the reduced rate of 42 to the pound whereas Caesar struck the aureus at 40 to the pound (8 grams). The weight was further reduced by Nero (54-68AD) who struck the aureus at 45 to the pound (7.3 grams). Marcus Aurelius (161–180AD) struck aurei at 50 to the pound (6.5 grams), and by the time of Caracalla (211–217AD) he introduced double denominations that were only about 50% greater in weight.

During the 3rd century, the gold aureus was reduced sharply during the financial meltdown of 260-268AD and after that crisis the coin stabilized at 4.5 grams. However, double aureii were struck regularly weighing only 6.62 grams on average or about 50% greater in weight yet were twice the value showing it was not the metal content that determined the purchasing power. The monetary reform of Diocletian (284–305AD) around 301 AD, struck the solidus at 60 to the Roman pound (and thus weighing about 5.5 grams each) and with an initial value equal to 1,000 denarii, which had been reduced to bronze. The gold solidus was reintroduced by Constantine I (306–337AD) in 312 AD after he confiscated the wealth of the pagan temples. This denomination now permanently replaced the aureus as the gold coin of the Roman Empire. The solidus was struck at a rate of 72 to a Roman pound of pure gold, each coin weighing about 4.5 grams of gold. By this time, the solidus was worth 275,000 of the increasingly debased bronze denarii (once silver).

During the 3rd century, the gold aureus was reduced sharply during the financial meltdown of 260-268AD and after that crisis the coin stabilized at 4.5 grams. However, double aureii were struck regularly weighing only 6.62 grams on average or about 50% greater in weight yet were twice the value showing it was not the metal content that determined the purchasing power. The monetary reform of Diocletian (284–305AD) around 301 AD, struck the solidus at 60 to the Roman pound (and thus weighing about 5.5 grams each) and with an initial value equal to 1,000 denarii, which had been reduced to bronze. The gold solidus was reintroduced by Constantine I (306–337AD) in 312 AD after he confiscated the wealth of the pagan temples. This denomination now permanently replaced the aureus as the gold coin of the Roman Empire. The solidus was struck at a rate of 72 to a Roman pound of pure gold, each coin weighing about 4.5 grams of gold. By this time, the solidus was worth 275,000 of the increasingly debased bronze denarii (once silver).

Where the silver was debased, the gold was reduced in weight. Julius Caesar doubled the salary for the legionary soldier according to Suetonius prior to the civil war (Sueton. Jul. Caes. 26). After the Civil War and Augustus defeats Marc Antony, Suetonius tells us that Augustus appears to have raised the military pay to 10 asses a day (three times the original sum), or 300 a month, or 1200 in four months.

We even know how many legions Marc Antony and Cleopatra had in the battle against Octavian. Antony issued a denarius for each legion. At the time of Julius Caesar, a denarius was ideally 4 grams. The legionary denarii of Marc Antony weight about 3.8 grams. So we do not see any massive debasement given there were two civil wars back to back despite the fact that the money supply rose significantly to pay the troops.

We even know how many legions Marc Antony and Cleopatra had in the battle against Octavian. Antony issued a denarius for each legion. At the time of Julius Caesar, a denarius was ideally 4 grams. The legionary denarii of Marc Antony weight about 3.8 grams. So we do not see any massive debasement given there were two civil wars back to back despite the fact that the money supply rose significantly to pay the troops.

Here is the chart of the debasement of the Roman silver denarius. Note that the debasement begins with Nero (54-68AD). The reason for this was largely to cover the cost of government, which included the military.

Here is the chart of the debasement of the Roman silver denarius. Note that the debasement begins with Nero (54-68AD). The reason for this was largely to cover the cost of government, which included the military.

Now as the original amount of a solider’s pay had been tripled, the soldiers could not complain if the denarius were reckoned at 16 asses (bronze) in payments made to themselves, as well as other persons; and taking this value, the 1200 asses amount to exactly 3 aurei, or 3 × 400 asses. This sum then was considered as an unit, and called stipendium, being paid three times a year. Hence Suetonius says of Domitian raised the soldier’s pay (Dom. 7): “Addidit et quartum stipendium, ternos aureos”: a fact which Zonaras confirms (Ann. II. p196) otherwise expresses by stating, that instead of 75 drachmae (i.e. denarii) Domitian gave the soldiers 100, i.e. he made a pay raise of 25 denarii or 1 aureus to their pay.

Putting together the history of the world monetary system reveals that there is ABSOLUTELY no support for the idea that “helicopter money” creates inflation nor is it the cause of the decline and fall of a nation. That becomes the net result of a collapse in confidence FIRST whereas people then hoard money and do not spend it. The economy turns down and tax revenue also declines. Rome’s budget was effectively 80% taxes and 20% creating new money. As confidence collapsed, there was less and less to tax. People saved (hoarded) rather than spent and in the process the economy shrinks. This comes SECOND comes the “helicopter money” which emerges as tax revenues collapse. We will see this in the years ahead as social programs are cut and we see state and local government go bust. The ONLY source of funding becomes the creation of money. When government becomes strapped and can no longer sell their debt today, then the implosion unfolds. This is being furthered by central banks buying government debt which they can never resell. Then the entire system implodes.

Putting together the history of the world monetary system reveals that there is ABSOLUTELY no support for the idea that “helicopter money” creates inflation nor is it the cause of the decline and fall of a nation. That becomes the net result of a collapse in confidence FIRST whereas people then hoard money and do not spend it. The economy turns down and tax revenue also declines. Rome’s budget was effectively 80% taxes and 20% creating new money. As confidence collapsed, there was less and less to tax. People saved (hoarded) rather than spent and in the process the economy shrinks. This comes SECOND comes the “helicopter money” which emerges as tax revenues collapse. We will see this in the years ahead as social programs are cut and we see state and local government go bust. The ONLY source of funding becomes the creation of money. When government becomes strapped and can no longer sell their debt today, then the implosion unfolds. This is being furthered by central banks buying government debt which they can never resell. Then the entire system implodes.

There is a growing concern that the central bank is out of ammunition both in lowering interest rates as well as QE printing money. While many people will say I am wrong or whatever, they do not speak directly to people in central banks or to staff on the House Banking Committee – I do! Central Banks have even attended our World Economic Conferences. In fact, the Commission designing the Euro attended our 1997 Conference in London and took the entire back row. So I do not speak out of total speculation.

Right now, even in Germany, the Bundesbank is departing from the policies of the ECB and Draghi. The negative interest rates are becoming widely seen as undermining pensions. Here is the front cover of a German magazine warning that pension funds are broke thanks to negative interest rates.

I would NOT put it as 100% guaranteed that the Fed will engage in “helicopter money” buying government bonds. They are trapped. They know that. They may have no choice in the end, but that would be if government finds it cannot sell its debt. Do not expect the Fed to be the first to fall. They will be the LAST. We have the data. We have run the correlations. If someone wants to disagree, then ask for their data – not opinion or “I think” scenarios based upon assumptions and bias.

Monetary Unions – How Fast Can They Collapse?

QUESTION: Mr. Armstrong; Nobody seems to be able to answer this question. How fast would the Euro disintegrate if the EU appears to be on the verge of collapsing assuming Britain were to leave? There is a consensus that other states would then begin to also prepare referendums to leave. This question become paramount and you may be the only person with such a database to offer guidance other than just personal opinion.

Thank you for your consideration

KW

ANSWER: Our number one objective has always been to define time. The very reason we reconstructed the world monetary system, bought coins from around the world, and created the largest collection of Roman coins ever assembled was to answer the question – How fast did Rome fall? Was the collapse gradual like a 747 coming in for landing, or was it rapid like a waterfall? The answer that emerged we called the Waterfall Effect. You can see from the chart presented that the collapse took just 8.6 years out of one thousand. The decline and fall monetarily was extremely rapid once Valerian I was captured by the Persians in 260 AD, and his son Gallienus was finally killed in 268AD.

ANSWER: Our number one objective has always been to define time. The very reason we reconstructed the world monetary system, bought coins from around the world, and created the largest collection of Roman coins ever assembled was to answer the question – How fast did Rome fall? Was the collapse gradual like a 747 coming in for landing, or was it rapid like a waterfall? The answer that emerged we called the Waterfall Effect. You can see from the chart presented that the collapse took just 8.6 years out of one thousand. The decline and fall monetarily was extremely rapid once Valerian I was captured by the Persians in 260 AD, and his son Gallienus was finally killed in 268AD.

Skeptics who simply refuse to believe anything try to claim history was irrelevant because it was long ago and this time it is different. Every fool who buys government debt convinces themselves that this time is different and government will never end. Well, the Bretton Woods fixed monetary system came under pressure and collapsed in August 1971. When did the pressure begin? Hm. Well, it was about 8.6 years prior when Kennedy agreed to end silver in the coinage. That was 1963 and the last coin to be produced in silver was 1964.

How about the two-tiered monetary system in the U.S. whereby we minted U.S. Silver Dollars of a different weight from those minted for international trade? That system lasted a half-cycle or about 4.3 years. Some coins were produced until 1885, but less than 2,000 were minted compared to nearly 5 million annually between 1873 and 1878.

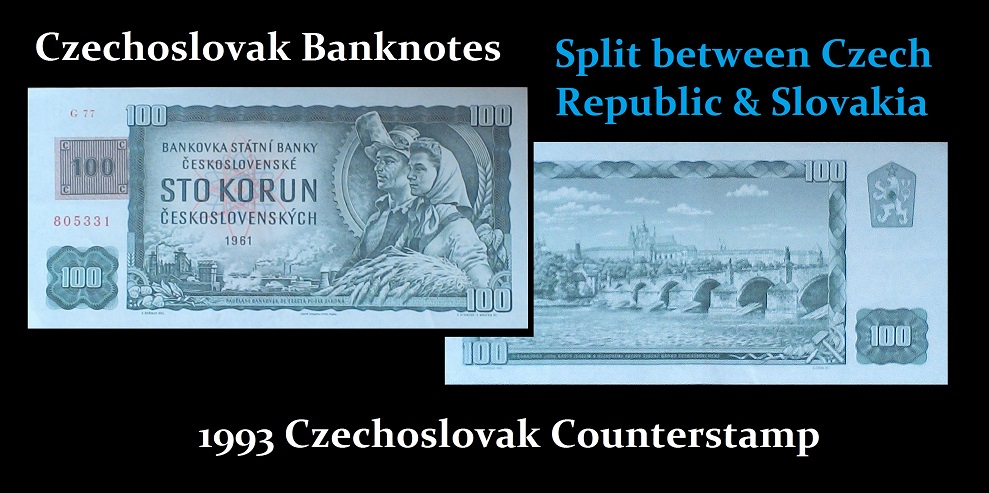

Pictured at the top of this article is a 1961 100 Korun banknote from Czechoslovakia with a 1993 Czech Republic adhesive stamp. In 1992, Czechoslovakia agreed to split into the Czech Republic and Slovakia. The split was to be January 1, 1993. They attempted to preserve a monetary and economic union. The monetary union was to last for 6 months. There was no effective means to really secure such a union among competing political interests. The monetary union collapsed, nearly perfectly in line with the pi cycle, and they were forced to end it in 33 days.

The note pictured above from our collection shows an adhesive stamp. The people in Slovakia feared what would happen and there was no confidence in the new state. Capital fled Slovakia to the Czech Republic since they feared that a Slovakian currency would lose its value rapidly. With a full capital flight in motion, the Czech Republic decided to split the currency on January 19, 1993, just 17.2 days into the system (2 x 8.6).

There were secret negotiations and a date was agreed upon for February 8. This was announced on February 2 and capital controls were imposed. The old currency was to receive a stamp, making it a new currency (as shown in the photo). The Czech Republic was to stamp the notes in circulation in its territory and Slovakia was to do the same in their territory. The people then drove from Slovakia to the Czech Republic with their currency to receive a Czech stamp rather than a Slovakian stamp. These notes were then replaced by their new currency in August of 1993. This incident proves that there will be a tremendous human reaction based upon who they think will survive. The neutral ground will be the U.S. dollar.

It does not matter what century we investigate. The timing always remains the same. Simply said, technology may change, but humans remain the same as we are driven by our emotions. Timing is about human confidence.

Did the Fed Create Cash or Debt with QE?

QUESTION: Mr. Armstrong; some people say you are wrong because the Fed did not create “cash,” but rather made more debt available through the QE process and whether people hoard money is irrelevant. I do not agree with this statement for the Fed clearly bought bonds, they did not create debt. It seems some people have completely got this all confused. Can you clarify this.

Thanks

ANSWER: This is a very strange question. I do not know how in the world someone can say the Fed created debt but not cash. The entire theory of QE was to increase the money supply in circulation by purchasing government bonds. That would inject cash into the system since the Fed does not and cannot create debt for it has no such borrowing authority. If they are saying the debt still increased because Congress always spends more each year that is irrelevant and cannot be attributed to the Fed creating debt. Then to say hoarding does not take place or is irrelevant is just unbelievable. I do not understand the reasoning.

The Fed bought in government bonds. The banks sold their bond holdings to the Fed and then complained that they would have no place to park their cash. They lobbied the Fed to pay 0.25% interest on excess cash parked at the Fed beyond their required reserves. The Fed accommodated the banks and defeated the entire theory of QE, which is in part why it did not create inflation as the banks parked (hoarded) the money at the Fed and never lent it out.

Here is a chart of the Fed’s facility they created to satisfy the banks. It stands at about $2.4 trillion. The Fed has the power to create money known as the elastic money supply, but it does not create debt. There were no excess reserves before QE. Instead of stimulating the economy, the banks themselves are hoarding the cash and not lending it out to the economy.

Corporations are also hoarding cash to such a point that they have engaged in a massive buy-back of their shares. This too is counter-trend to the entire idea of “stimulus.” Corporations reducing shares and handing back cash is deflationary and reduces assets.

Now let’s mix Europe into this madness. Why is Draghai unable to create inflation in Europe with his outrageous QE program and negative interest rates? The answer is very simple. There is no real confidence in Europe to borrow money to start any business. So what are the banks doing there? They are shipping money over to their U.S. branches, which must be part of the Fed system, and as such, they then park the money at the Fed and collect 0.25%. When rates are negative, they have a great spread and no risk. This is not something I made up or speculated. I have spoken with banks in Europe directly.

So normally I would not bother to answer such a frivolous question. This should be as simple as black and white. This is exactly what Bill Gross is hoping for; that the Fed will once again exchange bonds for cash and thus place a bid underneath the market that will support bonds. There are disagreements behind the curtain and it is not entirely certain if the Fed would attempt something they now realize failed. They just lucked out that the U.S. economy is in far better shape than Europe. This is why Yellen met at the White House and continues to say that interest rates have to be normalized. The central banks are trapped. Starting next year, the economy will turn down more aggressively. Yellen knows that creating more “helicopter money” by this QE program will not work. The very first thing she must do: shut down the excessive reserve facility that allows worldwide banks to park money at the Fed. Only then will the banks be forced to actually “stimulate” by lending money to real, live people to create something. That seems to be old school.

Goldman Sachs took investment banking and transformed the entire banking system from relationship banking to transactional banking. So now, normal banks think the way to do business is not to lend to real live people, but lend the money and then resell it to someone else. They have altered the face of banking forever. (I also sat on the board of a bank 30 years ago. When large loans were presented to the board, it was our decision whether to lend to that customer. Those days are gone).

Market Talk — May 6, 2016

A couple of rumors and some nerves ahead of the all important US Non-Farms Payrolls. In mainland China there were rumors that local regulators may want to delay mainland listings of mainland US listed Chinese companies. We will follow-up on this rumor when we hear more information. Shanghai index closed down 2.8% and the Shenzhen B closed down 3.6%.

Europe traded sub-par most of the morning ahead of NFP’s as the weakness in Asia tended to weigh on core indices. US number came in at 160k well below the market consensus of 202k and the rate was unchanged at 5%. Hourly earnings were a little better but the market was bound to focus on the headline number. The reaction was negative for stocks – where we were to hit session lows, Bonds loved the news and then currencies settled after the initial Dollar weakness. By close of business the USD had regained all lost ground and started to move ahead, whilst we saw bonds reverse all gains eventually trading down (price higher yield) on the day. Stocks decided they actually liked what they saw and by the close we back to unchanged. CAC was the only one of the core not to break back above par and closed down 0.5% on the day.

In the US the lows were hit just after the data release and then again around mid-morning trading but then spent the balance of the day recovering early losses and even managed to close up on the day. The DOW, S+P and NASDAQ all closed around +0.4% on the day which was said by many to show positive signs as it remains within its holding pattern.

We did see some weakness in the USD early in today’s session but by the close all that was a distant memory. With the Euro still flirting with the 1.1400 level and GBP closing near the days low (on rumors the BOE maybe tempted to vote for a rate-cut, the USD rout feels as though it has run its course.

US Treasuries were volatile but that is nothing new for a NFP’s day. Initially, bonds loved the headline print but as equities, Oil and the USD recovered the bond bounce run out of steam. The US curve saw weakness in the belly (5’s and 10’s) both closing 3bp higher on the day while the wings (2’s and 30’s) gained just 1.5bp. 2/10 curve closed +103.5bp. The European markets closed a little early for the late US rally so some of the spreads are out of whack but here are the European closes. Germany 10yr Bund closed 0.145% (US/Germany 10yr spread at +163.5bp. Italy 1.49%, Greece 8.16%, Turkey 9.63%, Portugal 3.29% and Gilts 1.42%.

The Subsidized Education & Health Care Disaster

QUESTION: Mr. Armstrong; What do you think about Bernie Sanders saying education should be free? Is this socialism or doable?

ANSWER:The two areas that constantly rise in price are education and health care. Both are a total disaster because the government subsidizes them.

Bernie’s idea of free education sounds nice. However, it will fail and constitutes Marxist socialism if it simply seeks to pay the educators and institutions their current price, as that would bankrupt the state completely. The idea is admirable. The only way to accomplish this is NOT to subsidize the current system. You must eliminate what the Clinton’s did to students and restore their right to file bankruptcy. Give them the right to sue a university if they cannot find employment with the degree they went to school for.

You have state-run universities. To inject competition, decree that whatever a parent or student pays for their education is tax-deductible from all taxation from Federal to local. If the educators must compete against the rest of government for their share of the taxes,costs will be kept in line.

Look at health care. In the 1980s, our company provided full health care to employees and their families. The cost was typically well under $2,000 annually. Obamacare made health care costs much higher. Whatever they name an act, the result is the opposite.

It sounds nice to provide people with free education, but that subsidizes the industry and eliminates the checks and balances needed to ensure it is in sync with the business cycle. It is insane that the only two industries that constantly rise in price against the trend are education and health care.

Can You be Forced to Incriminate Yourself With Your Phone of Computer?

The government is dancing between the raindrops. The 5th Amendment states that you cannot be compelled to testify against yourself. You have the right to remain silent. So how do they get around this? In my case, I personally was not held in contempt since that would have violated my constitutional right. Instead, the corporate officer was held in contempt, and since a corporation is not a person that right did not apply.

The bad news is that the government has held that anyone under investigation must submit a DNA sample, which they can then use to trace you or any member of your family who is suspected of a crime. Even worse is what courts have done with this regarding telephones. If you use a fingerprint scanner as a security feature on your computer or cell phone, they can trace it and throw you in prison until you do as the court demands because they regard any biological evidence as an exception. In other words, you are not being forced to testify against yourself. They are taking bodily evidence to find you guilty.

Now that measure may be acceptable in extreme cases such as rape. However, the government is simply using this to go after money. They need not even know that anything is on your phone. The mere fact that there might be evidence is sufficient to imprison you for life, without a trial, under civil contempt. Courts can and do order people to unlock their phones with their fingerprint. Providing a password is different from providing a fingerprint. So you might want to forget biotechnology for security. The legal implications are far different from a password.

Congressional Elections for 2016

While the media focuses on the U.S. presidential election, the real power is dangling in Congress. The 2018 election will be far more important as there is a risk of Independents sweeping into Congress at that time. For now, there is a total of 469 seats in the U.S. Congress (34 Senate seats and 435 House seats) that are up for election on November 8, 2016.

John McCain is already concerned that he may lose his seat because he has come out in favor of Trump. Actually, I say good riddance. McCain voted to impose taxes on internet commerce. When asked why he supported raising taxes, he replied that he was not voting to raise taxes, rather he was simply voting to collect taxes that should be collected. McCain is a hypocrite. There is no country he would not invade, including Canada.

The big story of the 2016 election cycle will be in Congress. The congressional election cycle will determine whether the Democratic Party will be able to regain control of the Senate. In order to take that chamber back, the Democrats will need to gain five seats in 2016. That may not sound like a lot, but it could be very difficult. Republican incumbents, not Democrats, hold the majority of the vulnerable seats. Consequently, Democrats only have 10 seats to defend in 2016, while 24 Republican incumbents are up for re-election. There is a shot that the Democrats could accomplish a victory.

The Democrats have been in a bearish trend since the Great Depression and have been making lower lows. Nonetheless, independents are turning up. The success of Bernie and Trump shows that the public is in a foul mood. As we begin to get closer to the elections, this should begin to flesh out, especially in August. We have to be concerned that August is often a time of civil unrest/war. So, we may begin to see activity rise at that time prior to the elections.

You do have a young (and over-the-hill) socialist movement against Trump. They actually claim this is some new form of socialism where you can give them more without robbing the rich. Very strange. They are throwing words around that Trump is a racist as they are doing in Britain against Nigel Farage. They are completely ignorant since “Muslim” is a religion and not a race. The benefit of being young is you can also be stupid.