We have a Special Room Block if you book directly with the Hotel

Join us at the 2016 World Economic Conference at the Hilton Bonnet Creek in Orlando, Florida!

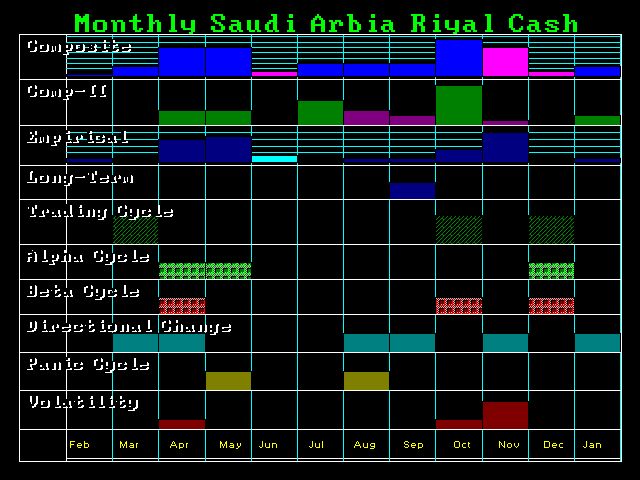

This year’s event will be a combination of training courses and forecasting Attendees with receive a proprietary tablet to take home. We will review world share markets, currencies, bonds, and commodities. We will discuss how to use the timing arrays and reversals as well as our risk model’s that provide an idea for trading options.

This year’s event will be a combination of training courses and forecasting Attendees with receive a proprietary tablet to take home. We will review world share markets, currencies, bonds, and commodities. We will discuss how to use the timing arrays and reversals as well as our risk model’s that provide an idea for trading options.

We will NOT be doing an introduction to the models this year. We will provide Day One of the 2015 Berlin Conference in Video format in advance for those to review ahead of the conference. This will allow our time to be exclusively forecasting world markets demonstrating how everything is connected and interdependent. We will be reviewing world share markets, currencies, bonds, and commodities going through each market reviewing the timing and reversals. Looking at the world collectively will enable you to see the trend as it emerges and acquire the CONFIDENCE to actually trade.

This year we will show you how to simply step in and out of markets in an orderly fashion while allowing the market to be your guide. Eliminating personal opinion is the ultimate goal to be a successful trader for the markets themselves are never wrong. This conference is designed to help you become a professional investor and beat the odds that most people lose because they cannot escape from their emotions fueled by the sophistry of the moment. CONFIDENCE is the key. Once you can see how the world functions, you can survive the turmoil that lies ahead. Without that understanding, you will not attain the level of CONFIDENCE necessary to survive the future.

We will be hosting two back-to-back conferences with a day of technical analysis in between. The first day (Thursday, Nov. 10) will begin our Institutional World Economic Conference that will focus on global correlations, currency based asset allocations and international indices. This session will be separate so we can deal with issues for global portfolios and how to strategically survive the interest rate crisis and the under-funding nightmare for pension funds. How will insurance companies cope with claims cross currency? These and other professional questions will be addressed. There will also be included an Institutional dinner for a meet and greet event.

We will be hosting two back-to-back conferences with a day of technical analysis in between. The first day (Thursday, Nov. 10) will begin our Institutional World Economic Conference that will focus on global correlations, currency based asset allocations and international indices. This session will be separate so we can deal with issues for global portfolios and how to strategically survive the interest rate crisis and the under-funding nightmare for pension funds. How will insurance companies cope with claims cross currency? These and other professional questions will be addressed. There will also be included an Institutional dinner for a meet and greet event.

The second day of the event (Friday, Nov. 11) will be dedicated to our proprietary form of Technical Analysis Training Course. This will be a key training course where you will be learning how to identifying trends, charting trends, and analyze channels analysis. Institutional clients may choose to attend one or both days of the session (see below for more information). We will be using the Socrates platform to conduct this session so you can see technical analysis in its true form – mathematics. Instead of guess where support and resistance rests, we will be demonstrating the difference precision analysis makes in help you to see the trend at a glance.

The second day of the event (Friday, Nov. 11) will be dedicated to our proprietary form of Technical Analysis Training Course. This will be a key training course where you will be learning how to identifying trends, charting trends, and analyze channels analysis. Institutional clients may choose to attend one or both days of the session (see below for more information). We will be using the Socrates platform to conduct this session so you can see technical analysis in its true form – mathematics. Instead of guess where support and resistance rests, we will be demonstrating the difference precision analysis makes in help you to see the trend at a glance.

The general 2016 World Economic Conference will begin on Saturday, Nov. 11, and will feature an introductory workshop that will discuss how to trade markets. We will be providing a workshop on using Reversals and Array Analysis using Socrates. Once you understand the basic model, you can apply the same system to any market in the world.

The general 2016 World Economic Conference will begin on Saturday, Nov. 11, and will feature an introductory workshop that will discuss how to trade markets. We will be providing a workshop on using Reversals and Array Analysis using Socrates. Once you understand the basic model, you can apply the same system to any market in the world.

We will also be reviewing the Global Market Watch and how that provides yet another layer of analysis employing Pattern Recognition. The exciting introduction of this system establishes that all markets trade creating the same patterns be they stocks, bonds, commodities, or general data trends.

The second day of the 2016 World Economic Conference will focus ONLY on forecasting world share markets, currencies, fixed-income and commodities based on individual markets. We will be reviewing each of the main markets going over the reversals and timing arrays. In this manner, you can see the entire world and how everything is connected. There will be NO historical introduction this year. That will be provided by a video link for everyone to watch prior to the conference so we do not waste time of others who have attended before.

There will also be included our famous World Economic Conference Cocktail Party. This has been touted as the international event for networking. This will be held as part of the weekend 2016 WEC.

Pricing and Packages:

- Institutional World Economic Conference (Nov. 10) and Technical Analysis Seminar (Nov. 11): $5500

- Institutional World Economic Conference Only (Nov. 10): $4000

- Technical Analysis Seminar Only (Nov. 11): $2000

- Technical Analysis Seminar (Nov. 11) & World Economic Conference (Nov. 12-13): $4000

- World Economic Conference (Nov. 12-13): $2500

Ticket prices include breakfast, lunch, pre-conference materials, a proprietary tablet, and a collector’s mug.

Schedule:

Location: The Hilton Bonnet Creek in Orlando, Florida

Please note that you are responsible for booking your hotel accommodations. Upon completing your purchase, you will receive a confirmation e-mail containing a group discount code for the Hilton Bonnet Creek.

Institutional World Economic Conference with Martin Armstrong (Thursday, Nov. 10, 2016, 9:00 AM to 5:00 PM)

- The Institutional World Economic Conference will center on timed, global investment currency allocation.

- The conference will include projections for world share markets, currencies, as well as the fixed-income and commodities markets.

- Dinner with Martin Armstrong (time TBA)

Technical Analysis Seminar with Martin Armstrong (Friday, Nov. 11, 2016, 9:00 AM to 5:00 PM)

- Learn how to identifying trends, chart trend lines, and analyze channels.

- This seminar will also provide an advanced analysis of the arrays.

World Economic Conference (Saturday and Sunday, Nov. 12-13, 2016)

Day 1: Introductory Workshop & Socrates Training hosted by Erwin Pletsch (time TBA)

- Learn how to use the forecast arrays, reversal system, Global Market Watch, and indicating ranges.

- This session will provide an overview of Socrates, including how to navigate and trade with Socrates.

- Cocktail reception (time TBA)

Day 2: Market Forecasting with Martin Armstrong (9:00 AM to 5:00 PM)

- In this session, Martin Armstrong will forecast the world share markets, currencies, fixed-income and commodities based on individual markets.

To purchase a ticket, please visit our “conferences“section. If you have any additional questions, you may contact us at [email protected].

I should point out that these fundamentals tend to apply only to the investing class. I remember 1981 when interest rates reached their peak. My mother and her sister went out and bought bank CDs at 20% for 10 years. They did not ask me. They made the decision on their own and said they would never see that much interest again. They are countless others changes the trend and made that peak in the Public Wave 1981.35. This class of people act out of common sense and do not listen to the fundamentals applied in the investing class. This is the real group of people who are the movers & shakers. The rest of us are trying to figure out what they are doing. Keep in mind that within the investing class, they always try to assign some fundamental to explain something. Everyone wants to know WHY. I named by debut report on the ECM back in 1979 – “WHY”.

I should point out that these fundamentals tend to apply only to the investing class. I remember 1981 when interest rates reached their peak. My mother and her sister went out and bought bank CDs at 20% for 10 years. They did not ask me. They made the decision on their own and said they would never see that much interest again. They are countless others changes the trend and made that peak in the Public Wave 1981.35. This class of people act out of common sense and do not listen to the fundamentals applied in the investing class. This is the real group of people who are the movers & shakers. The rest of us are trying to figure out what they are doing. Keep in mind that within the investing class, they always try to assign some fundamental to explain something. Everyone wants to know WHY. I named by debut report on the ECM back in 1979 – “WHY”.

This year’s event will be a combination of training courses and forecasting Attendees with receive a proprietary tablet to take home. We will review world share markets, currencies, bonds, and commodities. We will discuss how to use the timing arrays and reversals as well as our risk model’s that provide an idea for trading options.

This year’s event will be a combination of training courses and forecasting Attendees with receive a proprietary tablet to take home. We will review world share markets, currencies, bonds, and commodities. We will discuss how to use the timing arrays and reversals as well as our risk model’s that provide an idea for trading options.