QUESTION: Mr. Armstrong, I have listened to the gold propaganda and believed in it initially but with time they always say the same thing and nothing happens. One would think that this helicopter money should have produced inflation. This effort has failed as Japan and Europe keep moving negative punishing people for not spending. Now it seems that Americans are also starting to save more and spend less. Do we need reinflation and can government even tackle such a task?

Thoroughly confused

Thank you for your efforts

SJ

ANSWER: Governments have been pretending they can control the economy ever since Roosevelt adopted Marxism. The root of our problems lies directly in this idea that government can steer the economy as it desires. The rise of Trump and Sanders proves that something is wrong beneath the headlines.

There is a growing awareness today that the financial markets are beyond the control of national policymakers. We are even beginning to hear people in the business saying that publicly. While a few economies do have the scale to shape interconnected global markets with trade barriers, etc., they face serious constraints in doing so, not to mention political and economic consequences. As a result, the global economy is stuck in a declining financial cycle with few options for escape.

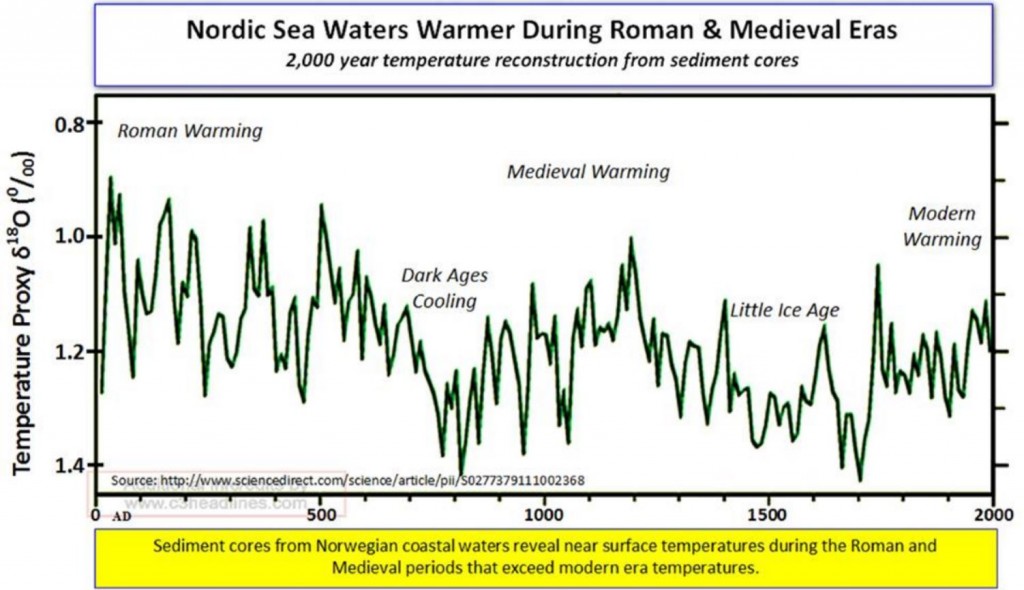

This idea of helicopter money is poorly constructed and assumes that the quantity of money is the explanation for inflation. There is no historical evidence of that proving to be true. The Roman Empire funded its budget on a general mix of 80% taxes and 20% through the creating new money. This did not result in 20% annual inflation.

This idea of helicopter money is poorly constructed and assumes that the quantity of money is the explanation for inflation. There is no historical evidence of that proving to be true. The Roman Empire funded its budget on a general mix of 80% taxes and 20% through the creating new money. This did not result in 20% annual inflation.

Look closely at the chart above. The sharp collapse takes place because Maximinus I (235-238AD) declared war on the rich. He simply declared that all their wealth was his and paid informants to report on anyone they thought had unreported money. This set off a deflationary wave as we have today with people hoarding money and not spending, which is causing investment to collapse. Once this was set in motion, the finances of the state could not be met because there was a declining trend in tax revenues. Every study shows that the more you raise taxes, the lower the GDP. Yet to this day, politicians cannot keep their hands out of other people’s pockets, which typically results in rapid debasement to try to meet expenses. Maximinus’ army was allowed to sack any Roman city that did not support their choice for emperor. This is like unions demanding to tax other people to pay for their pensions.

The final straw came when the Roman Emperor Valerian I (253-260AD) was captured by the Persians and turned into a royal slave to diminish the importance of the Roman Empire. The coinage still appeared to be silver until Valerian I was captured in 260 AD. From there in just 8 years the coinage collapsed to bronze silver plated.

The final straw came when the Roman Emperor Valerian I (253-260AD) was captured by the Persians and turned into a royal slave to diminish the importance of the Roman Empire. The coinage still appeared to be silver until Valerian I was captured in 260 AD. From there in just 8 years the coinage collapsed to bronze silver plated.

The capture of the emperor sent shock waves through the population and revealed that the Roman Empire was vulnerable after all. Once that took place, people hoarded wealth and spent very little. Taxes collapsed. This is caused the government to debase the coinage to meet expenses rapidly under his son Gallienus (253-268AD) in the subsequent 8 years (8.6 frequency).

It is NEVER the other way around where debasement takes place first and then inflation appears. This is simple propaganda that the promoters keep touting. The cause of such a monetary system collapse is not helicopter money at all, it is the collapse in public confidence. We see such a trend in the decline of public confidence that is rising with Trump and Sanders, as well as people starting to talk about the central banks losing control. The helicopter money is the RESULT of the collapse in public confidence, not the CAUSE of such events. So claiming a central bank is increasing the money supply and that will result in inflation is not ready for prime time. Such a scheme is the same as AIDS, where a person’s immune system collapses and causes them to get sick and die from typically non-fatal ailments like the flu. Was it the flu that killed the person of was it AIDS?

Paul Volcker in his “Rediscovery of the Business Cycle” amazingly spoke the truth back in 1979. He stated that behind the curtain they have always known they lack the power to control the economy. Even Larry Summers admitted that they cannot forecast the economy. This is a CONFIDENCE game – nothing more. How can you manipulate something you do not understand? Volcker made is very clear back then:

“Not much more than a decade ago, in what now seems a more innocent age, the ‘New Economics’had become orthodoxy. Its basic tenet, repeated in similar words in speech after speech, in article after article, was described by one of its leaders as ‘the conviction that business cycles were not inevitable, that government policy could and should keep the economy close to a path of steady real growth at a constant target rate of unemployment. … By the early 1970s, the persistence of inflationary pressures, even in the face of mild recession, began to flash some danger signals; the responses of the economy to the twisting of the dials of monetary and fiscal policy no longer seemed quite so predictable. But it was not until the events of 1974 and 1975, when a recession sprung on an unsuspecting world with an intensity unmatched in the post-World War II period, that the lessons of the ‘New Economics’ were seriously challenged.”

One can only laugh at these promoters and how they say I am wrong, yet they have never been behind the curtain and make up wild conspiracy theories to explain why they have been wrong. It is always someone else’s fault – never their thinking process. Undermine public confidence and everything collapses. Helicopter money will not collapse the economy and the hyperinflation of Germany and Zimbabwe were indicative of a collapse in public confidence to such an extent that nobody would lend those governments anything. The German republic was a communist revolution. The rich withdrew their money from the banks in Germany and sent it elsewhere. We are not in such a situation and the hyperinflation will never appear in the core economy – only peripherals. This is like saying everyone is starving in a third world country so the USA will have to do the same. They fail to consider a host of variables. These people base all this nonsense on this wrong interpretation that the supply of money dictates inflation. There is a lot more to this than that superficial one-dimensional perspective. If that was even remotely correct, then QE should have worked instantly. It has failed along with their theories.

One can only laugh at these promoters and how they say I am wrong, yet they have never been behind the curtain and make up wild conspiracy theories to explain why they have been wrong. It is always someone else’s fault – never their thinking process. Undermine public confidence and everything collapses. Helicopter money will not collapse the economy and the hyperinflation of Germany and Zimbabwe were indicative of a collapse in public confidence to such an extent that nobody would lend those governments anything. The German republic was a communist revolution. The rich withdrew their money from the banks in Germany and sent it elsewhere. We are not in such a situation and the hyperinflation will never appear in the core economy – only peripherals. This is like saying everyone is starving in a third world country so the USA will have to do the same. They fail to consider a host of variables. These people base all this nonsense on this wrong interpretation that the supply of money dictates inflation. There is a lot more to this than that superficial one-dimensional perspective. If that was even remotely correct, then QE should have worked instantly. It has failed along with their theories.

So do we “need reinflation? Yes, absolutely. But this implies a restoration of public confidence which cannot be compelled by punitive measures such as negative interest rates. To reinflate requires restoration of public confidence, and you do not achieve that by blaming the rich and hunting money by expanding the abuse of civil asset forfeiture. People will hoard money when they do not see the future as stable. You cannot force people to do what is unreasonable. So deflation is here for the moment; 2015.75 was the peak in the economy and we are in a full-blown recession. It takes economists almost a year to concede that there is a recession because they cannot forecast the business cycle. When the general public (not investors) realize it is hopeless to expect government to save the day, then public confidence will completely collapse and we will be off to the races.

This is what the Economic Confidence Model is all about – forecasting the economy. You will see a USA recession. It takes 7 to 8 months from such a turn as 2015.75 to confirm a downturn by traditional methods. They define a recession by two consecutive quarterly declines. Ironically, economists do not want to forecast a recession is coming for they too know this is a confidence game.

This is what the Economic Confidence Model is all about – forecasting the economy. You will see a USA recession. It takes 7 to 8 months from such a turn as 2015.75 to confirm a downturn by traditional methods. They define a recession by two consecutive quarterly declines. Ironically, economists do not want to forecast a recession is coming for they too know this is a confidence game.

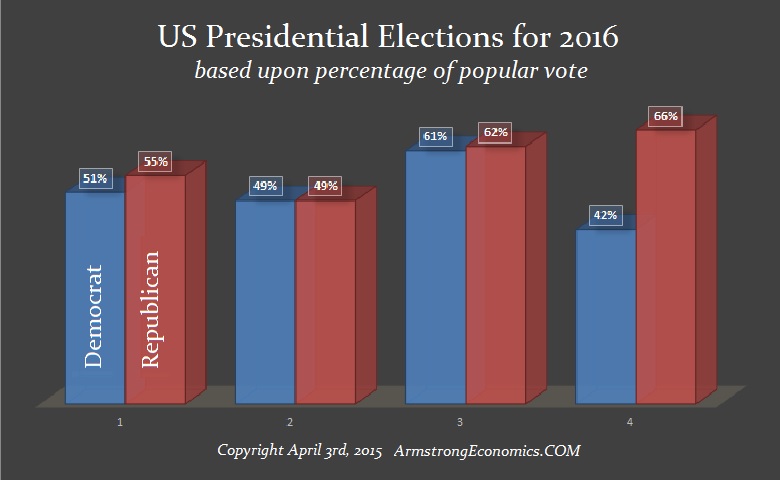

Hillary is the prime example of total bullshit and using a standard playbook that never works. She is promising to raise taxes, fight Wall Street (her biggest donors), and increase spending. Just how is this ever going to work? There is nothing different from what Hillary says and what central bankers are doing. Sorry, the business cycle wins. Simple as that. Nobody can stop the rediscovery of the business cycle. If those in government understood the business cycle instead of fighting against the wind, then the best we could do would be to reduce its amplitude so the landings are not so hard and steep. We cannot make it sunny when there is nothing but rain. Increasing the money supply will NEVER produce inflation if people save (hoard) and do not spend. Pictured here is an Arab dinar hoard proving that not even culture alters human nature. If you do not have confidence in the future, you will not spend. Therein lies the understanding and creating piles of money that are absorbed and hoarded does not result in inflation. A collapse in public confidence, causes everything falls apart.

“The Forecaster” will be shown this year at the

“The Forecaster” will be shown this year at the