QUESTION: Marty, you have said since the S&P 500 and the NASDAQ took out last year’s low and the Dow did not, it does not necessarily imply the Dow must do so since it is international compared to the others being domestic. You said that crude had to close below $35 at year end or it would bounce. That too has unfolded. You also said the euro “should” rally back to retest the 116 level before resuming a decline. You have taught us inter-connectivity and to approach a market from the yearly level on down. You have shown us turning points, and period of high volatility and your reversals are astonishing, very to the point and black and white. Do you think it takes a non-linear thinker to grasp how all this functions? Some people seem dense and no matter what you say they will always disagree. So is it the non-linear ability that makes a good trader? The difference between your caveman and a real analyst?

Cheers

PD

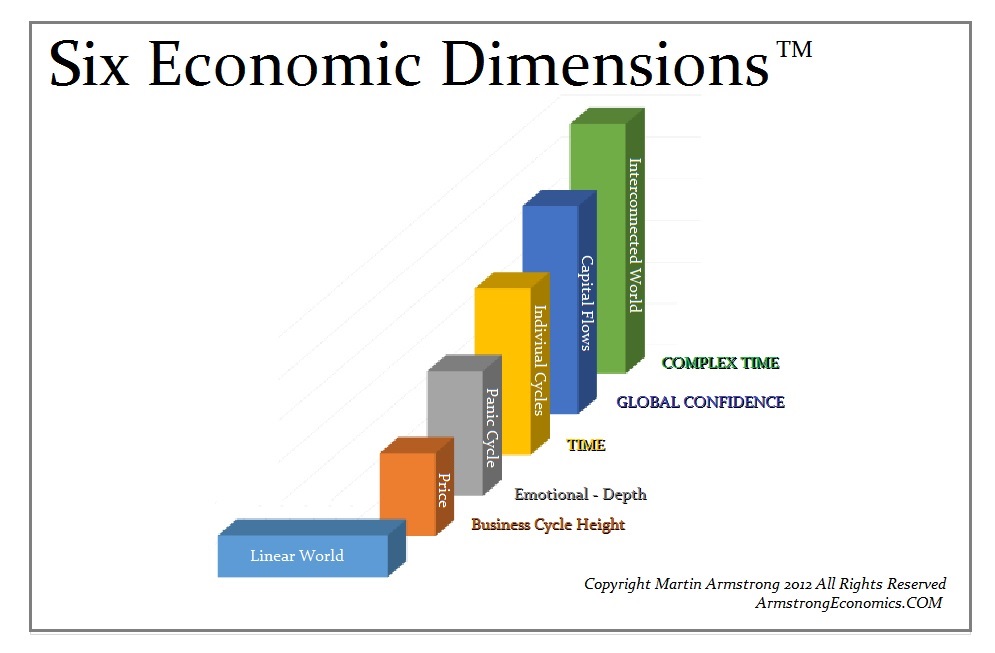

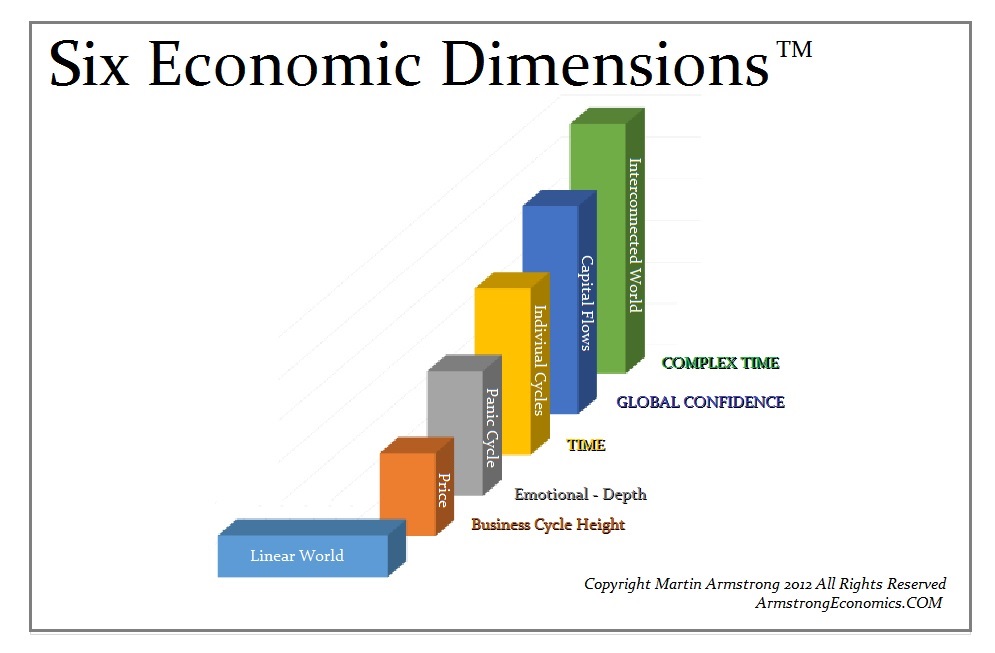

ANSWER: Primitive analysis is unable to see outside one dimension. I suppose there are people who can only see a straight line. That one-dimensional observation limitation typically condemns them to government employment or they become a follower. True, no matter what you show them they will not be able to grasp the substance of what you are saying. So it is pointless to try to argue with such people for you cannot win. It is like a diehard Democrat or Republican. No matter what you show them, they are unable to see beyond their own bias and typically repeat the brainwashing of that affiliation.

Honestly, I cannot recall how many times I have stated the markets are both interconnected and fractal.The daily level is the “noise”, while the trend emerges only starting with the weekly level insofar as reactions. The long-term trend shifts only from the monthly level on up. It does not get interesting until you start to elect weekly reversals.

The Dow is like the trophy real estate. The Japanese once bought Rockefeller Center. The Chinese today buy the most expensive properties in U.S. real estate whereas the Canadians are the number one buyer in terms of the quantity of properties. In stocks, this is the difference between the Dow compared to S&P 500 and the NASDAQ. You can have a high-flying stock on NASDAQ and the Chinese would never buy it because nobody there has ever heard of the company in mainstream. So the Dow NOT penetrating last year’s low is in line with the difference between international capital flows and domestic. The very first Weekly Bullish Reversal does not come into play until the 17750 zone. This wide gap illustrates how far a market can rally WITHOUT actually changing the trend in motion.

We will probably have workshops at this year’s WEC, which we are considering expanding into a four-day event. So the pros are not suffering from boredom if you only want to attend the professional sessions of analysis. We have not finalized the dates or location for the 2016 WEC, but we will make an announcement once we have more information.

To me, the system is logical and simple, but I am a trader from my youth. Here is just the Daily Reversals without using them in reverse or merging with TIME. We are still porting this over for the Trader Preview version (only available to 2015 WEC attendees) for testing. Most of the verbiage has been corrected and the last three months of work there will be moved over to the Trader Preview and Investor sites next week.

Here, you can see that the Daily Reversals capture the “noise.” If we then turn to the Weekly level, we elected the first four bearish from the May high and that signaled a serious correction, which confirmed what the timing models forecast. The Dow fell and stopped at 15370, whereas the previous year’s low was 15340. The Weekly Bearish resided at 15362 and the technical support was 15176.26. We also warned that August had to close below 15555 to spark a sharp continued decline. We are able to define the lines in the sand. To use the reversals in the negative, you would simply cover shorts at such a level and reenter it if these areas are broken. This time, they all held. The Daily Bullish was elected within seven days. Therefore, there was no reason to have a short position any longer. You should have covered against the previous year’s low and reentered to penetrate 15176 intraday or close weekly below 15362. Let the market do its thing.

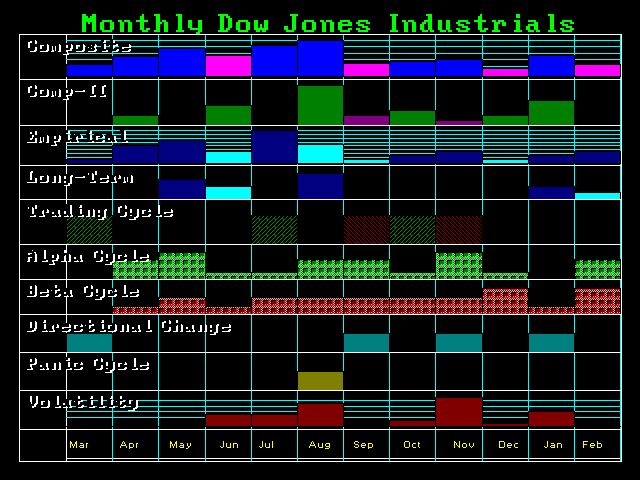

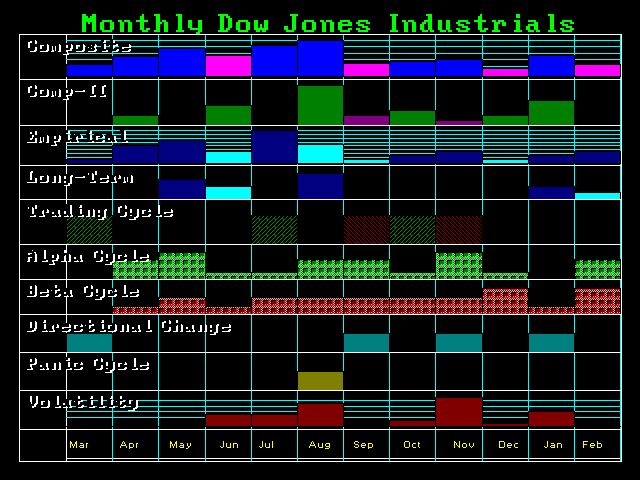

Now we approach the 17750 level, which is the FIRST Weekly Bullish. So, you step out of any long position and reenter a long position if that level is exceeded on a weekly closing basis, but we still have to be careful that 18100 is exceeded or step out again (see quarterly). This week is a turning point for they are the lowest and the highest bars in the top row of the array. We have a Panic Cycle coming into play next week and another turning point on the week of March 28 with a Directional Change the week after. So the timing is warning that we are starting to push the limits. The prudent thing is step out and let the market make the call. We have the time and price. Just let the market tell you. This is where using the reversals in a NEGATIVE manner comes into play.

To grasp the strategy, we start with the yearly level in this fractal dimension. We see that 2017 is a key target. We also know that reactions are two to three time units. We also know that the strongest way markets make moves is through a slingshot. So, if we fail to get through resistance and cannot close on a weekly level above 17750, there is nothing to get excited about. We can still flip to the downside and penetrate that low going into 2017 to complete a two-year reaction and then flip to the upside into 2020.

We then turn to the quarterly level. We had a Directional Change for the first quarter of 2016, so a bullish reaction for the first quarter was not unusual. Here, we have a Quarterly Bullish at 18106, so we can see that is some distance to cover for the March closing when that comes into play. Assuming we did test that level during the remainder of March, we look to the What-If models to ask what the Quarterly Bearish would be if we reached that level and failed. That returns 17575, so you can see that the bearish reversals are rising rapidly, which warns that we either breakout or breakdown. Since we are running out of time, more likely than not we will head lower rather than higher.

Now, we turn to the monthly level in the fractal game. Here we can see a Directional Change and turning point have been elected in March followed by May, and then we have August with a Panic Cycle. Interesting pattern of Directional Changes spread out into January. The big turning point on the empirical (fixed) quarterly level is the first quarter 2017 with some spillover into the second quarter.

Professionals do not want the nonsense. Keep it black and white. You have turning points and reversals. You elect one and you move to the next. The turning points tell you how long you have in time. Here, is the reversal set up for the 1987 and 1989 major highs in the S&P 500. In the case of 1987, it was a Friday and we elected both the Weekly Bearish Reversals.

We had two Weekly Bearish at 286.10. We closed that week at 282.30. That was the weekend of a World Economic Conference. I stood on that stage trying to find some technical support before the next reversal at 181.00; I could find nothing. The arrays gave us a turning point in two days. That was the precise day of the Economic Confidence Model.

Everyone was asking me what would happen. All I could say is look, we have a gap of about 10,000 basis points and the timing is two days. That is what this says. Do I think it is crazy? Of course. But I said, hey, that’s what it is telling us. Then the day of the low, I put out an urgent report saying the objectives were met and we would then make new highs — the “slingshot” that follows as it did from 2009. The gap for the 1989 turn in the USA was nothing. The crisis would be in Tokyo. We simply dropped from the 345 level to 323.

The model shows you the TIME and PRICE. You simply have to look at this layer by layer. I warned gold was NOT as weak as it appeared because it held the 1045 level for the year-end closing. Crude held the $35. These things do not happen randomly. The market speaks to us if you are not one of those linear thinkers. The negative people will get what they deserve — a total wipeout as they always do historically.

Fundamentally, 2017 is the year from political hell. The Republicans will no doubt change the rules of the convention to try to stop Trump. They figure this will blow over, but they are dead wrong. To stop Trump they will need to expose that the American people have no real right to vote at all. It is always the “elite” who determine who is president. Europe is finding out that the Troika (Lagarde, Draghi, and the head of the Commission) were not elected. There is no means to vote these people out of power. Americans are about to discover that they vote only for delegates, not actual candidates, and have been bullshitted for years. The rules they made to prevent Ron Paul’s name from even being introduced at the last Republican Convention are coming back to bite them in the ass. That means only Trump’s name could be introduced. So, they will change the rules to stop him since they can change the rules to do as they like. There is no rule of law here. We are looking at a collapse in CONFIDENCE that has existed in government since World War II. The game is over and this is what we must grasp lies on the horizon for 2017. The markets are trying to warn us here, so pay attention. Once we expose the truth in politics, confidence in government will come to an end and that will manifest in the shift from PUBLIC to PRIVATE investment.

It does get very frustrating when people who do not understand the markets or how they move constantly criticize you. They lash out and are so ignorant that you cannot have a conversation with them because it goes over their head. There are people who are always going to be negative because this is personal to them. Just as they treat Trump, they will bad mouth me to try to PREVENT people from learning or using the model. This is their goal. The more negative they get, the more their prejudiced agenda is exposed. Such people make me ask question why the hell I care. I should just retire since I do not need the grief or the money. At the very least, I will bar such people from subscribing to anything. They make me feel like I should just go find that beach and just wait for the mushroom cloud to appear, which will be like having your home fumigated. Only then we will come out when it has been wiped clean and humanity gets a fresh start. They are the worst of humanity; the real bottom feeders who are typically politicians and high-ranking members. They contribute nothing to society and are only in the game for themselves. So they try to prevent others from learning what they are incapable of seeing. If they cannot figure this model out, then nobody else should.

Then I realize just judge the source. Such nasty people are incapable of learning because they constantly want to blame others for their own stupidity, which typically goes hand in hand with the non-linear thinking process. The solution is to bar them from subscribing to any service or attending any conference on my part since it is a waste of time and they do not seek to learn but to criticize. They are the very type of people who stop any advancement in society for anything they do not instantly understand must be garbage and a piece of shit. They are really the people who destroy civilization for they are the cancer that compels us to repeat history over and over again. They are of the same type that burned Bruno alive at the stake for daring to say that the Earth revolved around the Sun. It does not matter if they are incapable of comprehending a model or anything else in society. They will tear something down to prevent any advancement, which leaves them and society behind.

Like the Republican elite, they conspire in secret meetings to prevent anything new to protect their idea of the status-quo. Insofar as trading, these sorts of people are incapable of ever becoming a professional trader for as soon as you declare yourself all knowledgeable, you cannot learn from your experience and you are incapable of helping society ever advance. The key to trading is to be flexible and go with the flow. The markets are NEVER wrong; only the trader can be wrong. If you cannot learn from the market, you cannot trade. The market speaks to us. It reveals the future if you comprehend its language. The model I designed allows us to quantify what markets are saying. It is very black and white. This is not OPINION or what I think should happen. I have nothing to do with that forecast. So they can bash me all they want, but they are the ignorant fools who are incapable of learning. They always blame other people for their own ignorance. So it does seem to go with the linear thinking process which is like that horse pulling a carriage with blinders on so it can only see straight ahead.

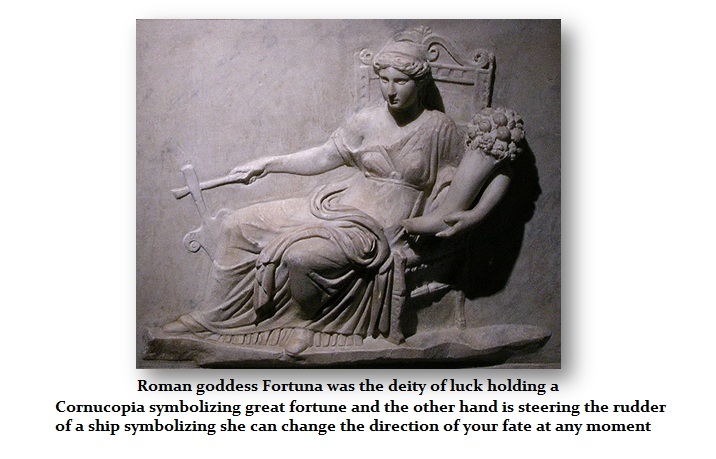

There is a beat to this whole thing we call the economy. If you are still going to wallow in single market perspective and soak up the fundamental nonsense, then good luck in life. Enjoy what you have now, for you will not have much left in a few years. You have come to the wrong blog if that is your expectation. This is a place to learn and expand your mind, not look for some guru. If your eyes are opening, there is a whole new world to explore just waiting to be discovered. Welcome to how everything really functions. It is a pendulum that swings back and forth between bulls and bears. Life is a learning experience. Enjoy it. Knowledge is the most EXPENSIVE thing we have. Why? It takes mistakes to acquire it.

There is a beat to this whole thing we call the economy. If you are still going to wallow in single market perspective and soak up the fundamental nonsense, then good luck in life. Enjoy what you have now, for you will not have much left in a few years. You have come to the wrong blog if that is your expectation. This is a place to learn and expand your mind, not look for some guru. If your eyes are opening, there is a whole new world to explore just waiting to be discovered. Welcome to how everything really functions. It is a pendulum that swings back and forth between bulls and bears. Life is a learning experience. Enjoy it. Knowledge is the most EXPENSIVE thing we have. Why? It takes mistakes to acquire it. We each have our role in society and in nature. The rich and the poor are part of the whole. This idea that everyone must be “materially” equal I have noted even violates the Ten Commandments. In nature, one species preys upon another. It may be horrible to watch, but you cannot pass a law to make it all fair and nice in nature. So why do we think we can do that among ourselves?

We each have our role in society and in nature. The rich and the poor are part of the whole. This idea that everyone must be “materially” equal I have noted even violates the Ten Commandments. In nature, one species preys upon another. It may be horrible to watch, but you cannot pass a law to make it all fair and nice in nature. So why do we think we can do that among ourselves?