QUESTION: Mr. Armstrong : Since you have deep knowledge about coins and currencies going back to ancient times, it would be really helpful to get your view of what Bitcoin is or could be as a sort of “World Currency”. Is it a fad or something that should be taken seriously?

Thank you – BH

ANSWER: No, Bitcoin can never become a “world currency” for it is highly questionable whether or not any electronic form of money can become a true “world currency” when more than half the world does not even have a bank account. This is why Europe declared it a right to have a bank account when in fact they are really saying it is mandatory. Call it a “right” and everyone wants a “right”; call it “mandatory” and they see it as authoritarian. This is the oldest game in town. Do you buy LIFE INSURANCE to cover you if you live forever? Or is it DEATH INSURANCE in case you die early? Try selling DEATH INSURANCE and they will hang the phone up.

The reason the paper U.S. dollar is a “world currency” is because it is recognizable. You will accept it in exchange ONLY because you know someone else will take it from you. One of the reasons Bitcoin has become popular is that people have wrongly assumed the Fed creates money at free will and that the money supply should not be in the hands of the banks. This reasoning shows naivety for the Fed can create elastic money and buy assets, but those assets ultimately mature and expire. They attribute all our problems to central banks and totally ignore the fact that Congress creates the money with new debt that reverts to money, which simply pays interest as it did in the 1860s to convince people to accept it. When government bonds could not be used as collateral to borrow against, then it was less inflationary to borrow than to print. That changed in the 1970s, so note there is no difference between borrowing or printing except borrowing creates more money because we have to pay the interest.

The story about the Dutch buying Manhattan from the Indians for some strings of beads and trinkets worth $24 has been a popular piece of trivia. Actually, in the Dutch National Archives, the only known primary reference to the purchase of Manhattan island is a letter written by Dutch merchant Pieter Schage, dated November 5, 1626, written to directors of the West India Company. This was in reference to the settlement of “New Netherland” and New York was first named New Amsterdam. In this letter, Schage writes, “They have purchased the Island of Manhattes from the savages for the value of 60 guilders.”

The guilder was essentially a one-ounce silver coin of .885 fineness. Beads to us seem like a scam, but to the American natives this was money. To the ancient Chinese, cowrie shells were money. Both cases, beads or shells actually come from the same branch as gold and silver – the desirable luxury line of value.

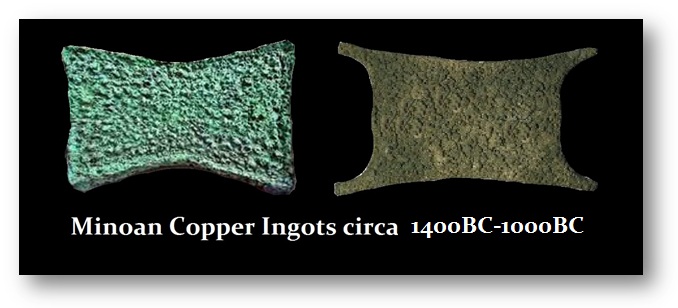

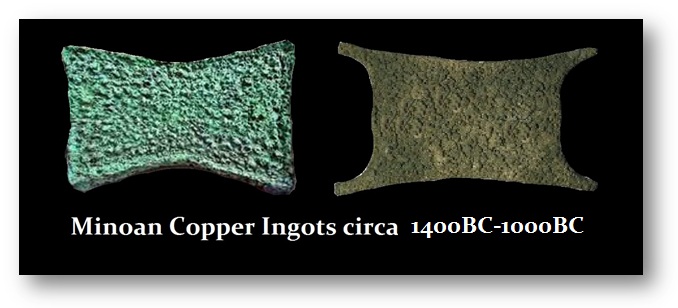

The second branch of money is the more practical avenue where the object must have some utilitarian value. For example, this was what we call the “Bronze Age” precisely because the Minoans traveled the seas and money became bronze ingots. Bronze was the next step up in that utilitarian branch that evolved from food and then clothing. Note the shape of these bronze ingots. They are imitating the previous universal form of money in the practical utilitarian branch, like sheep skin for clothing. The four points symbolize the four legs.

Gold and silver have no practical value. They, like shells and beads, come from the “luxury” branch where the object is simply desirable. Gold became prized because it was seen as the tears of the sun. Until it was widely discovered, only royalty could possess gold. We see it in the form of royal use in Egyptian coffins to royal cups in Greece. As gold became more common, then it moved down through the classes to become accepted as a commodity in trade.

The earliest form of money in Rome was simply lumps of bronze. Eventually, this became standardized by weight to save time in calculating how much metal one had for each transaction. This gave rise to coins, which began in Turkey during 7th century BC.

So within this context we must ask the question: can Bitcoin become a world currency? The answer to that is more likely than not a resounding NO. Any form of electronic money could function within the developed world, but to trade with the rest of the world we will be like the Dutch searching for beads to conclude a transaction outside the electric zone.

So we live within our developed world, but if we travel, we may find it not so easy to conduct business with electronic money just as not all places will accept a given type of credit card. Some people from Europe discover their cards do not work in the United States. This is just one example of a closed system.

Then there is the question of government. There is a profit to manufacturing money even when it is a precious metal. This profit is called Seigniorage (also spelled seignorage) which comes from the old French seigneuriage meaning the “right of the lord (seigneur) to mint money.” It was a death sentence to counterfeit for you were depriving the king of his right to make a profit. Pictured here are Indian imitations of Roman gold coins spanning from 14 AD to 240 AD. Why not mint your own gold coins? Because there was no “trust” in government so the value of a Roman coin had a premium to just the bullion value. They did keep pace with the changing emperors.

Bitcoin will eventually clash with government for they are hunting money. They will want their piece of the action. That is just how things evolve. After the crash and burn, the system will be completely new. That is when we will have a chance to reshape the world.

Larry Summers, the father of NEGATIVE INTEREST RATES, is so against a free society and looks upon us as dumb cattle to be herded and corralled for his pleasure. His ideas are just beyond belief. Now Mr. Pro-Government-Anti-Democracy is advocating

Larry Summers, the father of NEGATIVE INTEREST RATES, is so against a free society and looks upon us as dumb cattle to be herded and corralled for his pleasure. His ideas are just beyond belief. Now Mr. Pro-Government-Anti-Democracy is advocating

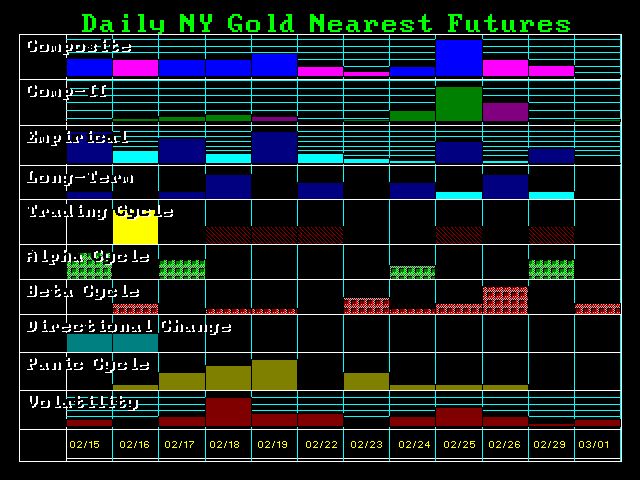

We had also only reached three Downtrend Lines. The timing was correct for the yen. We were at a major turn in the Economic Confidence Model. Our models had forecast that Russia was about to collapse, which manifested in the Long-Term Capital Management collapse.

We had also only reached three Downtrend Lines. The timing was correct for the yen. We were at a major turn in the Economic Confidence Model. Our models had forecast that Russia was about to collapse, which manifested in the Long-Term Capital Management collapse.