I took this picture at the beach. At first glance, it is hard to tell if it is a sunrise or a sunset. For the record, it was a sunrise – the dawn of a new day. What we face can be disastrous but it also can be the dawn of a new era. Government is our worst enemy because it refuses to relinquish power to save society. Like Hillary – it’s always just about them.

This Presidential election has exposed the tremendous deep divide of the nation and the world for that matter. We are headed into the eye of the storm in this battle between left and right. The left is all about punishing people who have more. They are really the people who would break into your house and rob you under the pretense that they deserve it because you have cheated them in some way. This uprising always comes from the left; i.e. China, Russia, and Europe. The uprisings that spring from the general population are directed at government and not the rich class warfare stuff. Those are the revolutions such as the American and French of the 18th century.

The future is dark and sinister if the majority remain silent against the left. Keep in mind that the left have the press in their pocket. This historically has always made them the most dangerous. The left will rise up in class warfare and that takes various forms. Even the uprising in Germany that targeted the Jews was based in class warfare. Kristallnacht, also referred to as the Night of Broken Glass or “crystal night”, symbolized this was really a class warfare incident that began with the idea that the Jews were the bankers and evolved into getting all the Jews who were often the store owners as well. Kristallnacht was the looting of the Jewish stores and robbing them of their property. Yes it targeted the Jews. But the ethnic origin masquerades the class warfare.

The future is dark and sinister if the majority remain silent against the left. Keep in mind that the left have the press in their pocket. This historically has always made them the most dangerous. The left will rise up in class warfare and that takes various forms. Even the uprising in Germany that targeted the Jews was based in class warfare. Kristallnacht, also referred to as the Night of Broken Glass or “crystal night”, symbolized this was really a class warfare incident that began with the idea that the Jews were the bankers and evolved into getting all the Jews who were often the store owners as well. Kristallnacht was the looting of the Jewish stores and robbing them of their property. Yes it targeted the Jews. But the ethnic origin masquerades the class warfare.

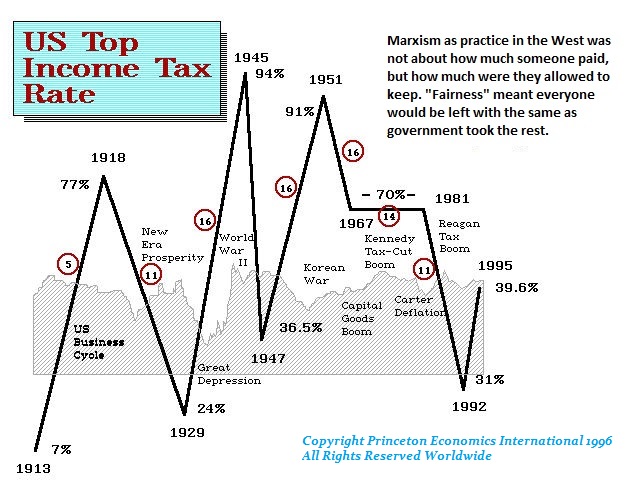

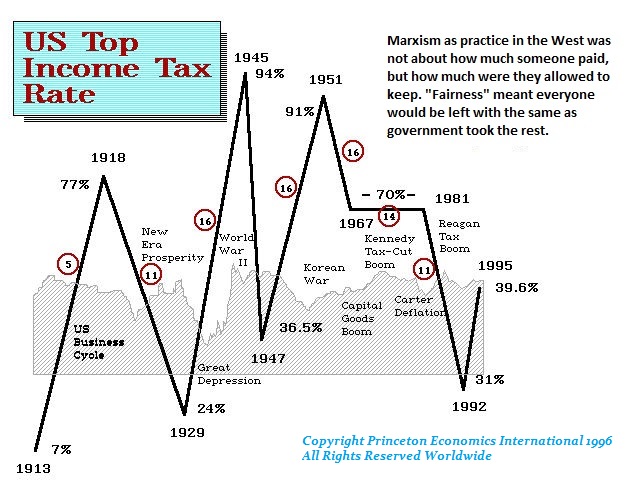

So what do we really face? We are looking at the Sovereign Debt Crisis beginning in Europe. Why? Europe has been excessively left. They have the highest levels of taxation and the ability of a government to function is dependent upon the level of taxation. When you reach the maximum point of tax extraction from the people, you see economic deflation sparked by hoarding rather than investment, which the European Central Bank (ECB) has been fighting without success since 2008. The ECB has been the buyer of state debt and there is now no reversing the process. If the ECB stopped buying government debt, government would quickly discover no bid for their debt and then interest rates would explode. Government would chase money rather than restructure until the entire facade collapsed in their face. This is just how governments always collapse when they are debt burdened as we have today. Thus enters the Sovereign Debt Default.

The Trump Revolution will breathe life into the U.S. economy and suck in capital from around the world. Capital is like water. It will flow to the lowest tax combined with security, and skilled labor. The United States has a top federal tax rate of 39.6% compared to Europe over 50%. With Trump lowering taxes, the economy will recover faster, but at the expense of the rest of the world. The United States is not at the same tax level as Europe so it is not in the same desperate position – YET. The Trump Revolution may buy us some more time. But the tax code of the United States illustrates this perpetual battle between the left and right. Business cannot function with the tax code constantly changing. This is the NUMBER ONE reason why jobs leave. It is not purely for wages – it is the chaos of politics creating uncertainty for the future.

The left hate the rich because they want a piece of that pie without working for it. In Australia, the Green Party is being moved to the extreme left led by NSW Senator Lee Rhiannon dedicated to the “fight to bring about the end of capitalism”. No matter how many times the left has tried to create utopia and failed, they never give up.

The left hate the rich because they want a piece of that pie without working for it. In Australia, the Green Party is being moved to the extreme left led by NSW Senator Lee Rhiannon dedicated to the “fight to bring about the end of capitalism”. No matter how many times the left has tried to create utopia and failed, they never give up.

The left always hates anyone who produces. They are the cancer within society and the key to its total destruction. They have been the sole culprit that stands behind the massacre of hundreds of millions of people.

So we face a crossroads – we go left or right. This is the real battle we face. If we can overcome this leftist movement, then we can step forward into a new era for once and shred the cloak of democracy that hides a republican pretend representative form of government. It is always government that self-destructs.

So we face a crossroads – we go left or right. This is the real battle we face. If we can overcome this leftist movement, then we can step forward into a new era for once and shred the cloak of democracy that hides a republican pretend representative form of government. It is always government that self-destructs.

The Tree of Liberty has been cut. The question becomes, which way will it fall? I can give you the date for the end of this era – 2032. We all can see that the system as is, cannot possibly survive. With each 8.6 year wave, the intensity rises or in market terms volatility. We can see this rise in intensity with the 2016 election – the Year From Political Hell.

So while others yell about hyperinflation and the quantity or money, these are NOT the real dangers we face – only symptoms of the political convulsion that lies ahead. Such forecasts lack depth. As if gold will rise to $10,000 and investors will become rich and somehow life goes on and they survive. Good luck. For such a price swing in gold even to $5,000, requires political chaos and economic instability. It’s just not that easy if we consult history.

I am frequently asked, why do I do what I do? Why not relax on a beach? That question incorporates the assumption one can simply ignore the political changes coming. I too have a family. I may not be around by 2032 – we all have expiration dates. What I do, I am compelled to do. I am at least trying to leave behind a better place for my posterity and on the other hand, I am curious if humanity can learn from the past and make that one step as Neil Armstrong said when he set foot on the Moon:

That’s one small step for man, one giant leap for mankind.

History is our map to the future. It creates wonder and fuels the imagination, which is the basis of man’s desire to understand and discover. To quote Albert Einstein, – “Imagination is more important than knowledge. For knowledge is limited to all we now know and understand, while imagination embraces the entire world, and all there ever will be to know and understand.” Indeed, Imagination is everything. All inventions emerge only from our imagination, which stimulates all progress and thereby gives birth to evolution in every field. This is why government is always the enemy. It is incapable of imagination and harbors only paranoia of what happens if the people what their freedom at the expense of its power.

If I can show that we have a choice to take that one step forward based upon our knowledge of the past, then I have fulfilled my personal goal in life. We can create a new world, but only when this one crashes and burns. If we embrace the knowledge of the past, and learn just for once, then we can crossover to a new way of doing things and let Laissez–faire guide us to a new world of liberty and freedom from the manipulations of the left and government. Many have tried to discredit me, because they know what I am about. They wrongly assume by trying to stop me, they avoid the end result. I am irrelevant. What will be will be. I merely point to what is unfolding. Nobody can prevent what is coming. We can make that choice only if we understand the game.

Merry Christmas and Happy Hanukkah

![]()

Amri got to Europe on a refugee boat in 2011. He ended up in a Sicilian prison but the Tunisians would not take Amri back. So the Italians simply released him in 2014. He made his way to Germany a year later and applied for asylum, which he was rejected. The Germans could not deport him, either, because he had no passport and the Tunisians simply refused accept him back.

Amri got to Europe on a refugee boat in 2011. He ended up in a Sicilian prison but the Tunisians would not take Amri back. So the Italians simply released him in 2014. He made his way to Germany a year later and applied for asylum, which he was rejected. The Germans could not deport him, either, because he had no passport and the Tunisians simply refused accept him back.