Cruz Defeats Trump in Wisconsin — Is This 1828-1832 All Over Again?

From the outset, inside sources have relayed that Cruz is very disliked behind the curtain. His entire strategy from the beginning has been to be the last man standing against Trump. Cruz assumes the party will install him despite the fact that most really dislike him.

All the exit polls show that more than half of the voters in this Republican primary are merely “dissatisfied” with government, compared to one-third who are outright “angry.” The voters in Wisconsin seem to be in Never-never Land, and, for the most part, they want someone with experience. That is how the USA will implode for nobody in the establishment gives a shit about the people; this is all about them. So that experienced candidate will be a vote for more of the same.

Nevertheless, we have to understand that we have two major risks in politics. First, the establishment may not select Trump or Cruz. If they can simply defeat Trump on the first ballot then all bets are off and they can nominate someone who did not bother to run like Romney.

If Trump does not get the Republican nomination, then if he is smart, he could get on the ballot as a Libertarian since they have already done the heavy lifting. Alternatively, Trump could get on the ballot in a few states and win those but not the general election. This could prevent either the Republicans or Democrats from winning enough votes for the Electoral College whom really votes for president.

If no one wins enough Electoral College votes, it will be the ultimate demonstration that we do not live in a democracy by any measure. A failure for any candidate to win the required votes at the Electoral College means the current establishment on Capitol Hill gets to select the next president.

The election of 1824 is an example of how the establishment can do as they like. Andrew Jackson won 153,544 popular votes to John Quincy Adams won 108,8740 popular votes. Neither won the Electoral College so Congress picked the president and Jackson lost. When Jackson finally became president in the 1828 election. Jackson did two major things that were against the establishment. First, he actually paid down the national debt. President Andrew Jackson reported that the United States would be debt-free as of January 1, 1835. This marked the first and only time that the United States, or any other major nation in history, had ever been free from debt.

Jackson declared: “Let us commemorate the payment of the public debt as an event that gives us increased power as a nation and reflects luster on our Federal Union.”

In the course of this objective, Jackson generally opposed bills that allocated taxpayer money for “internal improvements” or what we call “pork barrel spending” today. In the 1863 popular story “The Children of the Public,” Edward Everett Hale used the term “pork barrel” as a homely metaphor for any form of public spending to the citizenry. However, after the American Civil War, the term’s usage turned derogatory.

Andrew Jackson despised the Second Bank of the United States, not because it held too much power over the economy, but because his political enemies controlled it. Jackson set out to destroy the bank for it had provided loans to his political rivals. The bank’s president, Nicholas Biddle (1786-1844), routinely used lending practices for political gain, including using bank funds to publish newspaper attacks on opponents as some money-center trading banks in NY engage in to this day. Biddle openly favored the National Republicans (later to become the Whig Party), many of whom benefited financially from Biddle’s favor. Prominent National Republicans were Congressmen Daniel Webster (who was on the bank’s payroll as a legal counsel) and of course Jackson’s archenemy, Henry Clay, who was his opponent in the 1832 presidential election.

It is ironic that New York bankers today own Cruz and Hillary. Both engage in methods to fund their elections that are not much different from the actions of Biddle. Those who want to see the Federal Reserve eliminated, citing what Jackson had done, fail to understand what really took place. The destruction of the Second Bank of the United States resulted in the Panic of 1837, the sovereign debt defaults of states in the 1840s, and a severe economic decline that set the stage for the Civil War. The parallel to today is not the Federal Reserve with political power, but the New York bankers.

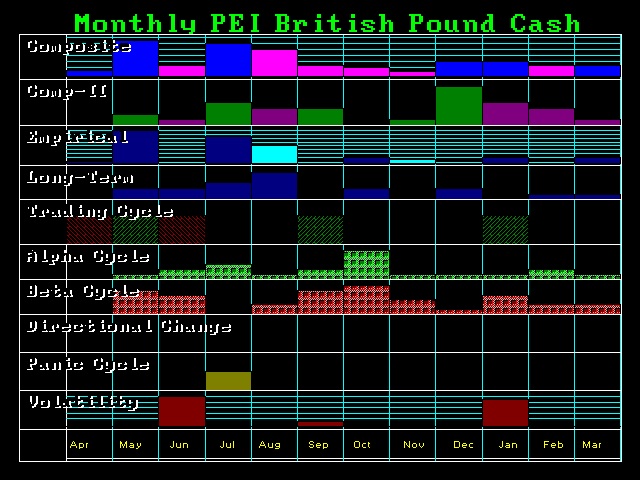

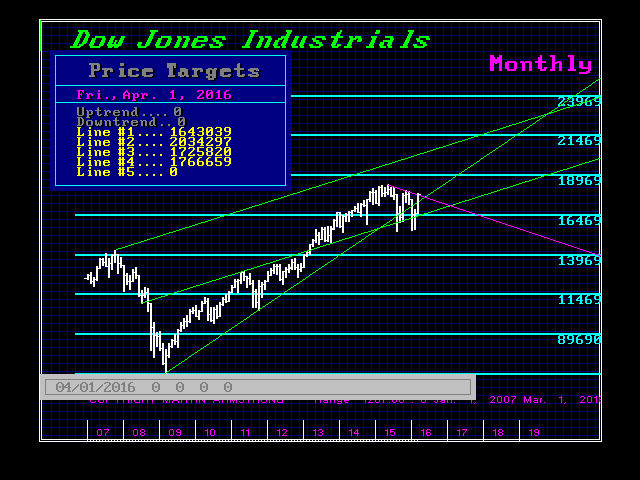

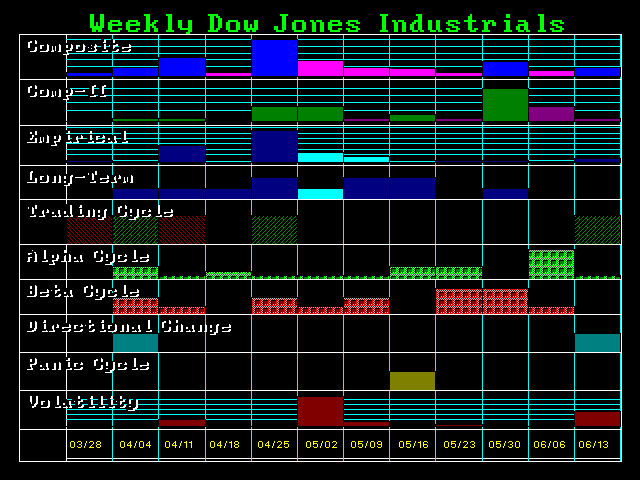

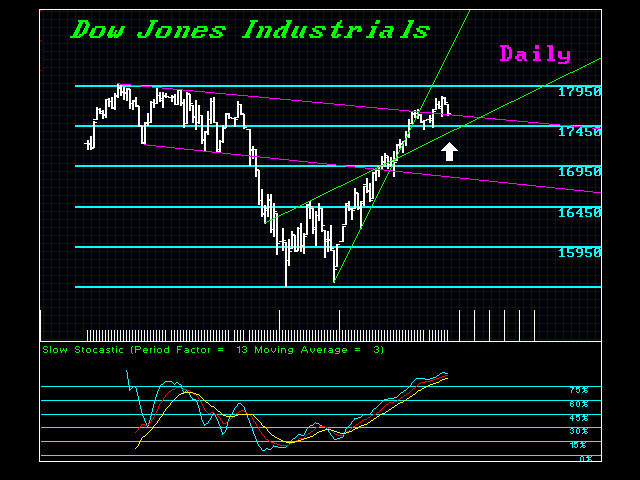

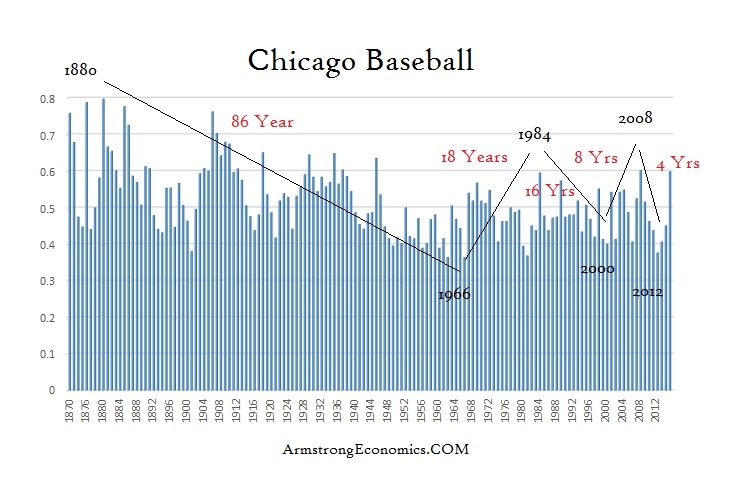

Our models are starting to highlight Panic Cycles hitting in August. This will start just after the Republican Convention. If we go to the extreme in this collapse of confidence in government, then we may see a repeat of the 1828 election. However, we are also in a battle against the establishment and Trump is closer to Andrew Jackson than anyone else running for office. So the future looks like a political war ahead that is going to turn everything upside down. The establishment is focused on defeating Trump; they think everyone will go back to watching soap operas and sports and they can rob us and our children blind as always.