A comment by a reader with a philosophy is interesting and delusional at the same time. “Armstrong chose not to seek any compromise but to put all the blame on government. In principle, that’s got to be an absurd point of view. So it seems to me. One more thing, to his alleged factual correlation. Government really began to grow during the Roosevelt years, including the war years, and the economy has been growing ever since. Is your buddy playing fast and loose with history and, hence, with reality?”

Corporations only have influence because they buy government and that is possible only because we have career politicians. Corporations cannot run the world for they compete against each other. We do need government, but an honest one. The only way to achieve that is with shorter one-time office terms. It should be more of a citizen government and any conflict of interest is a bar to any office in any capacity. Cruz’s wife works at Goldman Sachs. Hillary will not release transcripts of her speeches for Goldman Sachs. They buy candidates and own Washington, DC. We deserve what we vote for and stupidly believe in. We are the fools who soak up all the lies each and every time and then the press is anything but independent and free. Hillary has raised tens of millions from the very banks on Wall Street she claims she will stand against. Come on. If that was remotely true then they would not give her a dime. They call Sanders and Trump dangerous because they are not bought and paid for by the bankers.

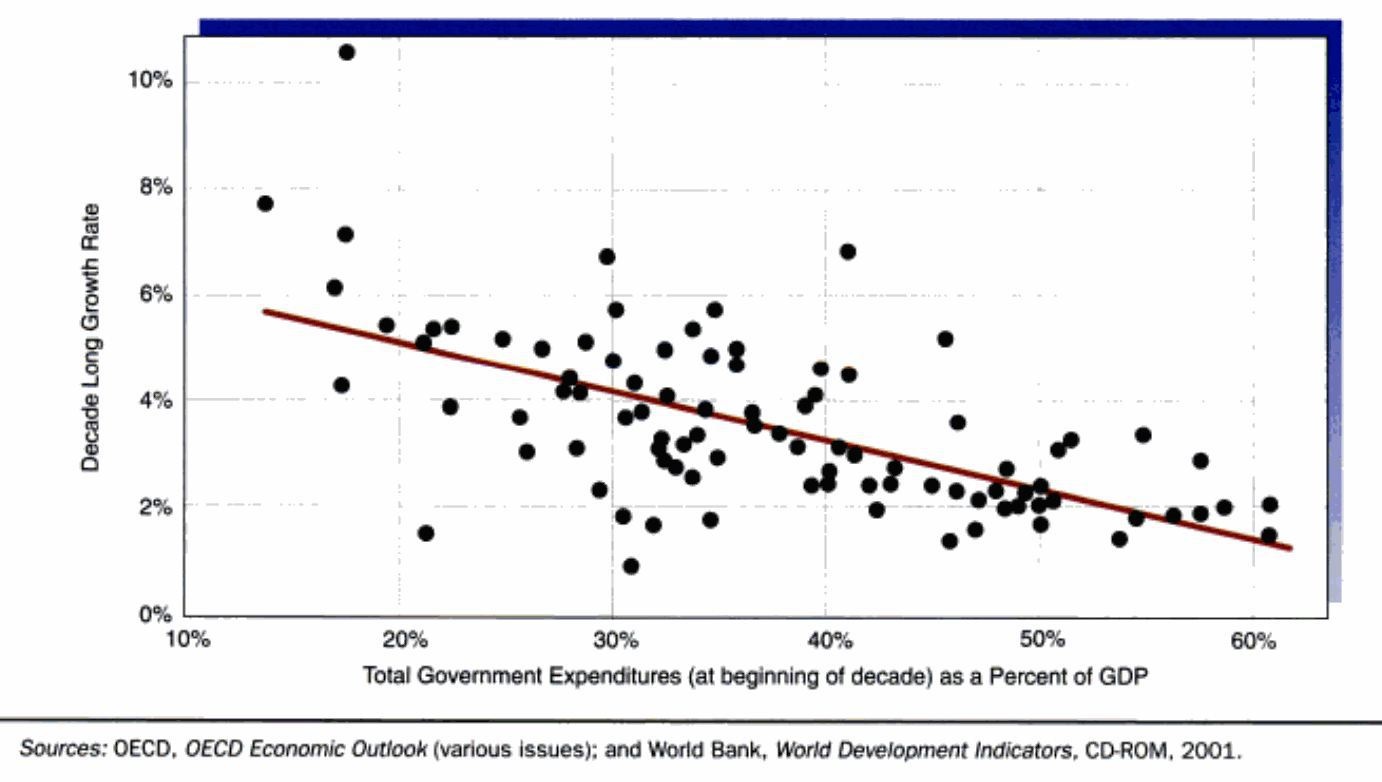

More over, the idea that we have lived in some fantastic socialist era with GDP always expanding is an outright LIE, if not a delusional statement by someone who refuses to look at the trend. At the top is a chart of the government’s own source, the Bureau of Economic Analysis. GDP growth has been declining steadily as taxes rise. Like China, its first blast of GDP growth came at the beginning. It was true for the West as well following World War II. GDP growth has steadily declined to where a good number is less than population growth. Social Security collapses in 2017 as illustrated by this second chart, which was also prepared by government. This is the entire problem. People are clueless as to the trend and do not want to open their eyes to reality.

Why do the NY bankers fund the bulk of the candidates? Well certainly to buy their get out of jail free card. There is no possible way they will ever criminally imprison the bankers who have destroyed our future, because then who would FUND people like Hillary or Cruz? Secondly, if socialism is not a bullshit story, then why have we reached, at times, 70% of the entire national debt in accumulated interest? That money created neither schools nor roads and did not feed children or fund welfare. The bulk of the debt has been interest paid to the bondholders.

Why is the youth going for Sanders and Trump? Why do we have a generational gap in voting that first appeared in Scotland? Socialism is collapsing because the older generation has paid into a system that they do not want to believe is falling apart when it is time to get theirs. So they live in a delusional world that ignores everything factual around them and they cannot see they are robbing their own children of the very life they enjoyed.

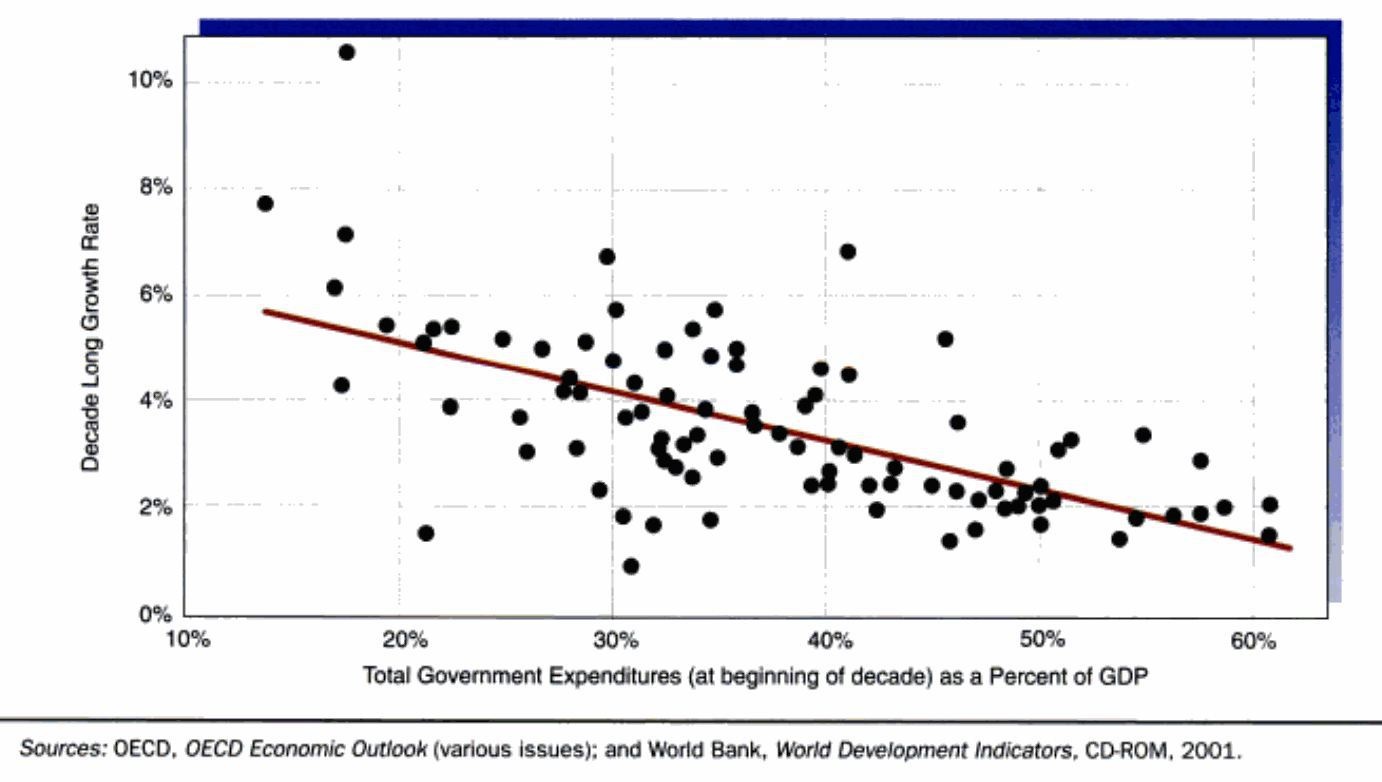

This is a chart from the OECD which clearly shows that higher the tax rate, the lower the economic growth. I for one hope the country splits in two and we can build a wall, not between Mexico and USA, but between left and right. Let all the left socialists who want to steal from everyone because they can and so they do not have to earn in life live on one side of the wall and chase each other in circles. The rest of us can live in peace. After all, it is one of the Ten Commandments — “Thou shalt not covet their neighbor’s goods.” The pope says building a wall is not Christian. That is not one of the Ten Commandments. It is not being Christian or Jewish to drool over robbing other people’s money. Christ did not preach socialism by government force. It is no longer charity when it is involuntary.

In my mind, the legal challenge against income tax (which requires the surrender of privacy) is that such taxes violate the First Amendment, freedom of religion. Socialism, progressive taxation, as well as the coveting and hatred of anyone who has more money violates the Ten Commandments. This is no different from communism, which preached the state was your parent, not your biological parents, and if they said anything against the state then their children were obligated to report them. Marx also said, “Religion is the opium of the people.” Socialists should admit the father of their beliefs and what he stood for — there is no God.