The inundated Chancellor Angel Merkel has always had her own team who poll her popularity regularly. She cannot let go of power and she is known for not standing for anything but herself. She will change positions whenever necessary to maintain her popularity. Merkel created this entire refugee crisis because she was being criticized for her hardline on Greece. Now, Merkel is changing direction promising to deport 100,000 refugees.

Merkel’s harsh actions toward Greece drew international condemnation. On July 15, 2015, Time Magazine wrote, “Berlin’s role as the enforcer in negotiations over Greece’s debt could cause lasting damage to Germany’s global image.” Images of elderly Greeks committing suicide in Syntagma central square in front of the Greek Parliament in Athens made the front pages in the international press. Pictures surfaced of retired Greeks who were moved to tears after they were unable to withdraw money from banks and unable to buy food. Merkel’s image was becoming that of a money-grubber without any humanity.

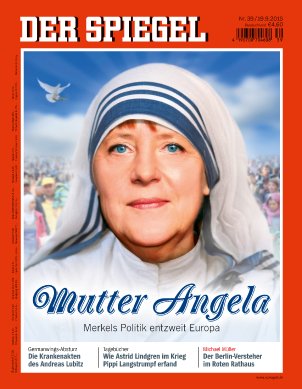

Then, the Washington Times wrote on September 10, 2015, “Angela Merkel welcomes refugees to Germany despite rising anti-immigrant movement.” Merkel created this crisis as a diversion because Germany was being viewed as the harsh enforcer of loans, which were structured to hide what Goldman Sachs had instituted to get Greece into the euro from the outset. The entire reason for the refugee crisis was simply the view of Merkel globally. She needed to reshape her image from the loan shark to the caring Mother Merkel. Europe is now paying the price because career politicians were simply concerned about her polls.

Merkel had refused to accept any responsibility and outright denied that the refugee issue was even the problem. A leaked document surfaced that 2,000 men assaulted and raped 1,200 girls across Germany on New Year’s Eve. This was not an act of terrorism or some normal crime wave that has ever taken place in ANY western country before Merkel’s refugee crisis. If the refugees were not the issue, then why create flirting courses to show Islamic men how to get lucky with Germany girls? Police even altered records in Cologne to remove the word “rape” from criminal reports to support Merkel.

Merkel now promises for her election next year that she will increase the rate of forced deportations as she comes against a collapse in support to third place. Mrs. Merkel’s decision to open the doors to refugees without any verification has undermined the entire security of Europe. You even have her policy imposed on Australia who hopes to dump their undesirables on the United States thanks to Obama.

This is the biggest crisis that Europe faces and Merkel has the audacity to try to stay in politics and fight her way back through the polls.

Well the emails are pouring in already since our post on the upcoming French elections where our model was showing that

Well the emails are pouring in already since our post on the upcoming French elections where our model was showing that